Advanced (先端技術FPD搭載) TV市場、2026年には360億ドル到達の見通し

冒頭部和訳

DSCCの Quarterly Advanced TV Shipment and Forecast Report (一部実データ付きサンプルをお送りします) の最新版によると、Advanced (先端技術FPD搭載) TVの出荷台数は2026年まで年平均成長率17%で成長して3460万台に到達、出荷金額は361億ドルになると予測されている。最新予測では、OLEDとMiniLEDの間の競争が激化している状況を踏まえ、OLED TVの予測値が引き下げられた。2021年中盤以降はTV用LCDの価格が急落していることから、MiniLED TVにはより積極的な価格設定がなされており、引き続きシェアを獲得すると予測される。

本レポートでは最先端のTV技術 (WOLED、QD-OLED、QDEF、MicroLED、4Kおよび8K解像度のMiniLED) を含む、世界のプレミアムTV市場を対象としている。技術、地域、ブランド、解像度、サイズなどの項目ごとに、現在と将来のTV出荷台数と出荷金額を調査、これらすべての技術の成長を予測している。3週間前には最新実績を取り上げたが、本稿では最新予測を取り上げる。

Advanced TV Market Expected to Reach $36B by 2026

Advanced TV shipments are expected to grow by a 17% CAGR through 2026 to 34.6M units generating $36.1B in revenue, according to the latest update to DSCC’s Quarterly Advanced TV Shipment and Forecast Report (一部実データ付きサンプルをお送りします), now available to subscribers. In our latest update, our forecast for OLED TV has been reduced as the competition between OLED and MiniLED has heated up. With the steep declines in LCD TV panel prices since mid-2021, MiniLED TVs have been priced more aggressively and are expected to continue to gain share.

This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD-OLED, QDEF, MicroLED and MiniLED with 4K and 8K resolution. The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and size, and forecasts the growth of all these technologies. Three weeks ago, we covered the most recent historical results and this week we will cover our updated forecast.

In this report, we define an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The forecast in the report allows analysis by feature for Advanced LCD TVs, including:

- QD LCD: TV using a Quantum Dot Enhancement Film; these TVs are sold as “QLED” by Samsung, TCL and others;

- MiniLED: LCD TVs with a MiniLED backlight, as sold by TCL starting in 2019 with many brands following. Note that we expect that all MiniLED TVs will also have QDEF, but not all QDEF will have MiniLED;

- QD OLED: Samsung’s Quantum Dot OLED technology, which Samsung names QD Display.

- MicroLED: Samsung has introduced direct-view MicroLED TVs with sizes from 88”-110”, marketed as TVs for wealthy consumers. Our report excludes larger MicroLED products such as the 146” and 292” “The Wall” products sold by Samsung, as these are primarily business displays.

Two Advanced TV technologies appear in our historical data but are not included in our forecasts, because both technologies appear to be discontinued.

- Dual Cell: LCD TVs employing dual-cell technology, as introduced by Hisense in 2019. Dual Cell appears to be phased out in TV, we forecast zero volume for this technology starting in 2022;

- Rollable OLED TV, introduced by LG in 2021, has been discontinued in 2022.

