2024年FPD産業の予測10選

本記事の出典調査レポートの一つ Future of OLED Manufacturing Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。

10 Predictions for the Display Industry in 2024

※ご参考※ 無料翻訳ツール (DeepL)

As we have done each year since 2019, we have some predictions for the year. This year’s predictions came from several of the analysts on the DSCC team, with Bob O’Brien serving as the editor.

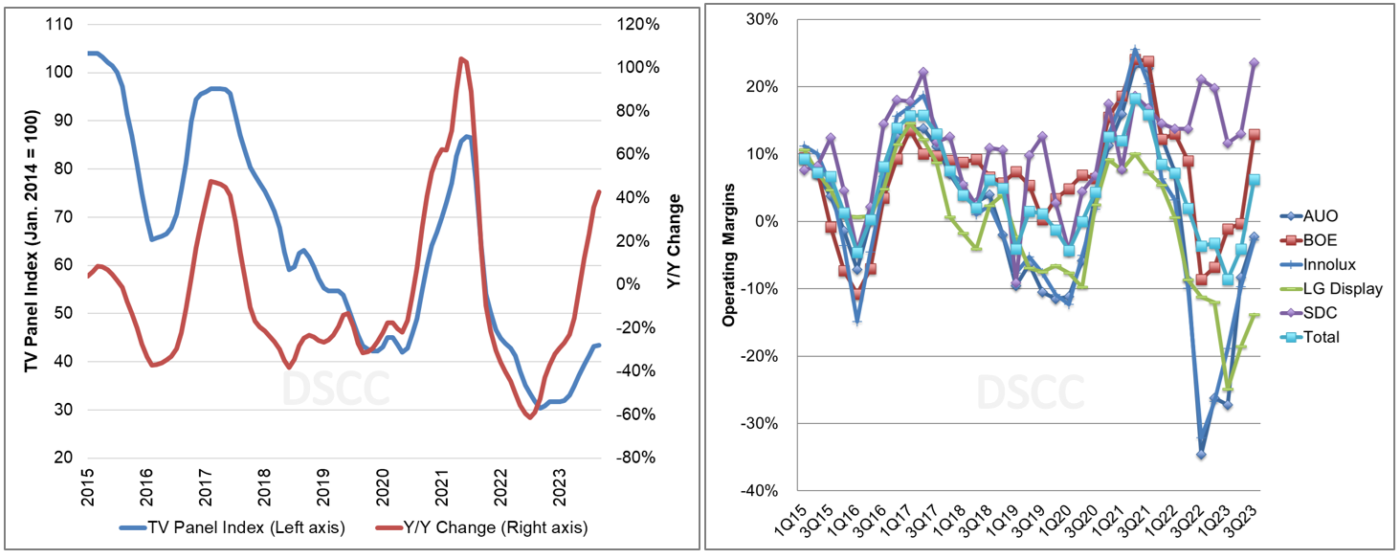

#1: LCD TV Panel Prices Fall but Will Remain Above All-Time Lows

DSCC’s price index for LCD TV panels serves as perhaps the most important indicator of the health of the flat panel display industry as it illuminates the Crystal Cycle of shortage and oversupply. As shown in the charts here, it is easy to see the correlation between LCD TV panel prices and the operating profit margins for flat panel display makers. This correlation fits a little bit less well than it used to, because Samsung Display has completely exited the LCD business and LG Display has partially exited LCD. Nevertheless, it still holds for the Taiwanese panel makers and those in China.

In the wake of the pandemic, panel prices crashed as shortage turned to oversupply and prices reached an all-time low in September 2022 with panel makers selling below cash costs to raise cash by selling off inventory. Prices increased slowly in Q4’22 and Q1’23 before double-digit % increases in Q2’23 and Q3’23. Prices started to fall in the fourth quarter and are continuing to fall as 2024 begins.

LCD TV Panel Price Index (L) and Panel Maker Operating Profit Margins (R)

While prices are falling as we enter the year, and the oversupply in the industry remains, we do not believe that prices will fall to a new all-time low in 2024. The previous low in September 2022 was preceded by a massive inventory build-up throughout the TV value chain, which itself was the result of a severe shortage in 2020-2021 as pandemic demand exceeded the industry supply.

Although panel prices increased in the middle quarters of 2023, there was nothing close to a shortage. Prices increased because some panel makers refused to produce at the all-time low prices which were below cash costs. Even with the price increases in Q2’23-Q3’23, most panel makers continued to post losses in Q3. So while prices are falling in Q1, we think the floor in 2024 will be at cash cost, which is higher than the all-time low prices.

#2: The First Smart Watches with MicroLED Displays Will Be Launched

MicroLED technology holds great promise as the display technology of the future. It can deliver all the great performance attributes of OLED displays – perfect black giving tremendous contrast performance, ridiculously fast response times and great color – with brightness and efficiency exceeding OLED and much better lifetime with inorganic LEDs. At least, that is the promise. To date, the only MicroLED products available to consumers have been Samsung’s MicroLED TVs. Arguably, these TVs are hardly “available” because the price exceeds $100,000.

For years, analysts in the industry have predicted that the first application of MicroLED displays would be in wearables, specifically smart watches. The advantages of MicroLED in contrast, daylight readability and power consumption are all valuable in a smart watch, and the main disadvantage of MicroLED – much of the cost scale with the number of pixels – is minimized in a display with fewer than one million pixels.

