フォルダブル/ローラブルFPD調査レポートのハイライト

冒頭部和訳

DSCCの Quarterly Foldable/Rollable Display Shipment and Technology Report は、フォルダブルおよびローラブルディスプレイについて、パネルメーカーとブランドの最新製品計画、地域別需要、パネルとカバーウィンドウのコスト予測、サプライチェーン関係とその予測、デバイスの断面図など、さまざまなインサイトを満載している。同レポートは付属のエクセル式データベース(ピボットテーブル)とともに今週リリース予定である。

レポートのハイライトは以下の通り:

- 2021年フォルダブルディスプレイ出荷枚数は前年比207%増の1000万枚で、予測通りだった。

- 2021年フォルダブルスマートフォン出荷台数は前年比254%増の798万台で、予測を6%上回った。増加の最大の理由はQ4'21にSamsung Galaxy Z Flip 3が強い需要により予測を14%上回る販売を記録したこと。特に欧州では出荷が前期比30%超と伸びた。

- Samsung は2021年フォルダブルスマートフォン出荷のシェア88%を獲得。同社のシェアは2020年の86%から上昇した。ベストセラー上位2モデルと、上位5モデルのうち4モデルがSamsung製だった。

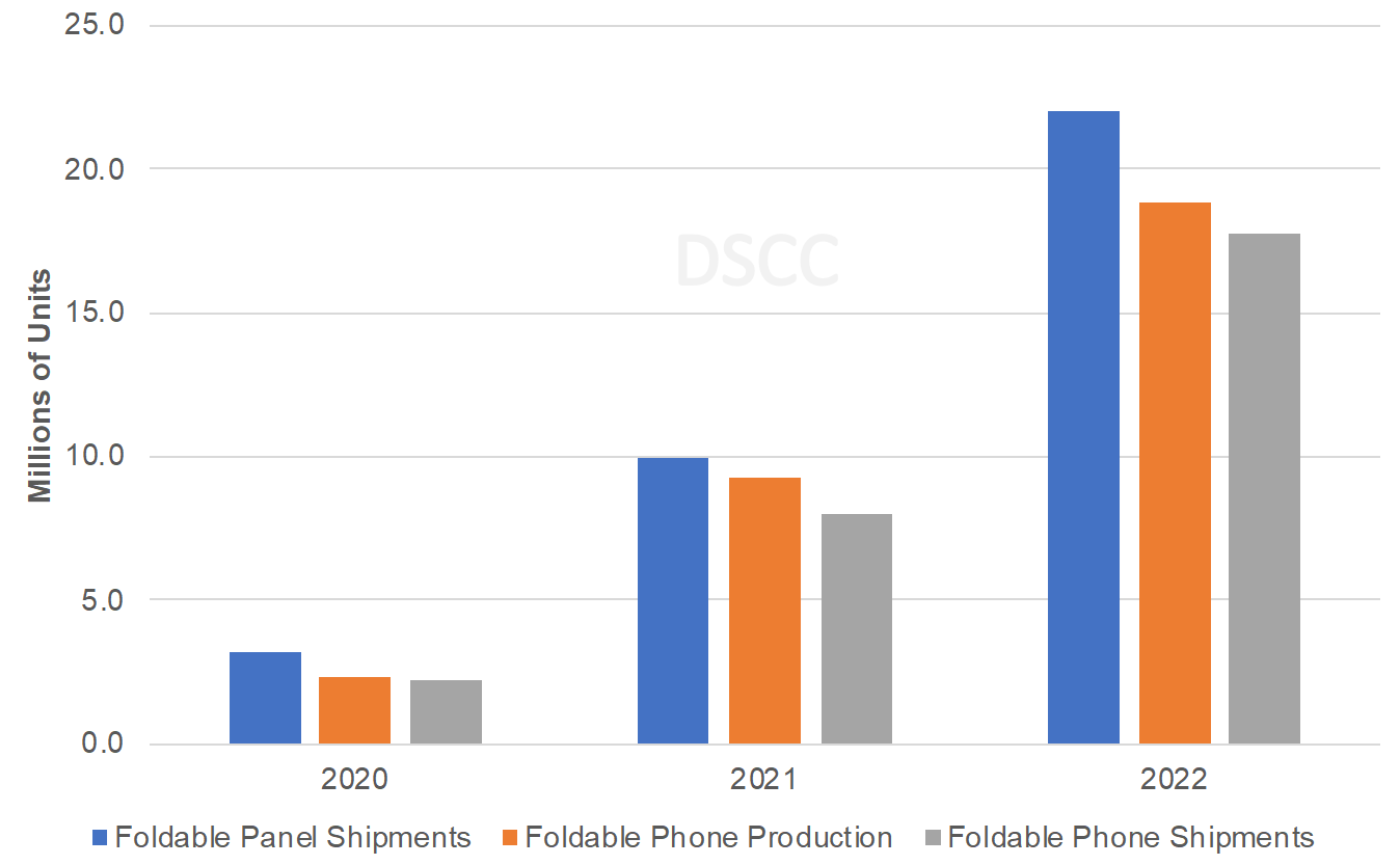

- 2022年にはフォルダブルディスプレイ出荷、フォルダブルスマートフォン生産、フォルダブルスマートフォン出荷のいずれも100%以上の増加が見込まれる。Samsungのスマートフォン目標は1400万台以上、Samsung Displayからは約1900万枚のディスプレイ出荷が予測される。

Highlights from DSCC’s Upcoming Foldable/Rollable Report

Our Quarterly Foldable/Rollable Display Shipment and Technology Report (一部実データ付きサンプルをお送りします) is filled with insights on the latest foldable and rollable product plans from panel makers and brands, regional demand as well as panel and cover window cost forecasts, supply chain relationships and forecasts, device cross sections and much more. We expect to publish the pivot tables and report this week.

