Advancedタブレット市場予測~OLEDが2024年からシェアを大幅拡大

冒頭部和訳

DSCCは Quarterly Advanced IT Display Shipment and Technology Report (一部実データ付きサンプルをお送りします) の最新号を発行、タブレット用OLED、MiniLED LCD、LED LCDの最新出荷実績と予測を明らかにしている。

DSCCでは、OLEDまたはMiniLEDを搭載したタブレットをAdvanced (先端技術FPD搭載) タブレットと呼んでいる。このカテゴリーの出荷台数は前期比5%減・前年比362%増の243万台となった。12.9インチMiniLED搭載iPad Proに対する継続的な強い需要と、SamsungのOLED搭載Galaxy Tab S8+およびS8 Ultraの発売により、このカテゴリーにとって過去2番目の好実績を記録した四半期となった。Q1’22にはMiniLEDのシェアが数量ベースで74%から56%に、金額ベースでは87%から71%に低下した。数量ベースと金額ベースのシェアの差は、MiniLEDの価格上昇によるものである。

タブレット用FPD市場全体は、前期比1%増・前年比28%減の4900万台となった。前年比ベースで2桁の減少となったのは3四半期連続で、少なくともQ2’22まで続くと予測される。タブレット用FPDの総出荷金額は、前期比7%減・前年比23%減の22億ドルとなった。これは、パンデミックによるIT市場ブーム後のQ2’20以来、最も低い値である。

2022年通年では、タブレットが8%減少する一方でAdvancedタブレットが22%増加し、Advancedカテゴリーのシェアが数量ベースで3%から4%に上昇するとDSCCは予測している。また、Advancedタブレット用FPDの出荷金額は15%増加し、タブレット用FPDの総出荷金額は22%減少すると予測している。その結果、Advancedタブレット用FPDの出荷金額シェアは、2021年の12%から2022年には18%に上昇する見通しである。

DSCC Updates Tablet Forecasts, OLEDs Poised to Take Significant Share from 2024

DSCC reported on its latest results and forecasts for OLED, MiniLED LCD and LED LCD tablet panels in its latest Quarterly Advanced IT Display Shipment and Technology Report (一部実データ付きサンプルをお送りします).

We refer to OLED and MiniLED tablets as Advanced Tablets. This category fell 5% Q/Q while rising 362% Y/Y to 2.43M. It was the second best quarter to date for this category on continued strong demand for the 12.9” MiniLED iPad Pro and the launch of Samsung’s OLED Galaxy Tab S8+ and S8 Ultra. MiniLEDs had a 56% share of the Advanced Tablet market on a unit basis in Q1’22, down from 74%, and a 71% share on a revenue basis, down from 87%, with the disparity related to the higher MiniLED panel prices.

The overall tablet display market rose 1% Q/Q while falling 28% Y/Y to 49M units. It was the third straight quarter down double-digits on a Y/Y basis, which is expected to continue through at least Q2’22. Total tablet display revenues were down 7% Q/Q and 23% Y/Y to $2.2B, the lowest value since Q2’20 after the boom in the IT market resulting from the pandemic.

For all of 2022, DSCC expects tablets to fall 8% with the Advanced Tablet category rising 22% and its share rising from 3% to 4% of units. Advanced Tablet panel revenues are expected to rise 15% while total tablet display revenues fall 22%. As a result, the Advanced Tablet display revenue share is expected to rise from 12% in 2021 to 18% in 2022.