The path for success for a new display technology goes like this:

- Develop a new technology with performance advantages;

- Find an application where you can charge a premium for performance;

- Build displays and make a profit (or at least come close) to justify new investment;

- Invest to generate more scale;

- Use bigger scale and experience to drive lower costs;

- Lower costs open up new applications. Go back to #2 and repeat.

MicroLED has clearly achieved #1 and smartwatch looks like the candidate for #2. We expect that the efforts to succeed in #3 will start to take place in 2024 with the introduction by TAG Heuer of a smartwatch with a MicroLED display.

TAG Heuer is a luxury watch maker based in Switzerland, coming from that country’s long history of excellence in mechanical clocks and watches. The company was founded in 1860. Like many luxury products, TAG Heuer’s watches function first as a status symbol, but the performance must be top notch. Their watches range in price from $1600 to $10,750, with an additional charge for engraving. For comparison, the Apple Watch SE costs $249, and Apple’s most expensive watch, the Ultra 2, costs $799. Also, like many other luxury goods, they can be found widely available at prices discounted by 20% or more.

TAG Heuer Connected Digital Display Watch with TAG Heuer Carrera Heuer 02 Watch Face

Our sources indicate that TAG Heuer will introduce a new smartwatch with a 1.39” Round shaped MicroLED display. The display will utilize an LTPS backplane and 15µm x 30µm RGB LED chips. The display will have 454x454 resolution, although with the round shape these figures refer to the axes, and the display will have fewer than the 200K pixels for a square display (162K, by my calculation). We estimate that the price of the display will exceed $300.

Based on the higher cost of the display compared to its existing product line with OLED displays, we expect the new watch with a MicroLED display to at least sit in the mid-range of TAG Heuer’s portfolio, with a list price of at least $3000.

A less expensive option for MicroLED may be available in 2024 as well. US-based Garmin, well known for its navigation devices, sells smartwatches for as little as $139 for a child-size watch, with a product range that goes up to $1199 for a luxury series. The Garmin watch may have similar specifications, but likely a lower price for the display as Garmin is not likely to stretch too far from its current maximum price.