Some of the highlights include:

- Foldable panel shipments for 2021 came in as expected at 10.0M, up 207% Y/Y.

- Foldable smartphone shipments came in 6% better than expected for 2021 at 7.98M, up 254% Y/Y. The biggest reason for the increase was the outperformance of the Samsung Galaxy Z Flip 3, which sold 14% better than expected in Q4’21 on strong demand, particularly in Europe where shipments rose over 30% Q/Q.

- Samsung enjoyed an 88% share of foldable smartphone shipments in 2021, up from 86% in 2020 and had the top two best-selling models and four of the top five.

- We expect foldable panel shipments, phone production and phone shipments to all rise by more than 100% in 2022 with Samsung targeting over 14M phones and Samsung Display expected to ship around 19M panels.

Foldable Panel Shipments, Phone Production and Phone Shipments

- However, demand for the Samsung Z Fold 3 has stalled in Q1’22 with panel shipments and production down much more than expected. The jury is still out on whether and when in-folding type foldable smartphones can drive large volumes and achieve more than six months of healthy sell-through for a given model. On the other hand, clamshell devices are expected to exceed 14M units in 2022 with new brands, TCL and Xiaomi, entering this space in 2022 to compete with new models from existing players, Samsung, Huawei and Motorola.

- In addition to the high price, part of the problem for in-folding smartphones may be the form factor. The Oppo Find N 5G with its landscape form factor (8.4:9 vs. 5:4 on the Z Fold 3) and wider front display has gotten many positive reviews and we expect to see more landscape in-folding smartphones in 2022.

- It appears that Samsung will look to try and boost in-folding demand in its Z Fold 4 expected later this year by incorporating its S-Pen in a silo in the device rather than separately in the case. Samsung may also be revisiting the form factor of the Z Fold 4 by increasing the main display from 7.55” to 7.56” but reducing the cover display size from 6.21” to 6.19”, which should allow for a wider aspect ratio.

- One new player is Google. We had reported that they had cancelled their 2021 launch of their first foldable smartphone, but now we see them returning with a likely October 2022 launch with panel shipments starting in Q3’22. While the foldable display size is expected to remain 7.6”, the cover display size is rumored to have declined to 5.8” which makes me think this too will be a landscape device. Perhaps that was the reason they chose not to launch in 2021.

- We now expect Oppo to launch a larger size foldable in Q4’22. Although the 7.11” has gotten strong reviews, volumes have been relatively small so far. Perhaps they kept volumes low on this device to date on profitability concerns, or they were just looking to dip their toes into the foldable market. We also believe they may boost the Find N 5G volumes in the 2H of 2022.

- We also expect to see a couple of models from Vivo. The first one, around 8”, may launch at Mobile World Congress. The next model is expected to be even larger and should launch in Q4’22.

- Although Xiaomi has had extensive discussions with a follow up to the Mix Fold, we don’t expect a successor at the moment in 2022. However, it now looks like they will introduce a clamshell model in Q3’22 which may rival the Huawei P50 Pocket for the bestselling non-Samsung foldable in 2022.

- In other exciting product news, we hear one brand expects to bring a foldable smartphone with UTG to market in 2022 without using a Samsung Display panel. This would be the first time that has happened and is promising for UTG suppliers. This will be the first time that UTG will be processed by a Chinese glass processing supplier. The brand, model, UTG supplier and UTG processing supplier are all identified in the latest report.

- We delayed our expectations for Apple entering the foldable smartphone market by two years to 2025 after discussions with our supply chain contacts. The company does not appear to be in a hurry to enter the foldable smartphone market, and it may even take longer than that.

- On the other hand, we are now showing Apple in our roadmap for foldable notebooks. We hear there is interest at the largest size yet, around 20.x”. This size could create a new category for Apple and would result in a true dual use product, a notebook with a full-size keyboard when folded and for use as a monitor when not folded and used with an external keyboard. It may also allow for UHD/4K resolution or even higher at that size. The time frame is likely later than 2025 though, it could be 2026 or 2027. We explain which display glass size and backplane technology Apple is most likely to use at this point and why in the report. The fact that Apple has interest in a foldable notebook, even if it is five years away, is good news for the foldable space.

- We also report on Samsung making progress in a multi-fold with the timing moved up for product launch. We report on the timing, application and panel size as well as thickness goals. A multi-fold device has reportedly leapfrogged rollable/slidable timing at Samsung for a number of hardware, software and commercial reasons as outlined in the report.

- We also include updated UTG costs and provide a cost forecast for the 7.11” panel in the Oppo Find N 5G as well as Z Flip 3 and Z Fold 3 sized panels with breakouts for UTG vs. CPI, LTPS vs. LTPO and CoE vs. polarizers.

Our forecast includes monthly and quarterly data through 2022 and annual data through 2026 by brand, model, panel size, resolution, refresh rate, backplane technology, cover window material, UTG and CPI supplier, notch vs. hole vs. UPC, polarizer supplier, hardcoat supplier, touch sensor supplier, chipset, chipset supplier, number of cameras, network type, etc. and includes panel shipments, panel revenues, device shipments, device revenues, panel prices, device prices and much more. Also included are the latest film stacks for each foldable phone on the market.

For more information, please contact info@displaysupplychain.co.jp.