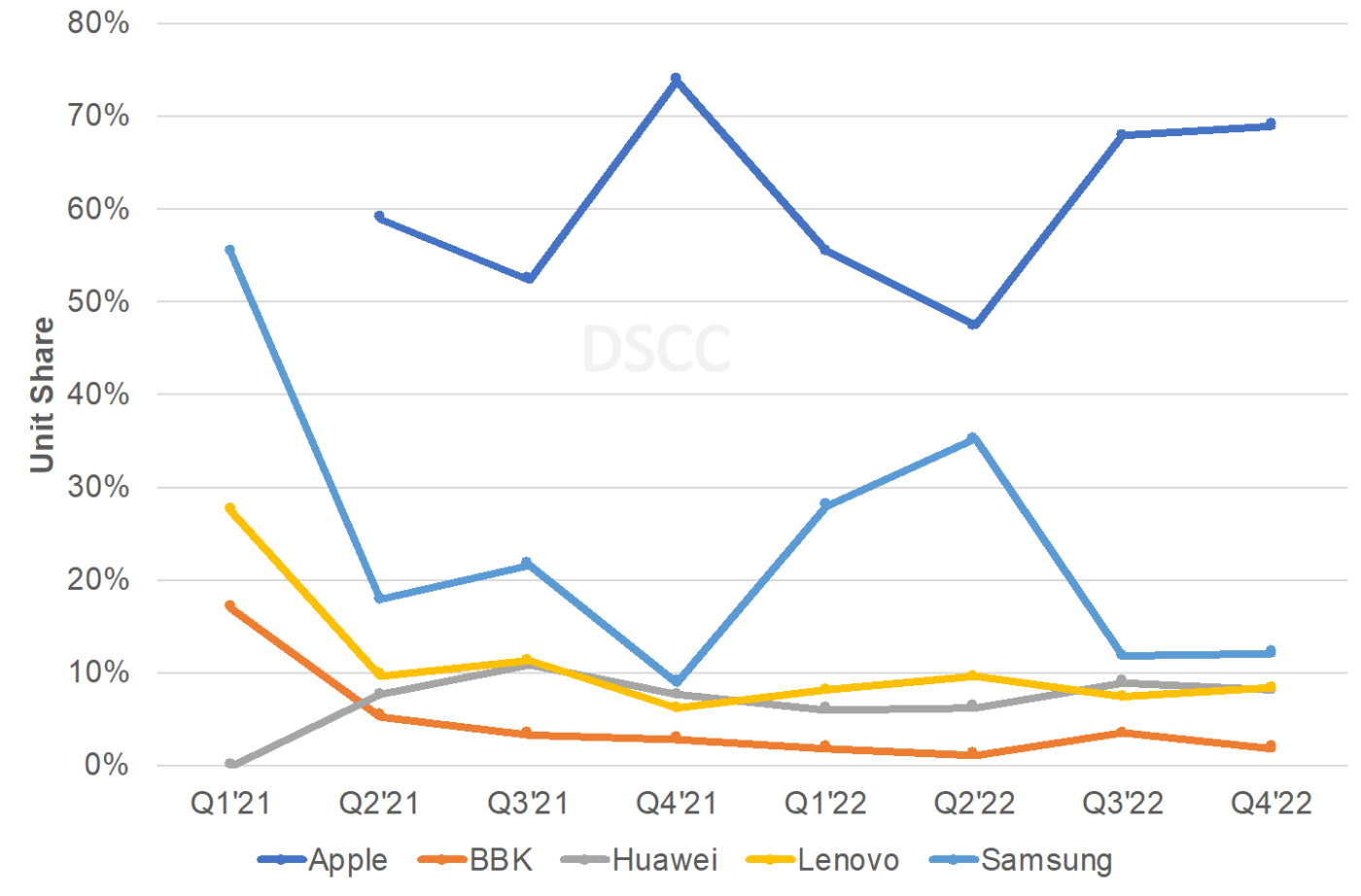

Apple’s share of Advanced Tablet panel procurement fell from 74% in Q4’21 to 56% in Q1’22, with Samsung’s share rising from 9% to 28% as it launched the OLED Galaxy Tab S8+ and S8 Ultra. Apple’s share should decline further in Q2’22 on seasonal weakness and the age of this product before rising to the high 60s on the launch of the M2 based MiniLED iPad Pro. The faster, more efficient M2 chip along with the introduction of Stage Manager offering the ability to use multiple workspaces should narrow the performance gap between iPads and MacBooks and boost the attractiveness of the new iPad Pro. The MiniLED configuration on the 12.9” model is not expected to change, as Apple will focus on the cost down of the initial implementation rather than redesigning it. Samsung should continue to gain share in Q2’22 before falling in 2H’22 on lack of new Advanced Tablets and Apple’s refresh.