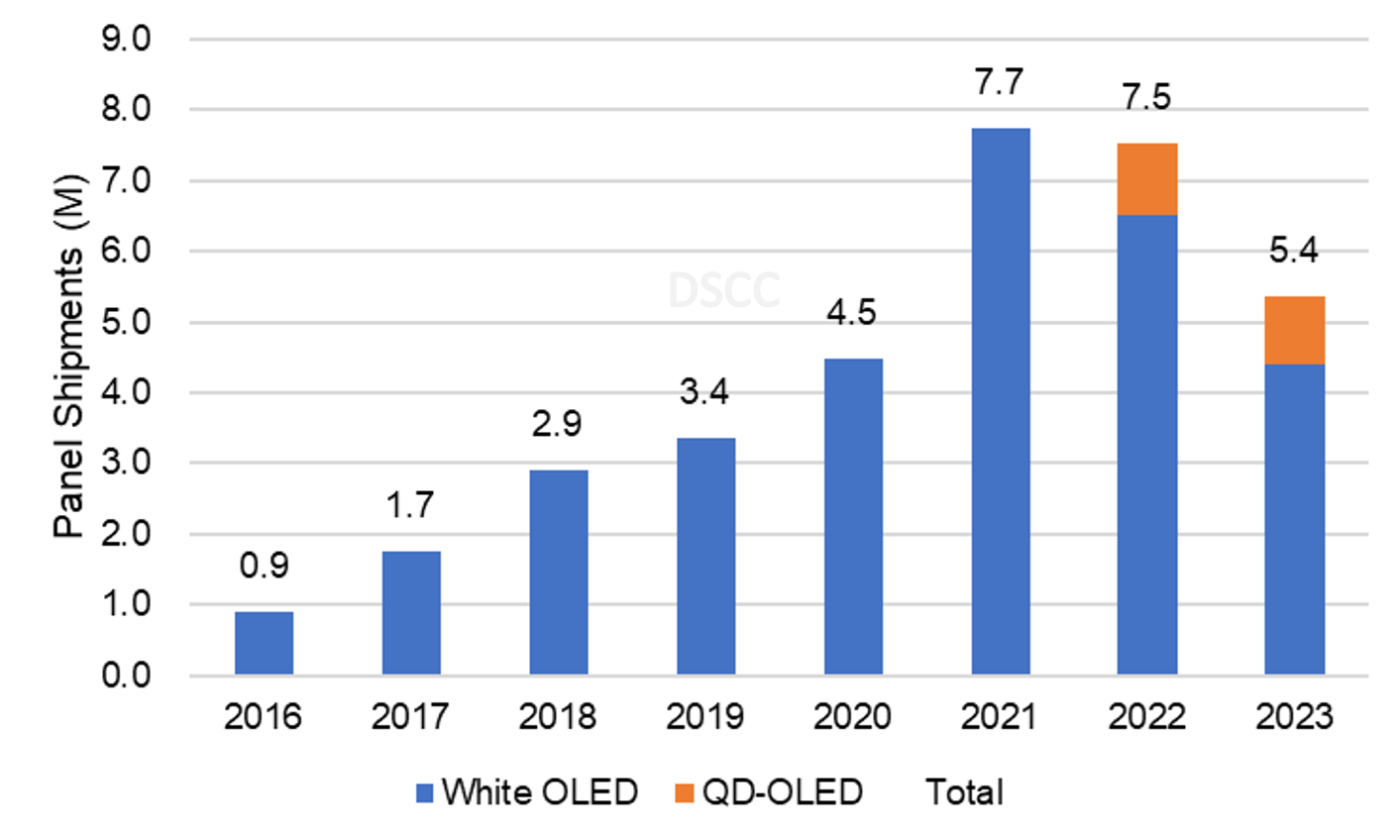

#3: OLED TV Panel Shipments Will Increase by 25%

2023 was the worst year ever for OLED TV, as an inventory glut combined with a soft TV market, especially in developed Western markets, to send panel shipments plummeting by 28%. As shown in the chart here, 2023 was the second consecutive year that OLED TV panel shipments declined, after increasing every year from 2016 to 2021.

When considering LG Display’s White OLED TV panels, the picture looks even worse, as White OLED panel shipments declined by 32% Y/Y in 2023 after declining by 16% in 2022. Samsung’s QD-OLED panels increased from zero in 2021 to 1M in 2023, but this volume remains far less than Samsung Display’s capacity.

OLED TV Panel Shipments

We believe that OLED TV panel shipments will rebound in 2024 to absorb at least some of the industry’s overcapacity. The inventory glut that suppressed panel demand in 2023 will not be repeated, and we believe there will be some recovery in the premium TV market. We expect Western Europe to lead the rebound with the Paris Olympics coming in the late summer.

Samsung’s Visual Display started sourcing WOLED panels in 2023, and we expect an expanded line-up of OLED TVs by Samsung in 2024. The increased competition between brands is sure to drive attractive prices for consumers.

Overall, we expect OLED TV panel shipments to total 6.9M units in 2024, still below the peak in 2021 but an increase of 28% Y/Y. Longer term, we expect that OLED TV shipments will surpass the 2021 peak in 2025, and that White OLED TV shipments will surpass the 2021 peak in 2027.

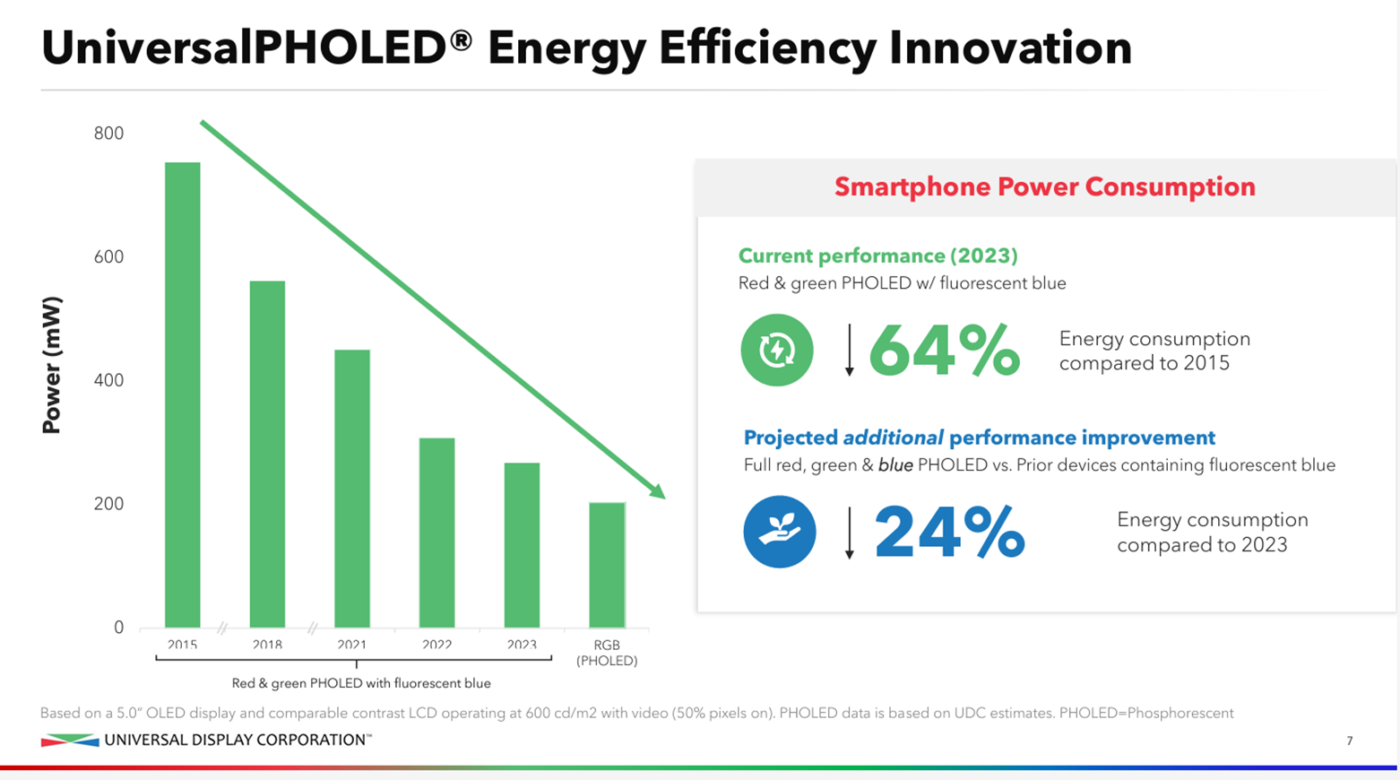

#4: No OLED Products with Phosphorescent Blue Emitters Will Be Sold

OLED fans have been waiting for more than 10 years for an improved blue OLED emitter, but they are going to have to wait at least one more year to see products with phosphorescent blue emitters.

