OLED出荷金額は2026年に650億ドル到達へ~IT/スマートフォン/TVの各用途で出荷枚数が2桁成長

冒頭部和訳

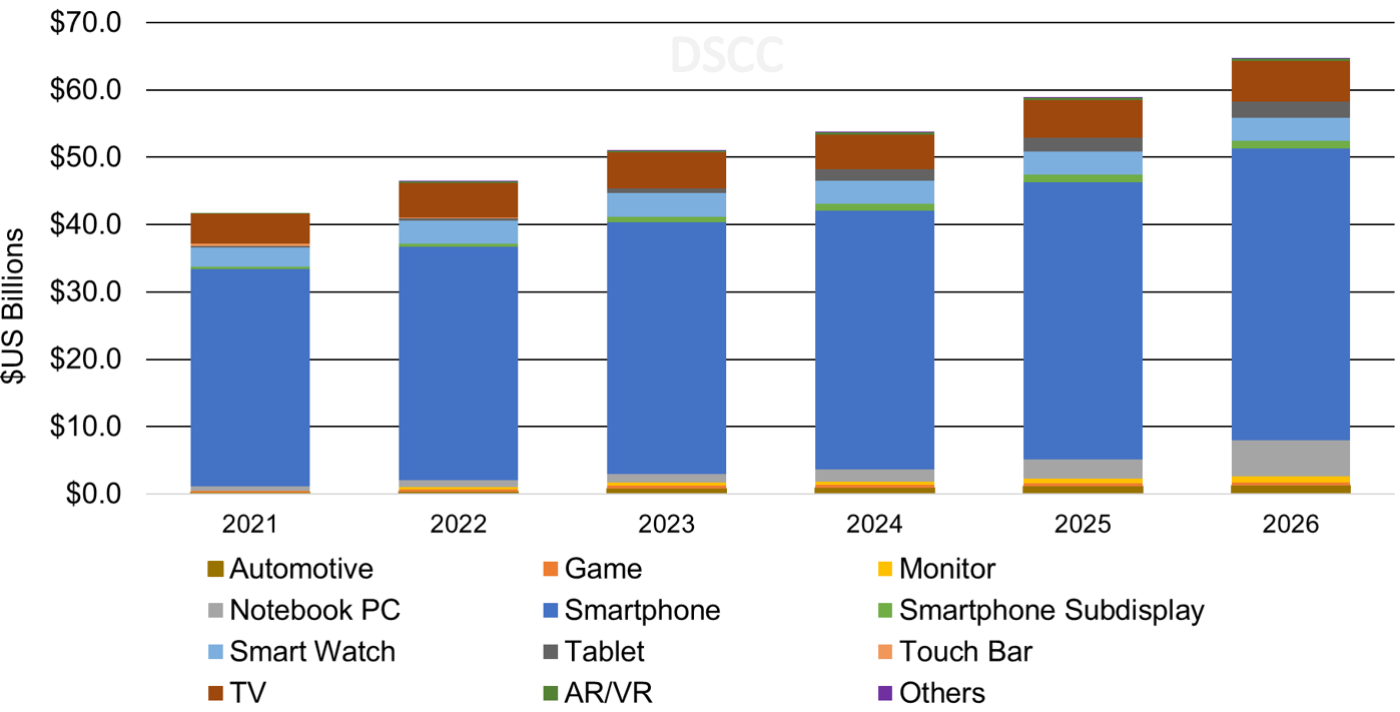

DSCCでは、コストの下落、性能の向上、生産能力の急拡大にともない、OLEDが急成長すると予測している。DSCCは Quarterly OLED Shipment Report (一部実データ付きサンプルをお送りします) 最新号で、OLED出荷金額は2021年から2026年にかけてCAGR 9%で成長し650億ドルに到達すると予測している。同レポートでは、すべてのOLEDアプリケーションの出荷と価格に関するデータを、ブランド別、モデル別、FPDメーカー別に提示している。