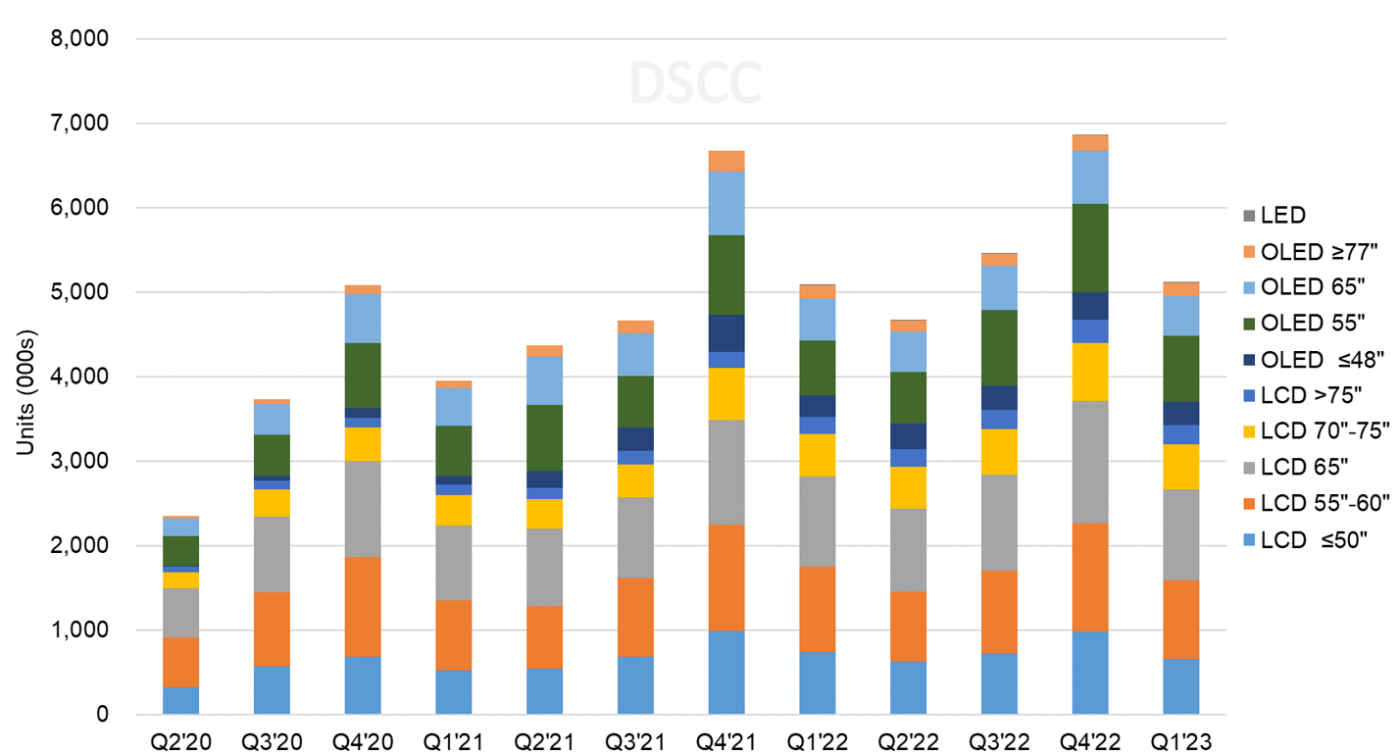

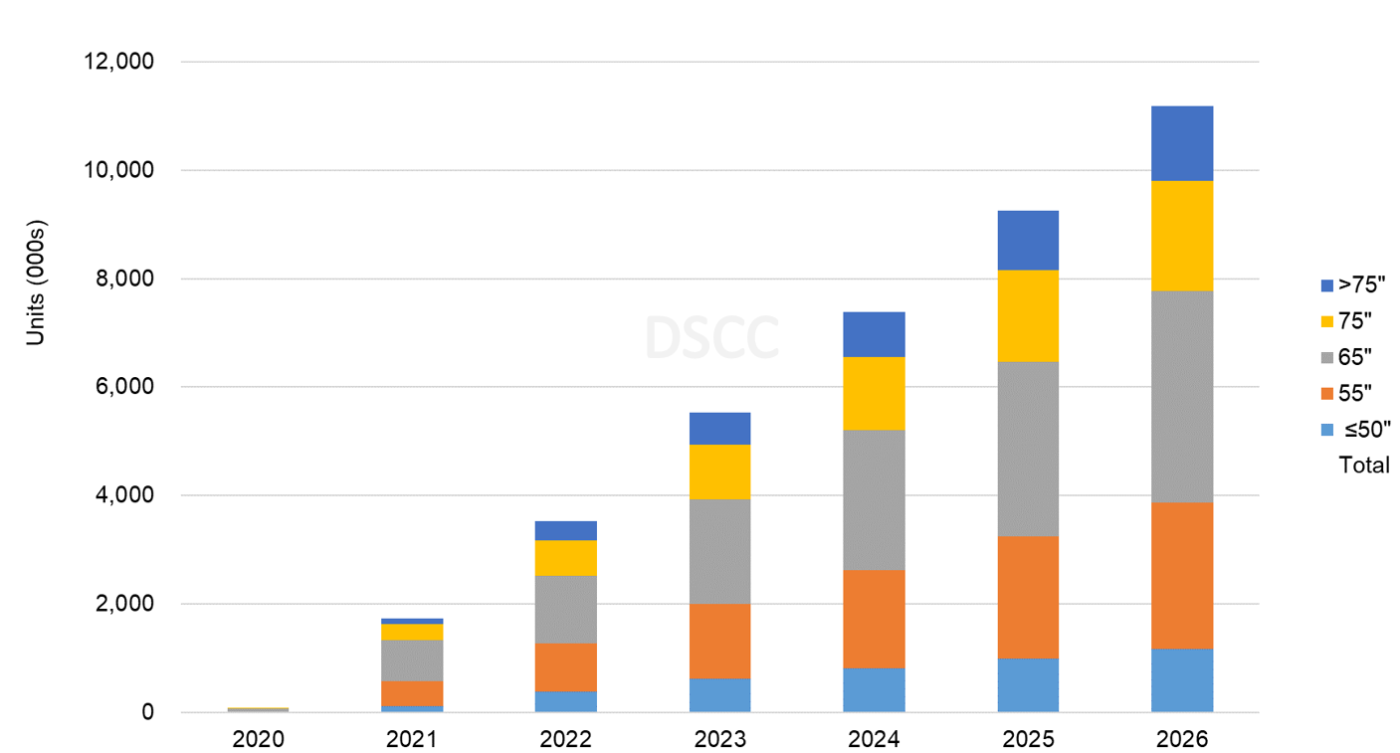

The first chart here shows our outlook for Advanced TV shipments by quarter and by technology and screen size group.

For the full year 2022, we expect Advanced TV shipments to increase by 13% Y/Y to 22.1M units and expect Advanced TV revenues to increase by 8% to $29.5B.

Quarterly Advanced TV Shipments by Screen Size and Technology

OLED TV units (including QD-OLED) are expected to increase by 4% to 7.1M with revenues flat Y/Y. OLED TV units and revenues will have growth in the smallest sizes (<50”) with the introduction of 42” and a full year of sales for 48”. Larger sized OLED TVs will fare worse, and we expect that 65” OLED TVs will decline in both units and revenue for the full year 2022 as they face competition from aggressively priced 65” MiniLED and QD LCD TVs. LCD panel prices for 65” have plummeted this year as they are efficiently made on abundant Gen 10.5 capacity.

Advanced LCD TV units are expected to increase by 17% Y/Y to 15.0M units with revenues increasing 14% Y/Y. Growth will be concentrated in 75” and larger sizes. Shipments of 75” Advanced LCD TVs are expected to increase by 33% Y/Y while shipments of even larger Advanced LCD TVs are expected to increase by 48% Y/Y to more than 900K units.

Because of war in Europe, worldwide inflation, COVID shutdowns in China and the letdown from pandemic-fed demand in North America, slower growth has been the norm in 2022 and we expect that Advanced TV shipments and revenues in Q1’23 will be flat Y/Y. Growth will resume later in the year, and we expect shipments and revenue to grow by 12% and 4%, respectively, for the full year 2023.