An efficient blue OLED emitter would be a tremendous boost to the whole OLED industry, but especially to the company that develops it. Universal Display Corporation’s (UDC’s) red and green emitter materials allow excellent color and lifetime with high efficiency, because phosphorescence allows 100% internal quantum efficiency, whereas the predecessor technology, fluorescence, only allows 25% internal quantum efficiency. A more efficient blue would bring cost and performance benefits to all of the various product architectures in the OLED space. In mobile RGB OLED, UDC projects that displays with phosphorescent blue emitters will achieve a 24% reduction in power consumption compared to 2023 displays.

UDC has worked for years on developing a phosphorescent blue emitter, and finally announced in February 2022 that they expected to meet commercial target specs by the end of that year, and they expected to start selling phosphorescent blue emitter materials starting in 2024. In repeated announcements since then, UDC has held to that timetable, but has reminded investors that while UDC sells OLED materials, it does not make OLED displays or devices.

We expected to see a demonstration of phosphorescent OLED in 2023 (see last year’s predictions) but were disappointed. Most recently our sources suggest that the timetable to introduce products has been delayed.

Readers interested in learning more about SDC’s commercialization plans and timing for high efficiency OLED emitters should see our Future of OLED Manufacturing Report (一部実データ付きサンプルをお届けします) which had a partial release last week consisting of over 200 pages including all OLED emitter related content.

Whenever it comes, the introduction of phosphorescent blue will give OLED technology a boost in its battle vs. LCD. The big investments by SDC, BOE and others in Gen 8.7 capacity in 2024-2027 were made with the expectation that improved OLED displays would be available. We believe that displays with these phosphorescent blue emitters will eventually hit the market, just not in 2024.

#5: We Will See More FPD Capacity Expansion in India

This prediction breaks one of my rules for annual predictions, but it’s so important to the display industry that I had to include it. It breaks a rule because the result may not be known with certainty by the end of 2024, so effectively this is a prediction about a prediction (or about a forecast if you prefer).

At several points during the first two decades of the 21st century, there were discussions about building flat panel display fabs in India. One of the most significant investigations was by TwinStar in 2017, which had a discussion with LG about technology sharing and construction of a Gen 8.5 fab. Not coincidentally, the display industry was facing a shortage in 2017 after Samsung shut down some Gen 8.5 capacity in Korea. However, when capacity of Gen 8.5 and Gen 10.5 LCD fabs in China ramped up in 2018, the industry shifted to oversupply and TwinStar’s plans were dropped.

More recently, Vedanta has emerged as the champion of FPD in India. Vedanta already participates in the FPD industry with its ownership of glassmaker Avanstrate which it bought in 2017, and the Indian conglomerate signed a technology licensing agreement with Innolux in early 2023. According to DSCC’s Display Fab Data with Input Capacity, we expect that Vedanta will start mass production of a Gen 8.5 a-Si LCD fab in 2026, ramping to 60K substrates per month. With the fab fully ramped by 2027, Vedanta will have 4.2M square meters of LCD capacity, about 1% of the worldwide total.

We predict that more expansions will be announced and planned in 2024, so that by the end of 2024 our capacity model will show more than 4.2M square meters of capacity by 2028.

Compared to the situation in 2017, the environment for flat panel display production in India is dramatically more favorable today, for the following reasons:

- The Indian government has announced a major subsidy program for semiconductors and flat panel displays. The central government will subsidize 50% of the investment in approved FPD capacity, and as much as 20% subsidy may be available from state and local governments.

- Geopolitical relations between the US and China, and between India and China, have deteriorated substantially. The US has initiated what amounts to a trade war with China, imposing both import and export barriers.

- China has come to dominate the FPD industry, especially in LCD. In 2016, China represented only 30% of worldwide LCD capacity, but by 2025 China will have 74% of LCD capacity.

- While economic growth in China has slowed, India has the fastest growing economy in the 2020s.

- While the population of China has peaked and is falling, India’s young population continues to grow, and it is now the world’s most populous country.

- The domestic TV market in India is the third largest country market in the world, after China and the US, but unlike China and the US the Indian market is continuing to grow. We estimate the India TV market was 22M in 2023 and will grow to 30M in 2030 with additional growth thereafter. China’s TV market peaked in 2018 at 59M units.

Whereas the US has historically (at least until 2017) been open to free trade and imports, India has historically had a much more closed market, with higher tariffs and non-tariff barriers. There are currently no barriers to importing flat panel displays into India, but it is easy to imagine India banning the import of LCD TV panels from China. India has already banned TikTok and more than 58 other Chinese-created apps from its smartphone market.

If India would ban LCD imports from China, it could create a distinct FPD market isolated from the worldwide display industry, and isolated from the Crystal Cycle of shortage and oversupply. Panel prices would likely be higher in India, allowing FPD makers there to ramp production more profitably than if they had to match worldwide prices.

Unlike most countries, India has an economy and a market large enough to support a substantial display industry. We estimate the end-market demand for display products across all applications in India to be 13.9M square meters in 2023, able to fill more than three fabs the size of Vedanta’s plans. Furthermore, while we expect worldwide FPD demand to grow slowly, we expect FPD demand in India to grow at a double-digit % throughout our forecast horizon.