2021年から2026年の成長をけん引する各カテゴリーの見通しは以下の通り。

- OLEDモニター:出荷枚数CAGR 104%、出荷金額 CAGR 70%

- OLEDノートPC:出荷枚数CAGR 51%、出荷金額 CAGR 52%

- OLEDタブレット:出荷枚数CAGR 45%、出荷金額 CAGR 52%

- OLED TV:出荷枚数CAGR 13%、出荷金額 CAGR 6%

- OLEDスマートフォン:出荷枚数CAGR 11%、出荷金額 CAGR 6%

ノートPCは引き続き強気の予測だが、その要因として、コスト最適化が進んだOLED生産ラインが稼働予定で、こうしたラインのターゲットがノートPCであることが挙げられる。IT市場対応のため、複数の企業が次の第6世代モバイル機器向けラインをスマートフォンから低コストの第8.5世代/第8.6世代ラインに切り替えており、モバイル機器向けOLED能力を大幅に拡張している。

OLEDモニターについては、FPDメーカーが今後、コストが最適化された第8.5世代IGZO FMM VTE RGB OLEDラインを強化するに従って、2025年以降に出荷が加速する見通しに基づき、予測を更新した。低コストの第8.5世代/第8.6世代IGZOバックプレーンでFMM VTE装置を使用するRGB OLEDは、より高い輝度を実現できることから、OLEDモニターの最適ソリューションとなる可能性がある。OLEDタブレットについては、Appleから11インチおよび12.9インチのOLEDタブレット発売が予想される2024年以降、急成長が見込まれる。