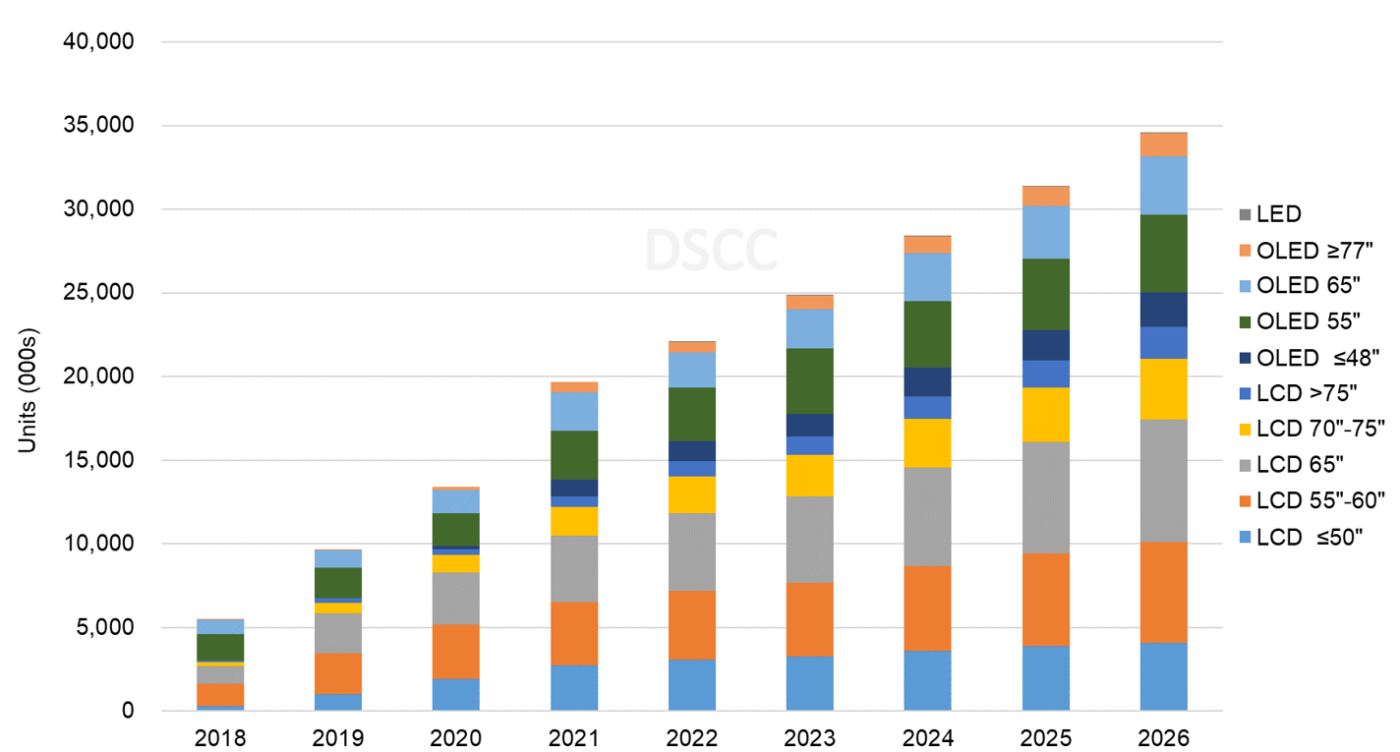

In our updated long-term forecast, we expect total Advanced TV shipments to grow by a 17% CAGR from 2020 to 2026 to 34.6M units, with OLED TV growing at a faster 21% CAGR to 11.6M and Advanced LCD TV units growing at 15% to 23.0M. We expect MicroLED to increase to 35k units in 2026 but this still represents less than 0.1% of the Advanced TV market.

Advanced TV Shipments by Screen Size and Technology

Advanced TV revenues jumped in 2021 with pandemic-fed demand and higher prices. Price declines in 2022-2026 will constrain revenue growth, but for the period 2020-2026 we expect Advanced TV revenues to increase at a 14% CAGR to $36.1B in 2026, driven by increasing volumes, larger screen sizes and new technologies. We forecast that OLED TV revenues, including QD-OLED, will grow by 14% to $13.9B in 2026 and that Advanced LCD TV revenues will grow by 13% to $20.7B. We expect that MicroLED will emerge as the super-premium TV to capture $1.5B or 4% of Advanced TV revenues with only 0.1% of units.