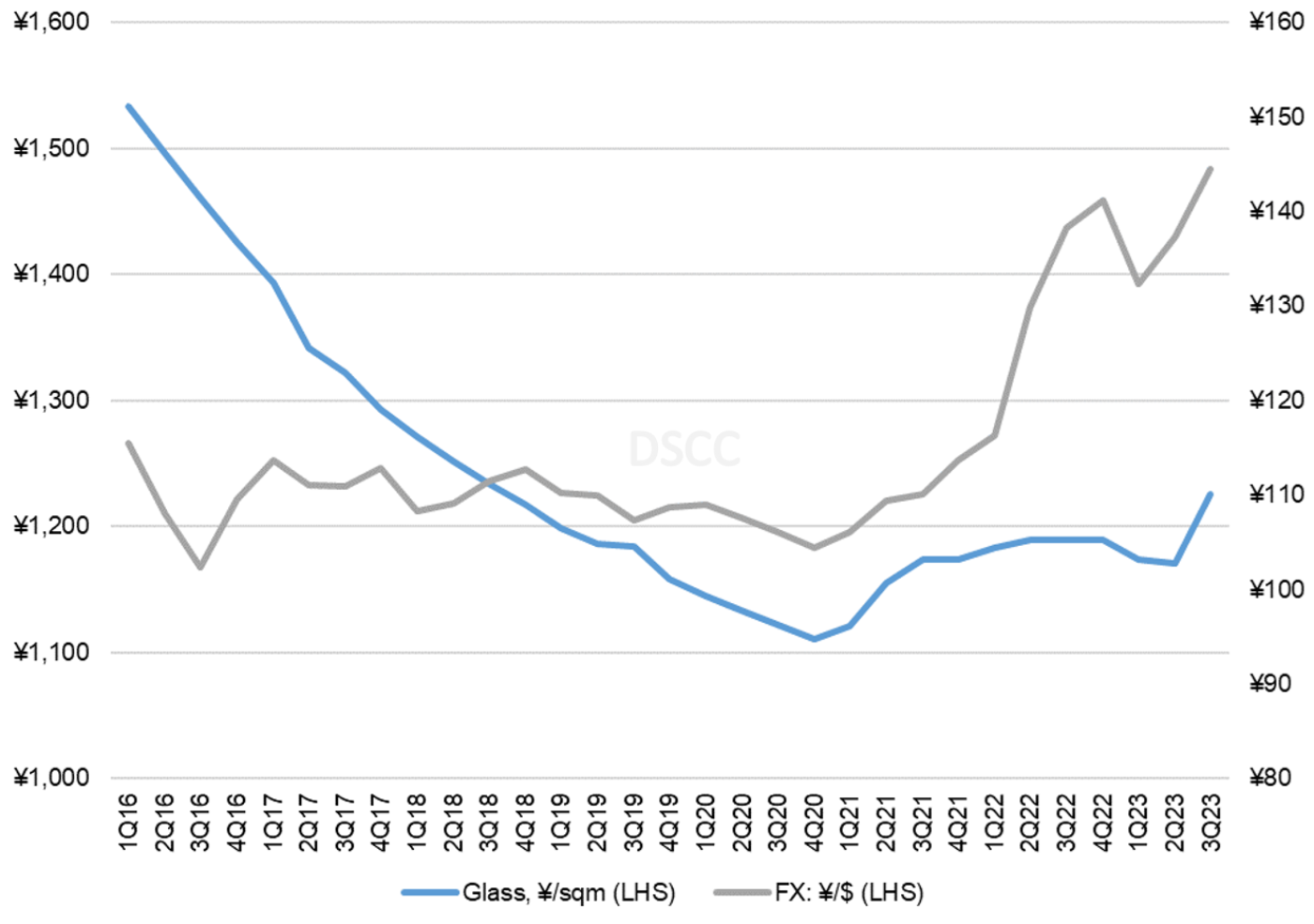

#6: Display Glass Prices Will Increase

For most of the history of the flat panel display industry, display glass prices went in only one direction – down. Like their customers the flat panel display makers, glass makers were subject to some swings of shortage and oversupply, but unlike the panel makers, glass makers did not raise prices during a shortage period from 2009-2010. Glass prices were stable for a few quarters and then resumed a decline.

During the decade of the 2010s, DSCC estimates that average display glass prices declined by 73% in terms of Japanese yen, and an even greater percentage when translated to US dollars. This damaged the profitability of glass makers, but productivity improvements and the shift to thin glass helped to reduce costs, and at the end of the decade all three of the major glassmakers (Corning, AGC and NEG) still reported profits in 2019.

For most of the decade of the 2010s, the glass industry leader Corning was a “price taker”. Corning had established agreements with key customers to guarantee a stable share in return for accepting a fixed relationship between Corning’s price and the market price. Those agreements worked, in the sense that Corning’s share across the industry remained stable for the rest of the decade, and the quarterly price reductions slowed down year after year.

As it did in many other areas, the pandemic disrupted the long-established patterns for display glass pricing. The tremendous surge in display demand, combined with some production problems at both NEG and AGC, led to a severe glass shortage. At the same time, costs increased in logistics, raw materials and other operational expenses. So, in 2021 Corning shifted from being a “price taker” to a “price maker” and announced a price increase for the second quarter of that year. Corning followed with another price increase in Q3’21, and then kept prices stable for several quarters. Corning’s competitors in Japan followed Corning’s lead, and both glass prices and share stabilized at a new, higher level.