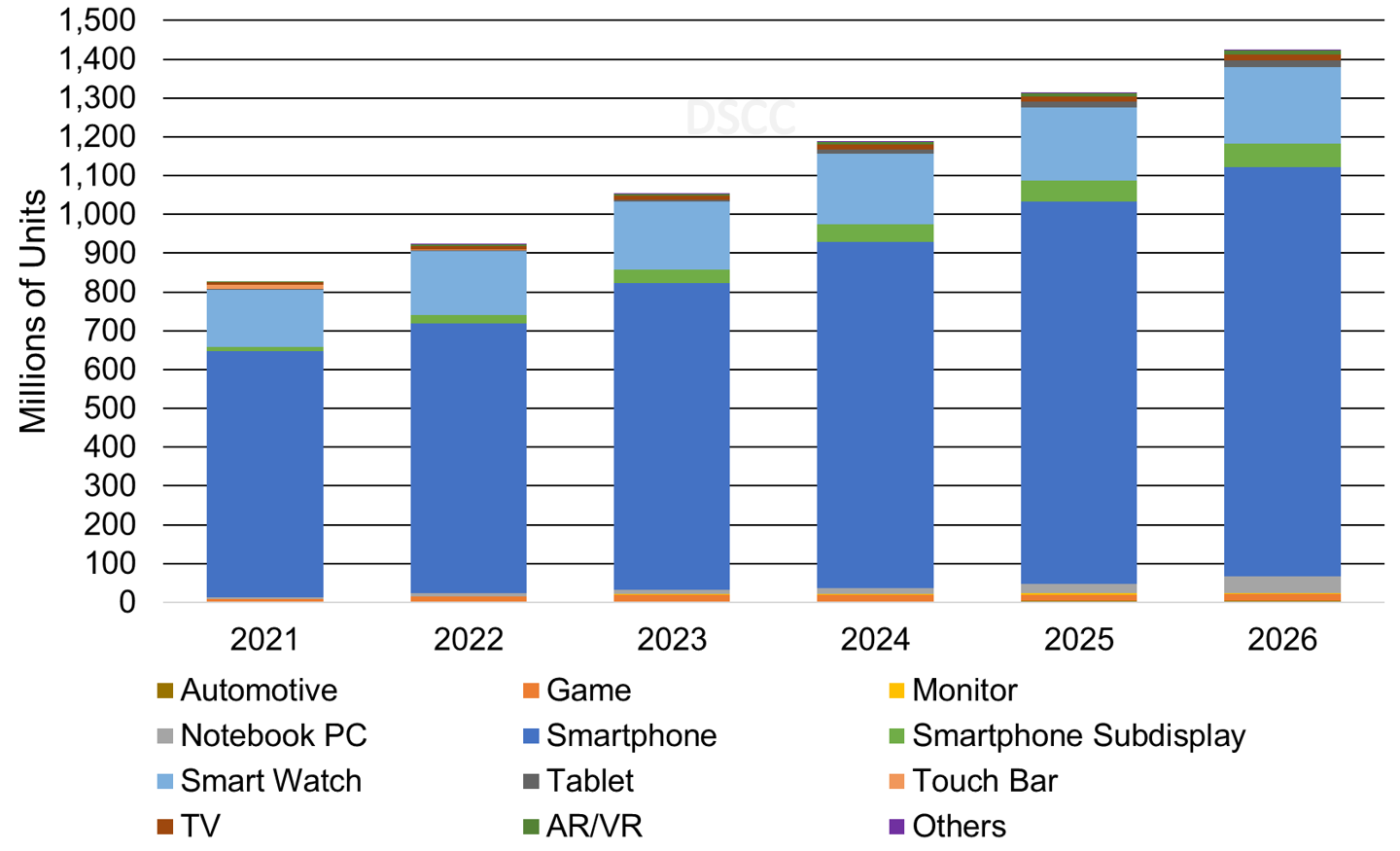

アプリケーション別では、スマートフォンが2026年まで数量シェア74%を獲得し、出荷枚数は10億枚超、出荷金額は430億ドルで首位を維持すると予測されている。スマートウォッチは2026年の数量シェアが14%、金額シェアが5%と予測され、数量ベースではアプリケーション別第2位のポジションをキープすると見られている。ノートPCをターゲットとしコスト最適化された第8.5世代リジッドOLED生産能力を追加するFPDメーカーの増加にともない、ノートPC用OLEDの出荷枚数は2021年の600万枚から2026年には4400万枚に成長すると予測されている。

DSCC Forecasts OLED Revenues to Reach $65B in 2026 on Double-Digit Unit Growth in IT, Smartphones and TVs

DSCC expects OLEDs to grow rapidly as costs fall, performance improves and capacity surges. The company is forecasting $65B in revenue on a 9% CAGR from 2021 to 2026 in the latest release of its Quarterly OLED Shipment Report (一部実データ付きサンプルをお送りします), which reveals shipments and prices for every OLED application by brand, model and panel supplier.

The 2021 – 2026 growth is driven by the following categories:

- OLED monitors: 104% and 70% CAGR unit and revenue growth;

- OLED notebook PCs: 51% and 52% CAGR unit and revenue growth;

- OLED tablets: 45% and 52% CAGR unit and revenue growth;

- OLED TVs: 13% and 6% CAGR unit and revenue growth;

- OLED smartphones: 11% and 6% CAGR unit and revenue growth.

Our continued bullish forecast for notebook PCs is primarily related to more cost optimized OLED fab capacity coming online that will target notebook PCs. Multiple companies have switched their next G6 mobile fabs from smartphones to lower cost G8.5/G8.6 fabs to address the IT market, significantly boosting mobile OLED capacity.

For OLED monitors, we have updated this forecast to reflect faster shipments from 2025 as panel suppliers ramp up future cost optimized G8.5 IGZO FMM VTE RGB OLED fabs. RGB OLEDs using FMM VTE equipment on lower cost G8.5/G8.6 IGZO backplanes could be the best solution for OLED monitors due to the ability to achieve higher brightness. For OLED tablets, we expect rapid growth from 2024 when Apple is expected to launch an 11” and 12.9” OLED tablet.

For OLED applications on a unit basis, smartphones are expected to remain the dominant application with a 74% unit share through 2026 with more than 1B OLED smartphone panel shipments and $43B in OLED smartphone panel revenue. Smartwatches are expected to remain the #2 application on a unit basis with a 14% unit share and a 5% revenue share in 2026. We expect OLED notebook PC panel shipments to grow to 44M units in 2026 from 6M in 2021 as more panel suppliers add cost optimized G8.5 rigid OLED capacity targeting this category.

