Q4'22の大手FPD製造装置メーカー17社の売上~6四半期連続で前年比減少

[ご案内] 4/11火 TCC品川で開催!DSCC Japan セミナー 2023年前期版~底を脱し上昇に転じたFPD市場を徹底解説!

コロナ禍からの夜明けと共に、いち早く対面式セミナーを復活 (昨年10月) させたDSCC Japanセミナー、ご来場者様からの大歓迎のお声を受けて、今年から通常体制の年2回・品川会場に戻ります!今回もお客様のビジネス戦略をご支援すべく、1日でFPD産業の必聴ポイントを把握できる最新分析データをご提供!みずほ証券・中根康夫シニアアナリスト⇔当社アジア代表・田村喜男の「言いたい放題」オフレコ対談枠も、本セミナーの名物企画として再演決定!徹底的に「ご来場者様満足」にこだわるDSCC Japanセミナーならではのバリューにご期待ください!

冒頭部和訳

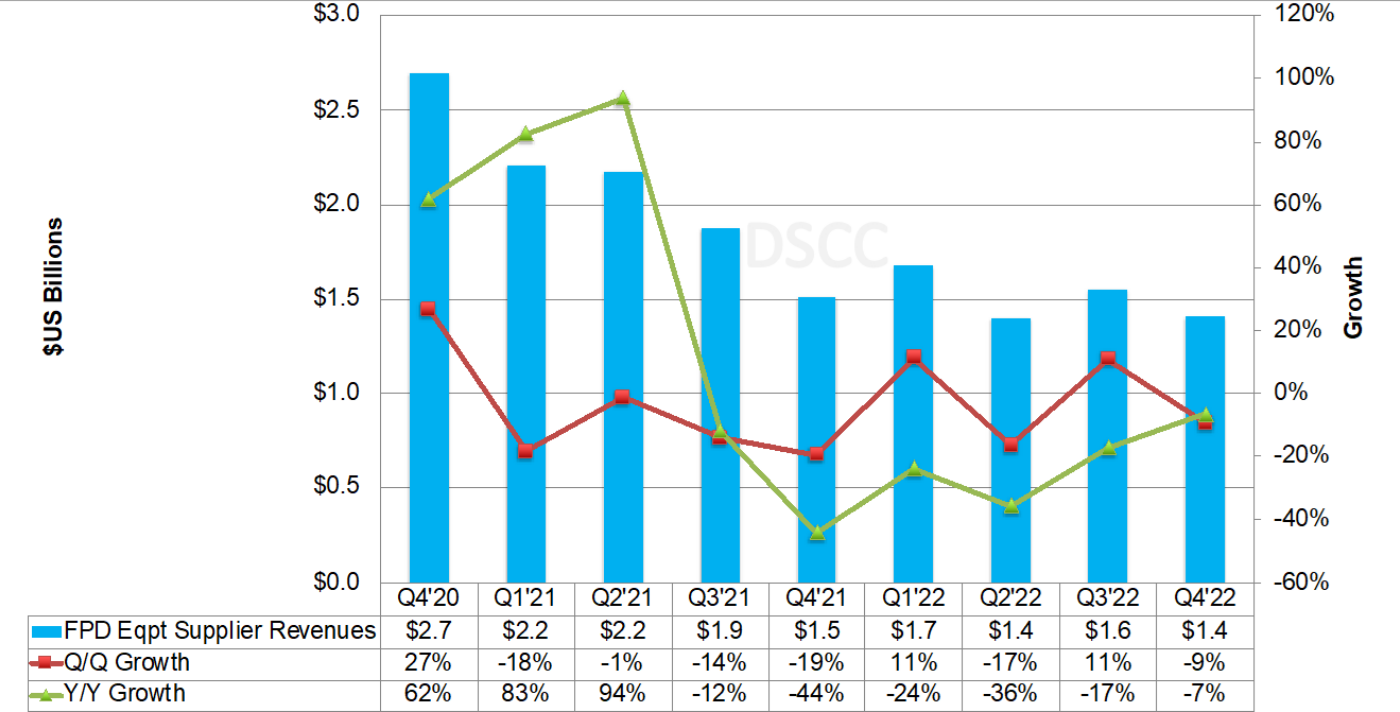

DSCCの Quarterly Display Supply Chain Financial Health Report の最新刊によると、大手FPD製造装置メーカー17社のQ4’22売上は前期比9%減、前年比7%減の14億1000万ドルで、6四半期連続で前年比減少となった。コロナ禍で納入と設置が中断されたQ2’20以来、2番目に不振の四半期となった。FPD製造装置の設備投資は下落傾向にあるが、その背景には、コロナバブルによって2021年と2022年にFPD需要が急増、これに対処するためFPDメーカー各社が2021年と2022年に生産能力を追加し、供給が増加した経緯がある。その結果、生産ライン稼働率は急落し、TV用LCD価格がキャッシュコストを下回り、FPDメーカー各社は2023年を通して続くはずの設備投資を延期し始めている。