During Display Week 2023, Corning shocked the industry by announcing a 20% price increase for all its display glass products, citing “elevated costs in energy, raw materials and other non-yen denominated operational expenses”. During the summer, both AGC and NEG announced that they too would raise prices, citing inflated costs.

The key phrase in Corning’s announcement was “non-yen denominated”. From the beginning of the industry until today, display glass has been priced in yen. As a US company, of course, Corning reports its results in dollars. Corning has had a hedging program which allows it to treat its display business as if it had a constant exchange rate of JPY 107/$. For years up until 2021 that rate was approximately the same as the market rate but starting in 2021 the yen depreciated rapidly, as shown on the chart here.

For panel makers, the depreciation of the yen was a welcome windfall, because of course flat panel displays are nearly universally priced in dollars. So, if glass prices are flat, but the yen depreciates, the panel makers see glass costs as falling. From their low prices in Q4’20, glass prices have increased (as of Q3’23) by more than 10% in terms of Japanese yen, but the yen has depreciated by 38%, so when expressed in dollars glass prices are 20% lower than Q4’20.

Display Glass Prices (Left Axis) and Dollar/Yen Exchange Rate (Right Axis)

Corning’s CFO Ed Schlesinger has said that the company is hedged at JPY 107/$ through 2024 but not beyond. Corning faces a major revision of its display glass business if it needs to adjust to the current market rate of JPY 141/$. AGC and NEG are in far worse shape, as both companies reported losses for their display glass businesses in 2023 and both companies announced restructuring and closed operations in Japan and Korea, respectively.

Therefore, unless the yen would suddenly reverse course and appreciate close to 107/$ (which however unlikely cannot be completely ruled out; the yen is by far the most volatile major currency), we expect Corning to announce at least one more increase in display glass prices in 2024. We expect that AGC and NEG will follow Corning’s lead and similarly raise prices.