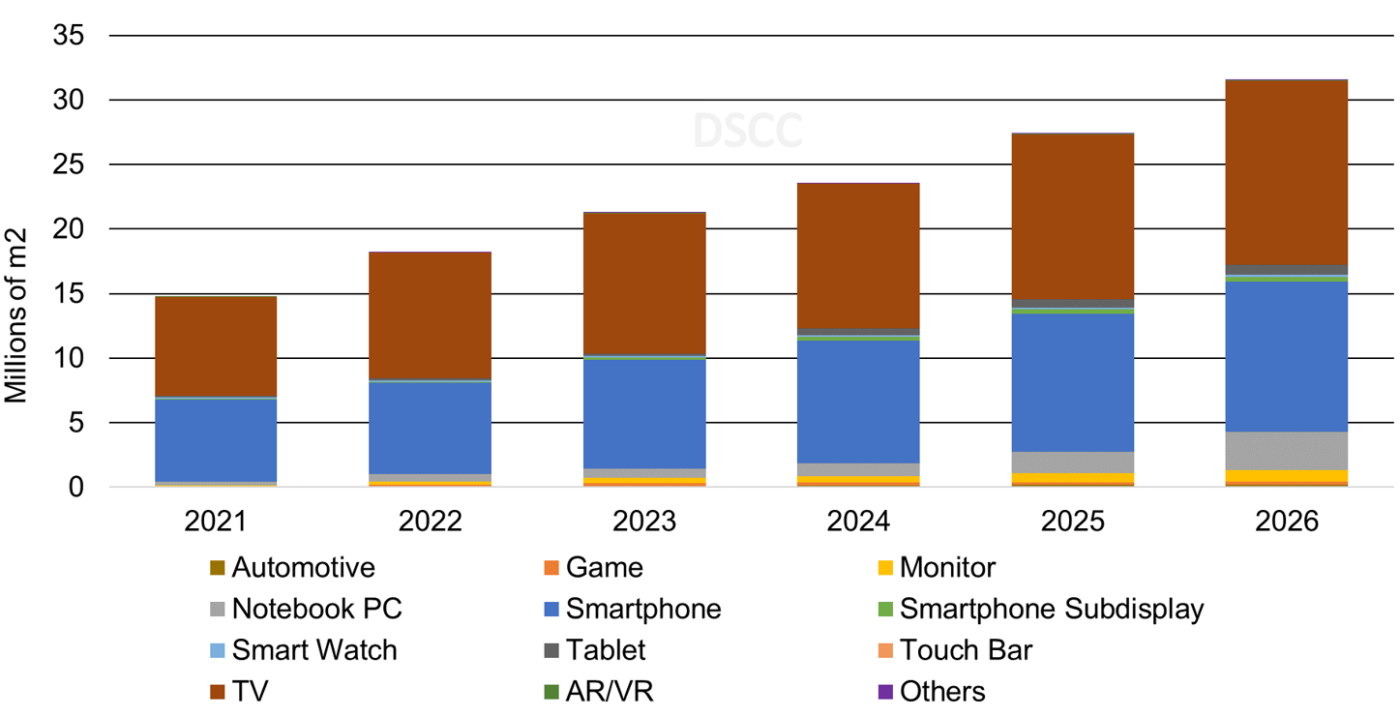

Annual OLED Panel Shipments by Application Forecast, 2021-2026

Annual OLED TV Panel Revenue by Application Forecast, 2021-2026

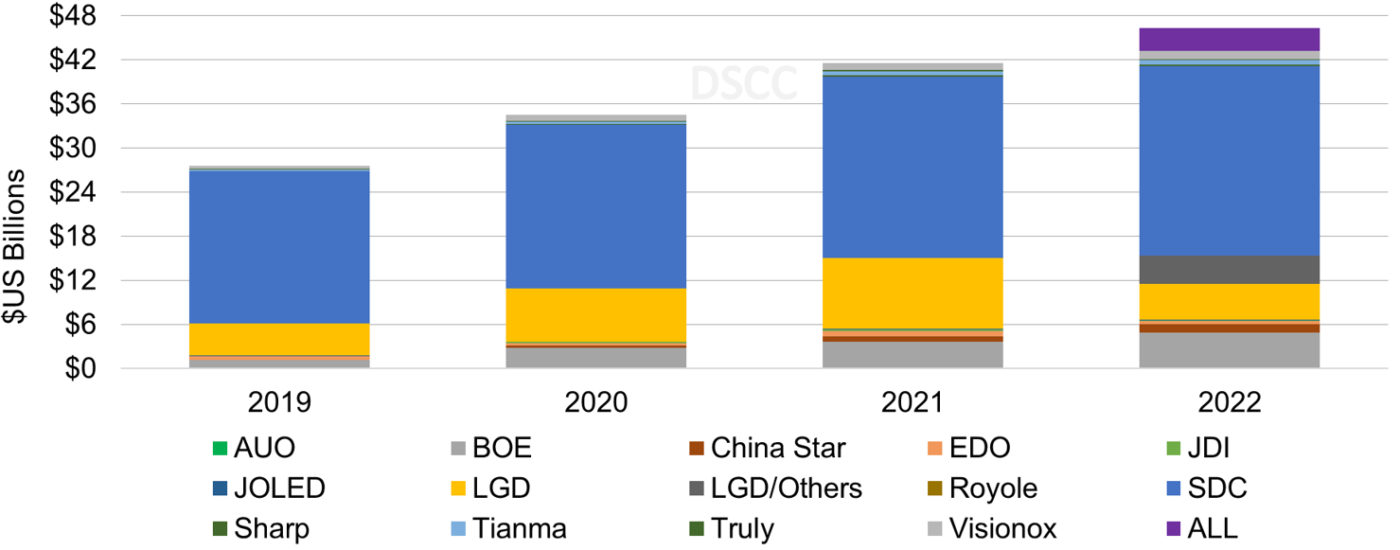

By revenue by panel supplier, BOE grew 29% Y/Y in 2021 due to growth from Huawei and Honor for smartwatches, increased volumes for the Apple iPhone 12 and iPhone 13 as well as key design wins for other leading Chinese smartphone brands. In 2022, BOE is expected to continue to grow in revenue as a result of their 696% Y/Y growth for the Apple iPhone 13, new smartphones for other brands including foldable models, a foldable notebook panel as well as smartwatches.

LGD grew by 32% Y/Y in 2021 as a result of supplying more OLED smartphone panels for the Apple iPhone 12 and iPhone 13 and the Apple Watch Series 7 along with healthy growth in the automotive market. In 2022, we expect LGD to grow in units as a result of expanding the OLED TV lineup to include a 42” model as well as expanding their OLED monitor offerings and the continued growth for the OLED automotive business.

SDC is the #1 panel supplier and grew 11% Y/Y for a 59% revenue share in 2021, down from 65% in 2020. SDC is the sole supplier for LTPO smartphone panels for Apple’s iPhone 13 Pro and iPhone 13 Pro Max. In addition to this, SDC has leveraged their rigid OLED capacity to greatly increase OLED notebook PC panel shipments as well as OLED gaming panel shipments for the Nintendo OLED Switch. We expect SDC to ship ~9M OLED notebook PC panels in 2022, which represents a 68% Y/Y increase. We expect SDC to continue to grow 4% in revenue in 2022 as a result of continued growth for OLED smartphones using LTPO panels, a 67% Y/Y increase for OLED notebook PC panels and a 62% Y/Y increase for OLED tablet panels.

