Q4’23のFPDメーカー業績レビュー

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

1月25日(木)のLG Displayを皮切りに、FPDメーカー各社が順次、四半期決算発表を行う。業界は2022年末の急激な落ち込みから回復、収益性の改善が見られた1年だった。第4四半期、FPDメーカーは第2四半期と第3四半期のLCD価格上昇の恩恵を受けたものの、需要の減速に苦しむことになった。本稿ではQ4’23業績のプレビューを行う。

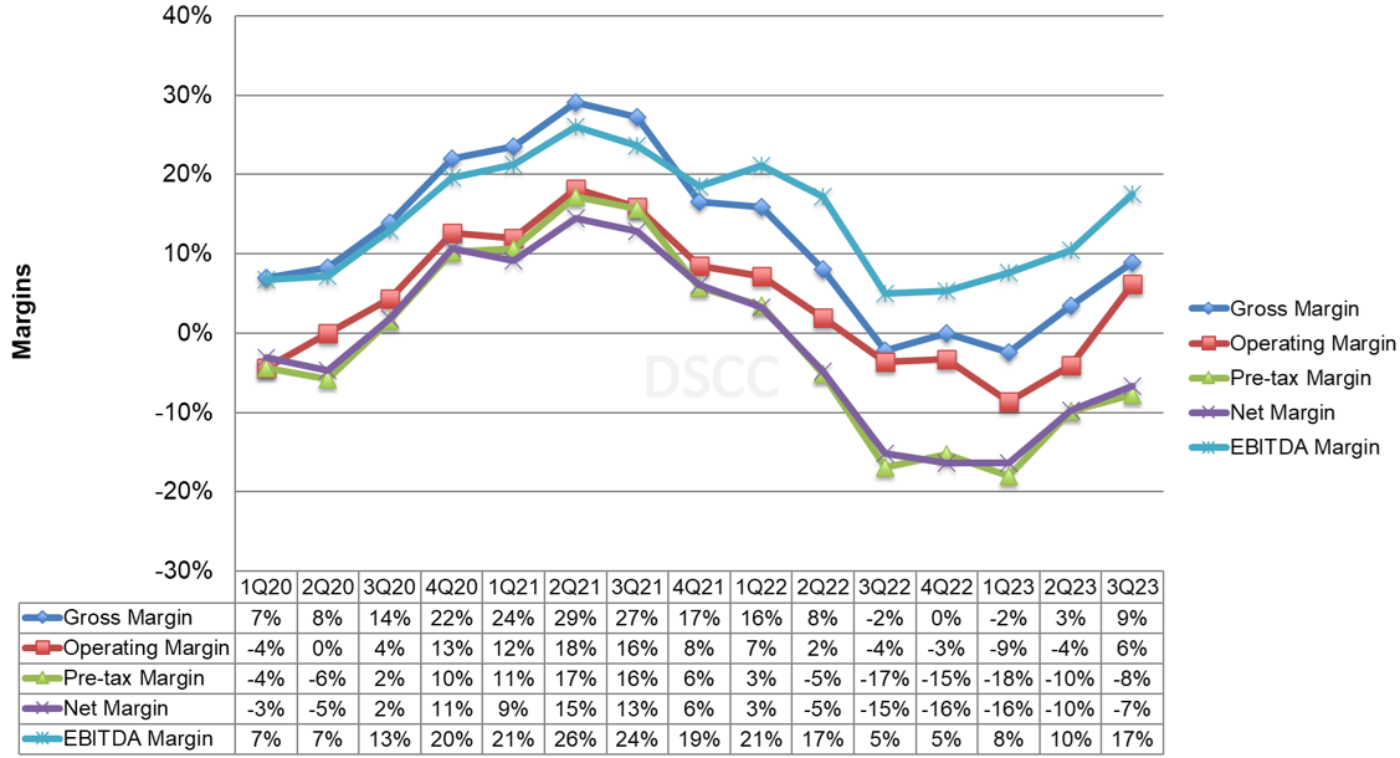

まず、FPD業界の利益率について概要を説明する。以下のグラフに示すように、需要はパンデミックの真っ只中に急増、利益率はQ2’21にピークを迎え、クリスタルサイクルの底から5四半期で頂上に達した。Q3’21以降、業界はQ3’22に底を打つまで5四半期連続で利益率が低下した。利益率はQ1’23まで非常に低い水準で安定し、Q2’23からQ3’23にかけて回復し始めた。TV用LCD価格はQ2'23に15%上昇し、利益率の4%~9%上昇に貢献した。Q3’23にはLCD価格がさらに14%上昇、利益率もさらに2%~10%上昇した。第4四半期はLCD価格が2%下落したため、利益率は第3四半期がピークだった可能性が高い。

Panel Maker Q4’23 Earnings Preview

※ご参考※ 無料翻訳ツール (DeepL)

LG Display will kick off earnings season for panel makers on Thursday, January 25th, ending a year that saw an improvement in profitability as the industry recovered from its steep downturn at the end of 2022. Panel makers in Q4 benefited from higher LCD panel prices resulting from increases in Q2 and Q3 but suffered a demand slowdown in the quarter. In this article, we will preview the results from Q4’23.