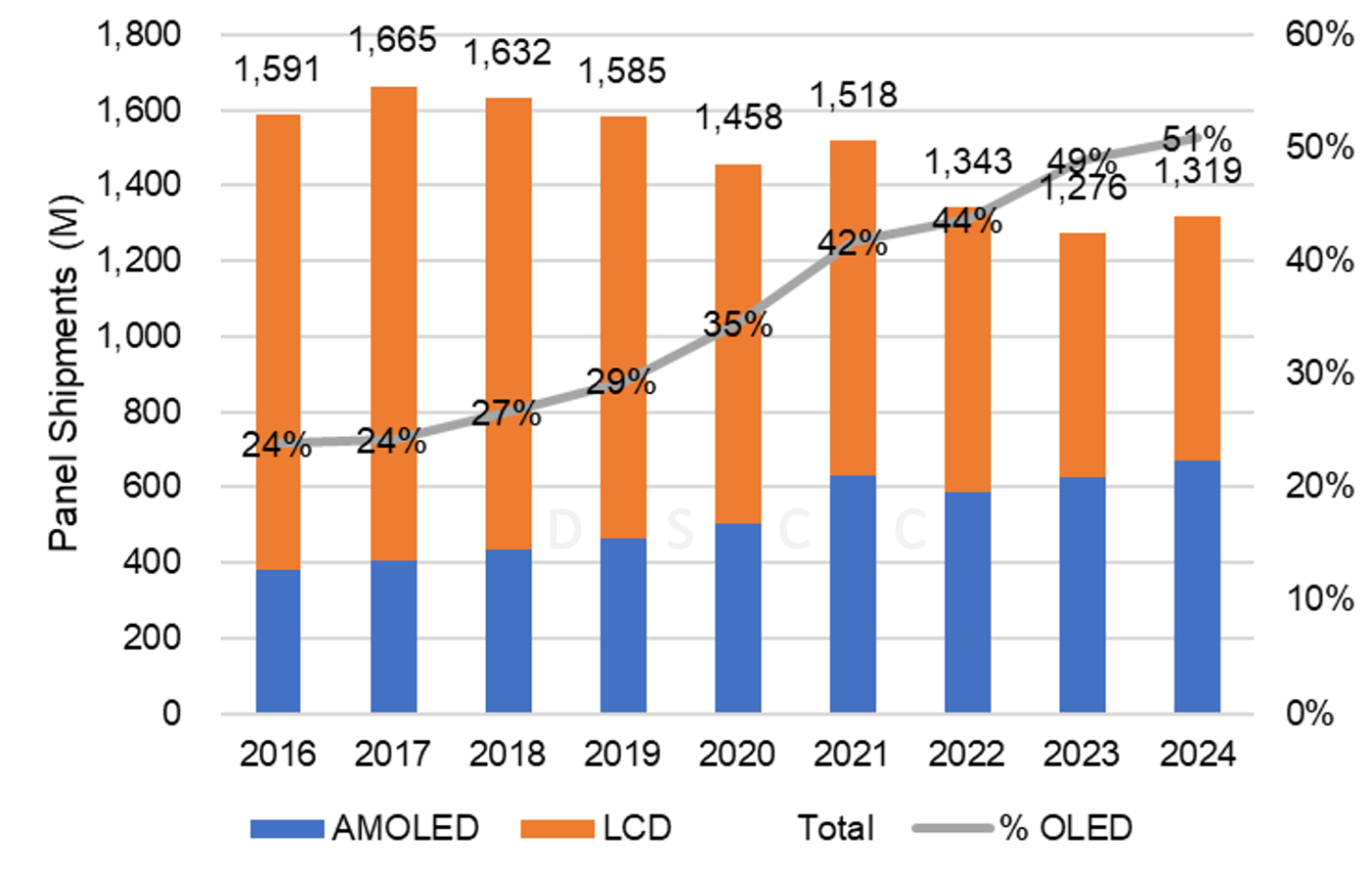

#7: OLED Smartphone Panel Shipments Will Surpass LCD

OLED is a superior display technology for smartphones, and as long as DSCC has existed, we have predicted that OLEDs would surpass LCDs in the smartphone market. Way back in the first half 2017, when it was clear that Apple would shift its iPhone models to OLED (which started that year with the iPhone X), in our OLED Supply/Demand Report we predicted that OLED would rapidly capture the smartphone market and reach a majority of the market by 2019.

More recently, in DSCC’s Quarterly OLED Shipment and Forecast Report in Q3’23, we still predicted that the crossover would happen two years out in 2025. In our latest revision, however, we predict that OLED smartphone shipments will surpass LCD in 2024.

Smartphone Panel Shipments by Display Technology

The change in our forecast is not entirely positive for the display industry. Although the percentage of OLED panels in our 2024 forecast increased to 51%, the absolute number of OLED panels in our forecast for 2024 increased by less than 1%. Instead, OLED is gaining more share because the overall smartphone market is smaller in our forecast.

As shown on the chart, total panel shipments for the smartphone market peaked in 2017 and have steadily declined since then. Although we are expecting the market to increase in 2024, the increase is only 3% Y/Y, and the market will remain 21% lower than it was in 2017. The slowdown can be attributed to a number of factors, including a saturation of the installed base, a lengthening of the purchase cycle for smartphones, a growing and vibrant secondary market for used smartphones, and even the population decline in key developed countries.

Note that the figures in the chart include only main displays; when counting smartphone sub-displays which are 100% OLEDs, OLED share edges up to 52%. While sub-displays are generally smaller than main displays, they are commonly used on foldable phones which have main displays that are larger than average.

For another twist on this data, remember that these figures are for smartphones only, not for all mobile phones which include feature phones which are 100% LCD. We expect LCD to maintain the majority of overall mobile phone display shipments through 2026, with OLED surpassing LCD in 2027.