Advanced Tablet Display Market Share by Brand

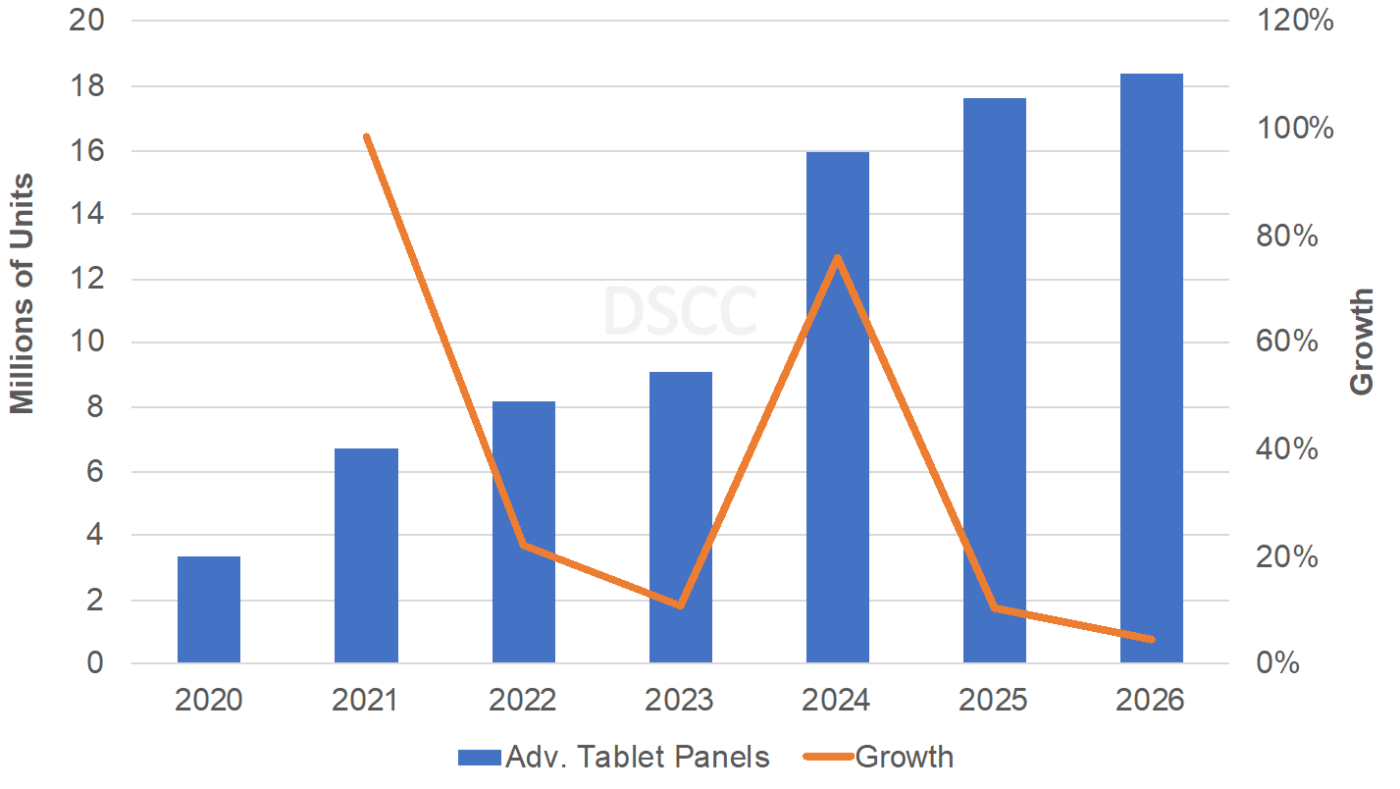

DSCC also provides a look at brands and panel suppliers’ roadmaps in this report, along with key OLED and MiniLED display technology advances for the tablet market. DSCC expects the Advanced Tablet display market to grow at a 22% CAGR from 2021 to 2026 to 18M panels, with OLEDs rising to a dominant share from 2025. Shipments were reduced from last quarter due to no evidence of other brands entering the MiniLED tablet market and Apple not pursuing MiniLEDs at >13” for now and instead, opting for conventional backlighting on the rumored 14.1” product. So, with fewer models and a more limited size range, our forecast came down. Although brighter with longer lifetimes, MiniLEDs are currently more expensive than OLEDs and have a more complicated supply chain. Other brands may be reluctant to purchase the more expensive product and compete with Apple at higher price points.

The 22% growth in Advanced Tablets can be supported by Apple’s entry into a second size (11”) as well as OLED performance improvements coming from tandem stacks, variable refresh, high efficiency blue emitters, lower costs from depreciated G6 fabs and new IGZO G8.5 fabs and new foldable form factors taking share. OLEDs also offer lower costs than MiniLEDs, a simpler supply chain and more OLED manufacturers are expected to enter this category.

The overall tablet market is expected to fall at a 2% CAGR from 2021 to 2026 on a unit basis and 4% on a revenue basis. However, the Advanced Tablet display market is expected to rise to a 9% share on a unit basis and 30% share on a $US basis.

2020 – 2026 Advanced Tablet Display Market Unit Forecast

Apple is forecasted to maintain its dominance in the Advanced Tablet market with at least a 50% share, which will increase to over 60% from 2024 once it launches its OLED models, adding a second Advanced model at 11”. We show Samsung and other brands close to equally sharing the remainder of the market. Apple is expected to launch 11” and 12.9” OLED iPad Pro’s with LTPO, tandem stacks and rigid + TFE substrates. Tandem stacks can double efficiency and brightness, increase lifetime by 4X, reduce burn-in and reduce power consumption by 30%. We show the latest build plan for the Apple iPad Pro’s by panel supplier through 2026, which leaves little opportunity for MiniLEDs from that year.

To learn more about DSCC’s research on Advanced tablets, notebooks and monitors, please contact info@displaysupplychain.co.jp or visit Quarterly Advanced IT Display Shipment and Technology Report.

本記事の出典調査レポート

Quarterly Advanced IT Display Shipment and Technology Report

一部実データ付きサンプルをご返送

ご案内手順

1) まずは「お問い合わせフォーム」経由のご連絡にて、ご紹介資料、国内販売価格、一部実データ付きサンプルをご返信します。2) その後、DSCCアジア代表・田村喜男アナリストによる「本レポートの強み~DSCC独自の分析手法とは」のご説明 (お電話またはWEB面談) の上、お客様のミッションやお悩みをお聞かせください。本レポートを主候補に、課題解決に向けた最適サービスをご提案させていただきます。 3) ご購入後も、掲載内容に関するご質問を国内お客様サポート窓口が承り、質疑応答ミーティングを通じた国内外アナリスト/コンサルタントとの積極的な交流をお手伝いします。