First, let’s set the stage with an industry overview of margins. With the spike in demand during the height of the pandemic, margins hit their all-time high in Q2’21, capping a five-quarter run from the bottom of the Crystal Cycle to the top, as shown in the chart here. Q3’21 started a five-quarter run of decreasing margins until the industry hit bottom in Q3’22. Margins stabilized at very low levels through Q1’23 before recovering in Q2’23-Q3’23. LCD TV panel prices increased by 15% in Q2’23, helping to boost margins by 4%-9%. Panel prices increased by another 14% in Q3’23, increasing margins by another 2%-10%. Panel prices declined by 2% in Q4, so margins likely peaked in Q3.

Display Maker Quarterly Margins

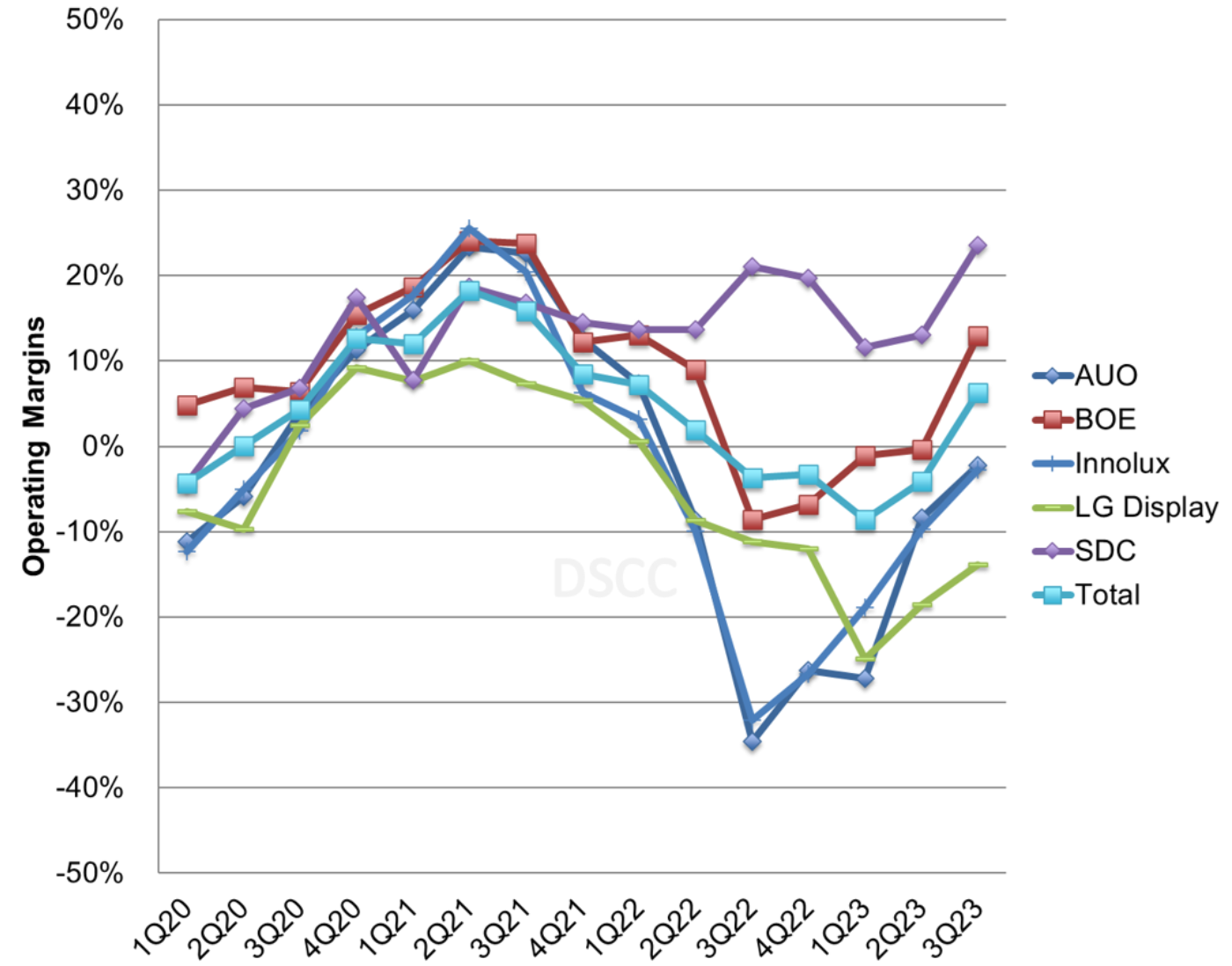

The second chart shows the operating margins of the larger companies in the industry from 2020. While operating margins held in a tight range in 2020-2021 following the Crystal Cycle, and while the Crystal Cycle still characterizes the industry average margins, we see an increasing divergence of performance among panel makers.