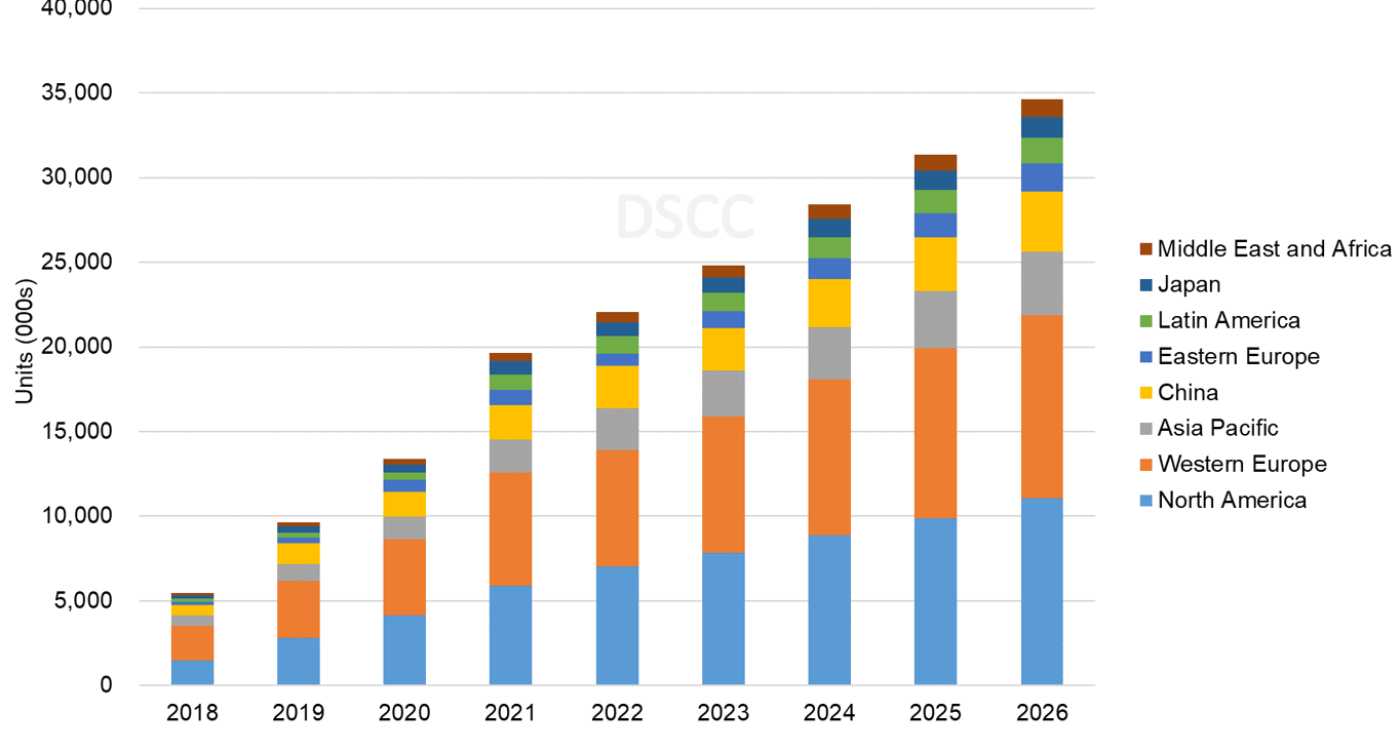

The report divides worldwide shipments into eight geographic regions, and we expect that Western Europe and North America will continue to be the largest regions for Advanced TV. These two regions represented a combined 63% and 62% of Advanced TV units and revenue, respectively, in 2021, and in the long term we expect the combined share will be nearly the same in 2026.

However, the war in Ukraine and the associated economic disruption has taken a toll on the Advanced TV market in Europe in 2022. Based on the sharp reduction in shipments in Q2, we now expect that Advanced TV shipments in Western Europe will increase by only 3% Y/Y and the share of Advanced TV shipments to Western Europe will fall from 34% in 2021 to 31% in 2022, with revenues showing a similar decline. As would be expected, the impact is greater in Eastern Europe; we expect Advanced TV shipments in that region to decline by 20% Y/Y in Q2 and revenues to decline by 23%. We expect that both regions will return to growth in 2023, but of course that outlook remains uncertain.