Annual OLED Panel Revenue by Panel Supplier Forecast, 2019-2022

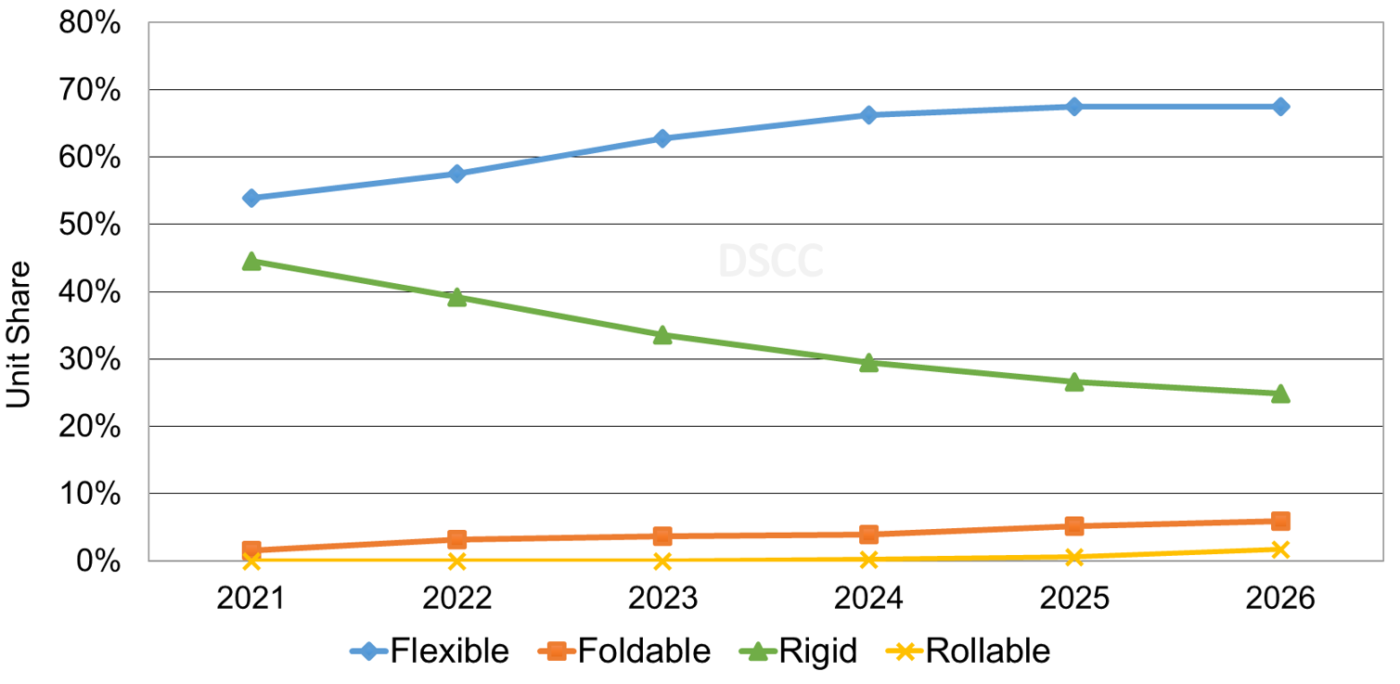

For OLED smartphones by panel shipments, 2021 increased 26% Y/Y to 634M. This growth was driven by 208% Y/Y growth for foldable OLEDs, followed by 25% for rigid OLEDs and 24% for flexible OLEDs. In 2022, we expect triple-digit Y/Y growth for foldable OLED panel shipments and double-digit Y/Y growth for flexible OLED panel shipments.

We expect a 3% Y/Y decline in 2022 for rigid OLED smartphone panel shipments due to Honor and Huawei significantly reducing quantities in 2022 and panel suppliers using existing rigid capacity for IT applications. In 2022, foldable OLED smartphone panel shipments are expected to take share rising to a 3% unit share and a 9% revenue share as Samsung and other brands focus on foldable OLED smartphones. In 2026, we expect foldable OLED smartphone panel shipments to achieve a 6% unit share and a 16% revenue share due to more brands entering the category and higher ASPs. In 2024, rollable OLED smartphone panel shipments are expected to start gaining share as major brands are expected to introduce these smartphone products at that time.

Annual OLED Smartphone Panel Share by Substrate Forecast, 2021-2026

On an area basis, OLED TVs remained the largest application with a 52% share in 2021. In 2022, this share is expected to increase to 54% on gains from 55” and 65” QD-OLED TV and gains from 55”, 65”, 77” and 88” WOLED TVs. We expect notebook PCs to grow share from 2% in 2021 to 9% in 2026 as existing and new rigid capacity is utilized and new capacity comes online. Excluding TVs, the notebook PC share increases to 17% in 2026. We expect monitors and tablets to grow share from <1% in 2021 to 3% in 2026.

Annual OLED Area by Application, 2021-2026

Readers interested in subscribing to the Quarterly OLED Shipment Report (一部実データ付きサンプルをお送りします) should contact info@displaysupplychain.co.jp.

本記事の出典調査レポート

Quarterly OLED Shipment Report

一部実データ付きサンプルをご返送

ご案内手順

1) まずは「お問い合わせフォーム」経由のご連絡にて、ご紹介資料、国内販売価格、一部実データ付きサンプルをご返信します。2) その後、DSCCアジア代表・田村喜男アナリストによる「本レポートの強み~DSCC独自の分析手法とは」のご説明 (お電話またはWEB面談) の上、お客様のミッションやお悩みをお聞かせください。本レポートを主候補に、課題解決に向けた最適サービスをご提案させていただきます。 3) ご購入後も、掲載内容に関するご質問を国内お客様サポート窓口が承り、質疑応答ミーティングを通じた国内外アナリスト/コンサルタントとの積極的な交流をお手伝いします。