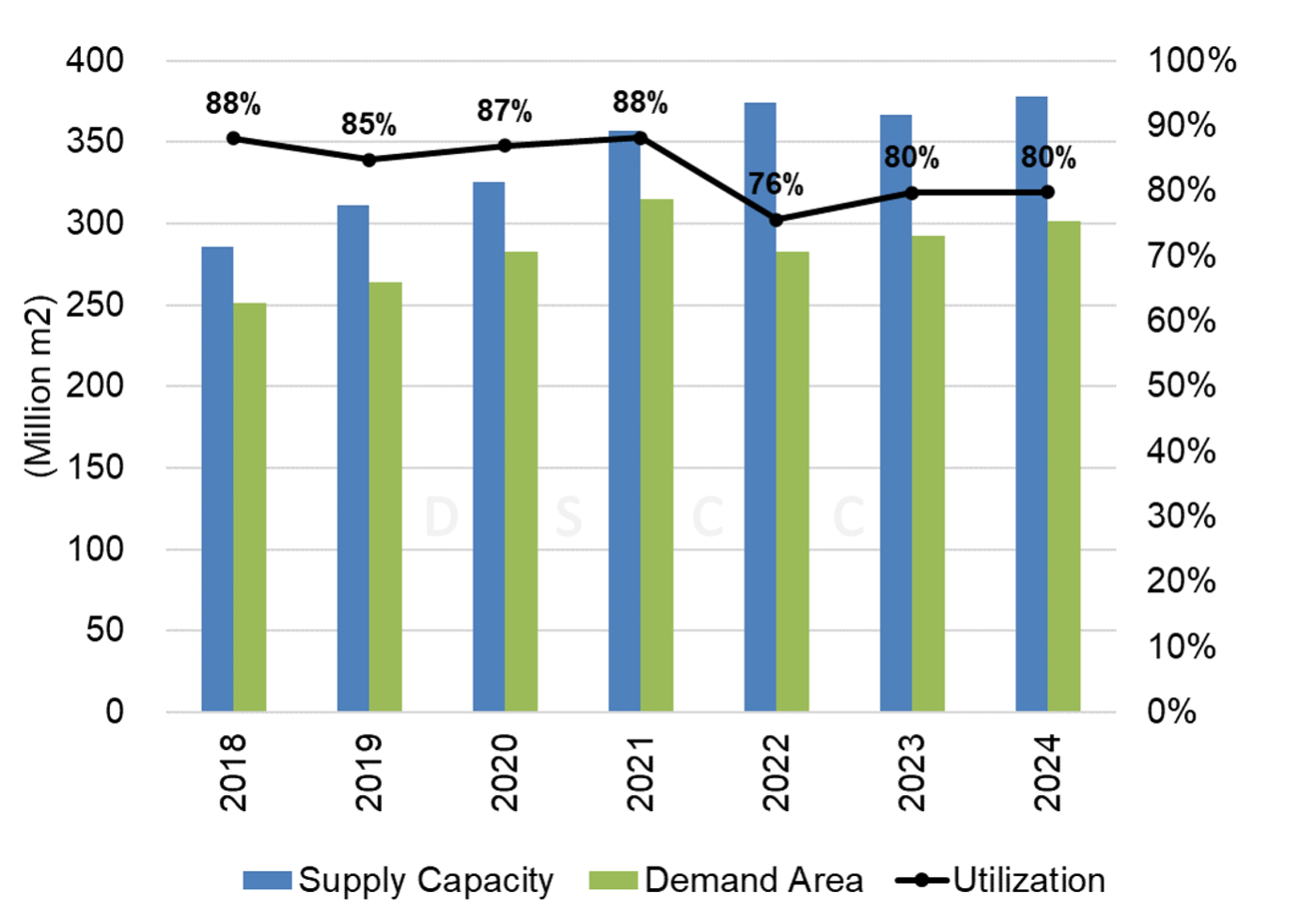

#8: More LCD Capacity Will Be Shut Down

We were right about this prediction in 2023, but the closures in 2023 were far from sufficient to bring LCD supply and demand into alignment. Although we expect LCD demand area to increase by a modest 3% which should help the supply/demand balance, that is offset by an expected 3% increase in capacity, leaving the industry in the same awful state it was in for 2023.

The capacity increases in 2024, as you might have guessed, are entirely in China; capacity in all other regions will decline. The increases in China include LGD’s CA-1 line restarting to supply LCD TV panels to Samsung and LG brands, plus increases in three different Gen 10.5 lines for BOE, China Star and Sharp/SIO.

LCD Supply/Demand and Fab Utilization

As we mentioned last year, Sharp’s Gen 10 fab in Japan, Sakai Display Products, is one candidate for capacity reduction. That fab started production in 2009 and was ahead of its time in many ways but it has never come close to sustained profitability. It was divested from the main corporation in the early 2010s and then reacquired in 2022. Since Q3’22 it has been included in Sharp’s financial results for its display business, which has reported an operating loss in every quarter since then.

Other candidates for consolidation include the smaller gen fabs of both AUO and Innolux. Both companies took some steps in 2023 but will remain with multiple fabs smaller than Gen 5, plus multiple Gen 5 fabs. We expect both companies to announce some restructuring when they release their full year 2023 financial results.

#9: MiniLED Shipments Will Increase by Double Digit % in TVs, Monitors and Autos

MiniLED LCD technology has been gaining momentum across most large-screen applications, with increasing numbers of suppliers, brands and products. In the TV market, according to DSCC’s Quarterly Advanced TV Shipment and Forecast Report, MiniLED shipments increased by 21% Y/Y in the first three quarters of 2023 even though Samsung MiniLED TV shipments decreased by 21% Y/Y. The gap was filled by two Chinese brands that have aggressively promoted MiniLED in both their home market and for exports – TCL and Hisense.

TCL was the pioneer for MiniLED technology, launching its first product in 2019. However, when Samsung launched MiniLED TVs in 2021, Samsung quickly surged into the #1 brand. In 2023, TCL regained some share and was joined by Hisense. Hisense came from nowhere to leap to the #2 brand position in Q3’21, as its shipments have increased by 18x in the first nine months of 2023. We expect MiniLED TV shipments to increase by 20% in 2024 to 4.4M units.

In TV the MiniLED market has been dominated by Samsung until 2023 and the market remains concentrated with the top three brands capturing more than 90% share in Q3’21. MiniLEDs in monitors are a much more competitive market, with more than 18 brands with products on the market and the top brand, AOC, capturing only 18% share. We expect that to continue because barriers to entry in the MiniLED monitor market are low to non-existent and expect MiniLED monitor shipments to increase by 17% Y/Y in 2024 to 3.7M units.

Many automakers have favored MiniLED over OLED because they have concerns about the latter technology’s lifetime performance. We have seen a number of autos with large MiniLED displays released in 2023, including the Buick Electra-X, Cadillac Lyric and CELECTIQ, Mercedes-Benz Vision EQXX and BYD YangWang U8. Many panel makers are competing for this business, and shipments for auto displays are expected to increase from nearly zero in 2023 to more than 500K in 2024.

#10: OLED Panel Shipments for Tablets Will Increase 200% Y/Y With Big Brand Introductions

The share of OLED displays in tablets has lagged far behind the corresponding share in smartphones, but that will start to change in 2024. Even more than in smartphones, the tablet market is dominated by Apple, and we expect Apple to launch two new iPad Pro models with OLED displays with 11.1” and 12.9” screens. These are likely to be the most expensive iPads, so they will form only a small fraction of Apple’s overall iPad business, but such is Apple’s dominance of the category that even a fraction of Apple’s product line is a big increase for OLED.

In addition to Apple, we expect that both Microsoft and Google will launch new tablets with OLED displays, offering an alternative for consumers familiar with Android applications on smartphones. Samsung, Huawei and Lenovo are expected to update their OLED tablets in an increasingly competitive market.

We expect the total tablet display market to increase by 2% in 2024 to 196M units, but within that worldwide total we expect OLED tablet display shipments to triple their market share from 2% in 2023 to 6% in 2024 with 12.3M units. That momentum will continue in future years as Apple adds more OLEDs to its iPad product line.

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】