Advanced TV Shipments by Region

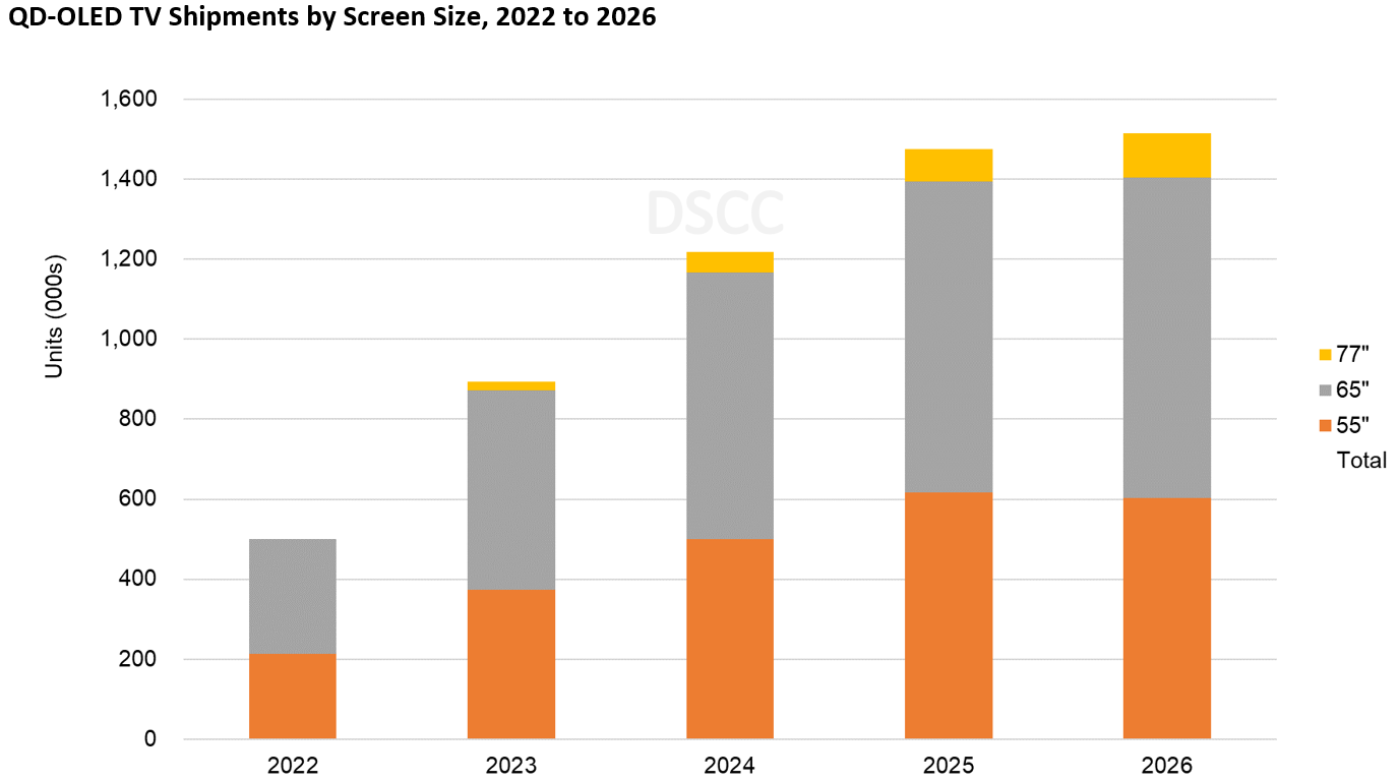

Now that Sony and Samsung have launched TVs with QD-OLED panels, we are seeing how this technology competes with other Advanced TV display technologies. Our forecast for QD-OLED TVs by screen size is shown in the next chart here. We expect these two brands to ship about 500K QD-OLED TVs in 2022, and shipments to increase to 1.5M in 2026, generally limited by SDC’s capacity. The product portfolio will be limited to 4K resolution panels, but 77” TVs and 49” monitors will be added in 2023 as SDC will make these in a Multi-cut Mother Glass (MMG) configuration, 2-up 77” and 2-up 49” on each Gen 8.5 substrate. SDC will also make 34” QD-OLED monitor panels, but monitors are not covered in the Advanced TV report.

QD-OLED TV Shipments by Screen Size

The category of Advanced TVs represents only a small fraction of the total TV market in unit terms, but it represents where all “the action” is in the technology battle. The champion for the LCD camp is MiniLED, and our forecast for MiniLED TV sets by screen size is shown in the final chart here. MiniLED TV was introduced by TCL in 2019 but sold only in very small volumes, but TCL has been followed by most other major brands introducing MiniLED TVs, including Samsung and LG in 2021 and Sony in 2022. We expect an ongoing battle between MiniLED, White OLED and QD-OLED for the premium TV market; because of the Gen 10.5 LCD fabs, we expect that MiniLED will have a substantial cost and price advantage over OLED in the largest screen sizes, and we have seen this pattern developing in 2022. MiniLED and big screens will also be the main pathway to 8K TVs; a majority of 8K TVs will employ MiniLED technology starting in 2022.

MiniLED TV Shipments by Screen Size

Overall, we expect that the volume for OLED TVs (including QD-OLED) to continue to exceed that of MiniLED, but that LCD TV (both MiniLED and standard backlit models) will continue to maintain >60% unit share of Advanced TV.

DSCC’s Quarterly Advanced TV Shipment and Forecast Report (一部実データ付きサンプルをお送りします) includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment history through Q2’22, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast out to 2026 across technology, region, resolution and size. Readers interested in subscribing to the report should contact info@displaysupplychain.co.jp.

本記事の出典調査レポート

Quarterly Advanced TV Shipment and Forecast Report

一部実データ付きサンプルをご返送

ご案内手順

1) まずは「お問い合わせフォーム」経由のご連絡にて、ご紹介資料、国内販売価格、一部実データ付きサンプルをご返信します。2) その後、DSCCアジア代表・田村喜男アナリストによる「本レポートの強み~DSCC独自の分析手法とは」のご説明 (お電話またはWEB面談) の上、お客様のミッションやお悩みをお聞かせください。本レポートを主候補に、課題解決に向けた最適サービスをご提案させていただきます。 3) ご購入後も、掲載内容に関するご質問を国内お客様サポート窓口が承り、質疑応答ミーティングを通じた国内外アナリスト/コンサルタントとの積極的な交流をお手伝いします。