- SDC has continued to report positive operating margins and SDC is now immune to declines in LCD panel prices since it stopped all production of LCD in June 2022. SDC reached its highest operating profit margin ever in Q3’23 with the seasonal increase in OLED smartphone panel demand.

- AUO, Innolux and LGD were more sensitive to the cycle with margins that fell sharply from Q2’21 through Q3’22 and recovered in the four quarters up to Q3’23. LGD fared better than the two Taiwanese companies in 2H’22 based on its emphasis on OLED panels, but the Taiwan players’ strength in LCD has helped them recover faster than LGD.

- BOE fell to an operating loss in Q3’22 for the first time since 2016 and reported operating losses in both Q4’22 and Q1’23, although BOE’s losses were substantially lower than its LCD competitors. BOE consistently sustains margins higher than its competitors in Taiwan.

Display Maker Quarterly Operating Margins

Currency effects likely had little impact in the fourth quarter. The Japanese yen weakened by 2% Q/Q but the Chinese yuan, the Taiwan New Dollar and the Korean won all changed by less than 1% Q/Q.

In terms of guidance, in October these companies diverged in their outlook for Q4’23, with LGD expecting improvement while the two Taiwanese expected a downturn:

- LGD was by far the most optimistic, expecting area shipments to increase by 19% Q/Q and for ASPs to increase by a mid-twenties % Q/Q.

- AUO expected area shipments to be down by a mid-teen % Q/Q and ASPs to be up by a low-single digit % Q/Q.

- Innolux expected large panel shipments to be down by a high single digit % Q/Q, small/medium panel shipments to be flat Q/Q and blended ASP to be down by a teen % Q/Q.

Based on monthly revenue reports, Innolux was right in line with its guidance: revenues were down 7% Q/Q in Taiwan dollar terms, and its large panel shipments were down 9% Q/Q and small panel shipments were up 1%. AUO revenues were down 10% Q/Q, also right in line with guidance.

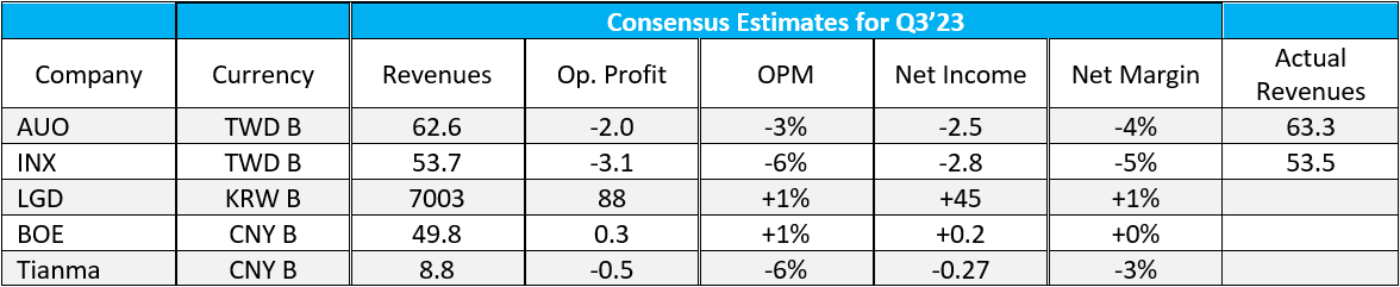

The table below shows analyst expectations for Q4’23 for the panel makers with analyst coverage, according to marketscreener.com. The analyst expectations for margins anticipate that margins in Q3’23 were improved from Q2’23 but still in the red for all except BOE and Tianma. AUO revenues were 3% higher than analysts’ expectations so AUO is likely to do better on operating margin as well. On the other hand, Innolux revenues were 1% below expectations, so Innolux is unlikely to beat expectations.

LGD’s guidance implies an increase in revenues (in KRW) of nearly 50% and consensus estimates predict a revenue increase of 46% Q/Q, so if LGD meets its guidance it will meet consensus expectations.

Perhaps more important than the results will be the guidance given about Q1’24 and the full year. With LCD panel prices declining in Q4 and Q1 and no obvious demand driver in sight, we believe that panel makers will be cautious about 2024.