Leading Display Equipment Suppliers’ Revenues Fall for Sixth Straight Quarter

※ご参考※ 無料翻訳ツール (DeepL)

As revealed in our latest Quarterly Display Supply Chain Financial Health Report, display equipment revenues for 17 of the largest suppliers fell 9% Q/Q and 7% Y/Y to $1.4B, declining on a Y/Y basis for the sixth straight quarter as shown in the figure here. At $1.41B, it was the second worst quarter since Q2’20, when COVID disrupted equipment deliveries and installations. Display equipment spending is on the decline due to a decline in display demand resulting from the COVID bubble when significant display demand was pulled in along with a rise in supply in 2021 and 2022 as suppliers responded to the higher demand by adding more capacity. As a result, utilization plummeted, LCD TV panel prices fell below cash cost and panel manufacturers began delaying spending, which should extend through most of 2023.

FPD Equipment Supplier Revenues (17 Leading Suppliers)

Canon was #1 for the second straight quarter followed by AMAT, Nikon, ULVAC and AP Systems. Canon’s share rose from 29% to 34% with Nikon, Avaco and Jusung also gaining at least a point of share. Companies losing at least a point of share included AMAT, ULVAC, TEL, SCREEN, Wonik IPS, ICD and HB Technology. Only five companies had Q/Q growth in display equipment revenues with 11 seeing declines. Jusung had the highest growth for the second straight quarter on LGD wins followed by Nikon and Avaco also on LGD business. AMAT and TEL saw 33% and 38% declines, respectively. Nine companies had Y/Y growth with eight seeing declines. Four companies had >100% growth - Jusung, Nissin, HB Solution and Canon. AMAT and TEL were each down over 50%.

Of the 17 companies we are tracking, six earned at least 50% of their revenues from display equipment. The blended share fell from 6.9% to 6.5%. Of the largest companies, Canon was flat at 6%, AMAT fell from 4% to 2%, TEL remained flat at 2%, Nikon rose from 8% to 12%, SCREEN fell from 7% to 5%, ULVAC fell from 29% to 22% and Wonik IPS dropped from 25% to 15%.

Margins were mostly down:

- Gross margins were flat at 44.4%;

- Overall operating margins fell from 20.7% to 18.2% and likely peaked in Q3’22;

- Display equipment operating margins rose from 11.5% to 12.2%, still well below overall operating margins;

- Pre-tax, net and EBITDA margins fell to the lowest levels since Q1’21 at 18.5%, 14.7% and 21.5%, respectively.

Jusung had the highest display equipment operating margins for the sixth straight quarter followed by DMS, AP Systems, Nikon and Canon. AMAT’s display equipment operating margins fell to 5%, the lowest we have seen dating back to at least Q3’13. Five companies had negative display equipment operating margins including SCREEN, TEL, V Tech., ICD and HB Tech.

Bookings for eight companies fell 35% Q/Q and 67% Y/Y to $335M, the lowest we have captured dating back to Q1’16. This was a result of negative bookings calculated at AVACO and HB Technology due to cancellations and write-offs. Wonik IPS had the highest bookings and highest growth, although this figure includes semiconductors. HB Solution and ULVAC also saw Q/Q bookings growth. Backlog for the eight companies covered fell 36% Q/Q and 52% Y/Y to $507M, a new low. Only HB Tech and KC Co saw increases in Q/Q backlog values. V Tech. had the highest backlog at $128M followed by Wonik IPS at $109M, which includes semiconductors and AP Systems at $83M.

The companies covered in this report now include Applied Materials, AP Systems, AVACO, Canon, DMS, HB Solution, HB Technology, ICD, Jusung Engineering, KC Co., Nikon, Nissin Electric, SCREEN Holdings, Tokyo Electron, ULVAC, V Technology and Wonik IPS. For more information on this report, please contact お問い合わせ窓口.