FPDメーカーQ3'22業績プレビュー

冒頭部和訳

10月26日 (水) のLG DisplayとAUOを皮切りに、今後数週間でFPDメーカー各社の第3四半期決算発表が相次ぐ。2021年の驚異的な利益は遠い記憶のように思われ、業界はパンデミック開始以来最悪の四半期を迎えることになりそうだ。1年前に下がり始めたFPD価格はいまだ下げ止まっておらず、価格が下がってもFPD需要は減少している。FPDサプライチェーンの下流パートナー企業と共に膨大な量の過剰在庫を積み上げたFPDメーカーはその後、業界の過剰供給を反転させるべく、第3四半期に稼働率を引き下げた。Q3’22にはFPDメーカーの利益率がさらに低下し、数社は営業損失を報告するものと予測される。

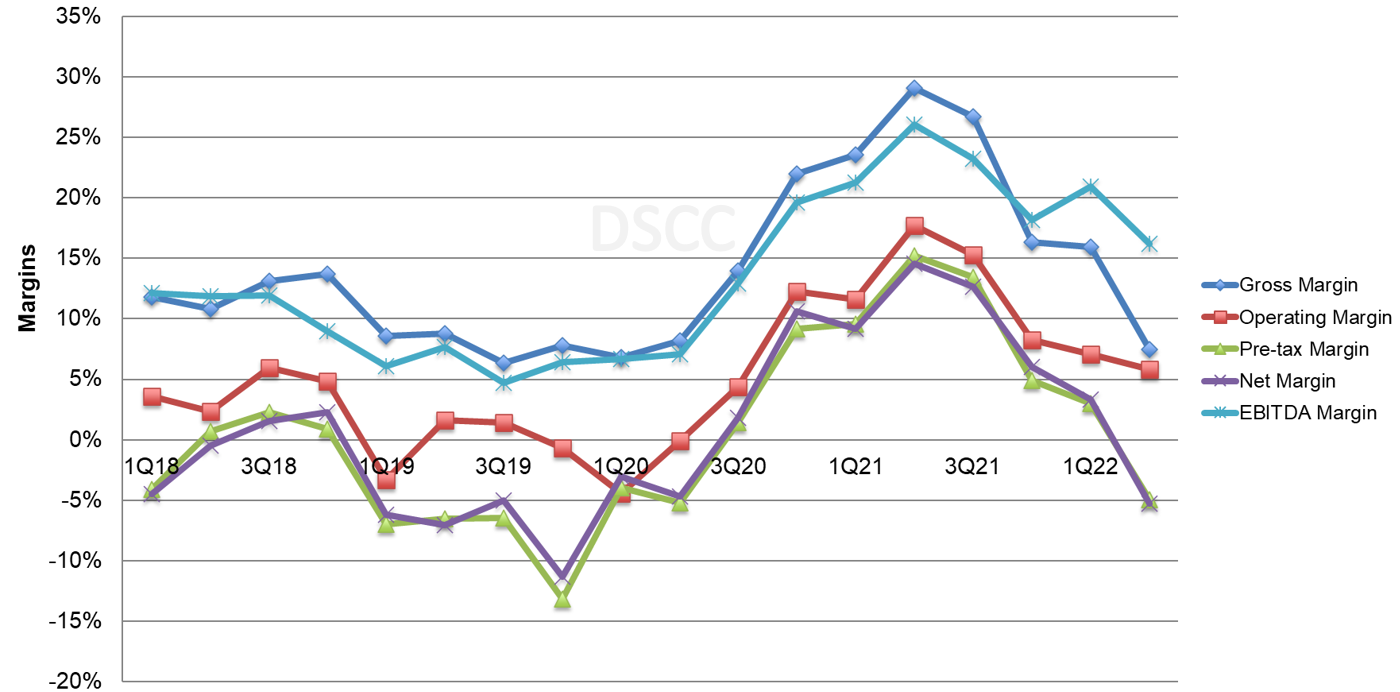

まず、以下の図で業界の利益率の全体像を見ていこう。利益率はQ2’21にピークに到達、5四半期でクリスタルサイクルの底から頂点まで上昇した。利益率はQ4’21に急落、その後Q1’22にもまた低下したものの、そのペースはFPD価格パターンに沿って減速したが、Q2’22には下落ペースが加速した。Q4’21にはTV用LCD価格が前期より平均32%下落、前期比の価格下落率としては過去最大を記録したが、Q1’22とQ2’22はいずれも13%に減速した。価格はQ3’22にさらに16%下落し、2022年9月までに 2021年6月のピークから65%下落した。従って、Q3の利益率の低下はQ2同様になると予測される。

Panel Maker Q3 Earnings Preview

In the next few weeks, we will see the Q3 earnings announcements for flat panel display makers, starting with LG Display and AUO on Wednesday, October 26th. The heady profits of 2021 seem like a distant memory, and the industry looks poised for its worst quarter since the start of the pandemic. Panel prices started to decline a year ago and have not stopped their decline, and even with lower prices the demand for panels has decreased. After panel makers along with their downstream partners in the display supply chain built a tremendous amount of excess inventory, they slowed their utilization in the third quarter in a bid to reverse the industry oversupply. We expect that panel makers will report another quarter of declining margins for Q3’22 and expect several panel makers to report operating losses.

First, let’s set the stage with an industry overview of margins. Margins peaked in Q2’21, capping a five-quarter run from the bottom of the Crystal Cycle to the top, as shown in the chart here. After a sharp decline in margins In Q4’21, margins declined again in Q1’22 but at a slower pace, matching the pattern of panel prices, and then the decline accelerated in Q2’22. LCD TV panel prices declined by an average of 32% Q/Q in Q4’21, the largest Q/Q price decline ever, but this slowed down to 13% in both Q1 and Q2’22. Prices declined another 16% in Q3’22, and by September 2022 had fallen by 65% from the peak of June 2021, so we expect that the decline in Q3 margins is like that of Q2.

Display Maker Quarterly Margins

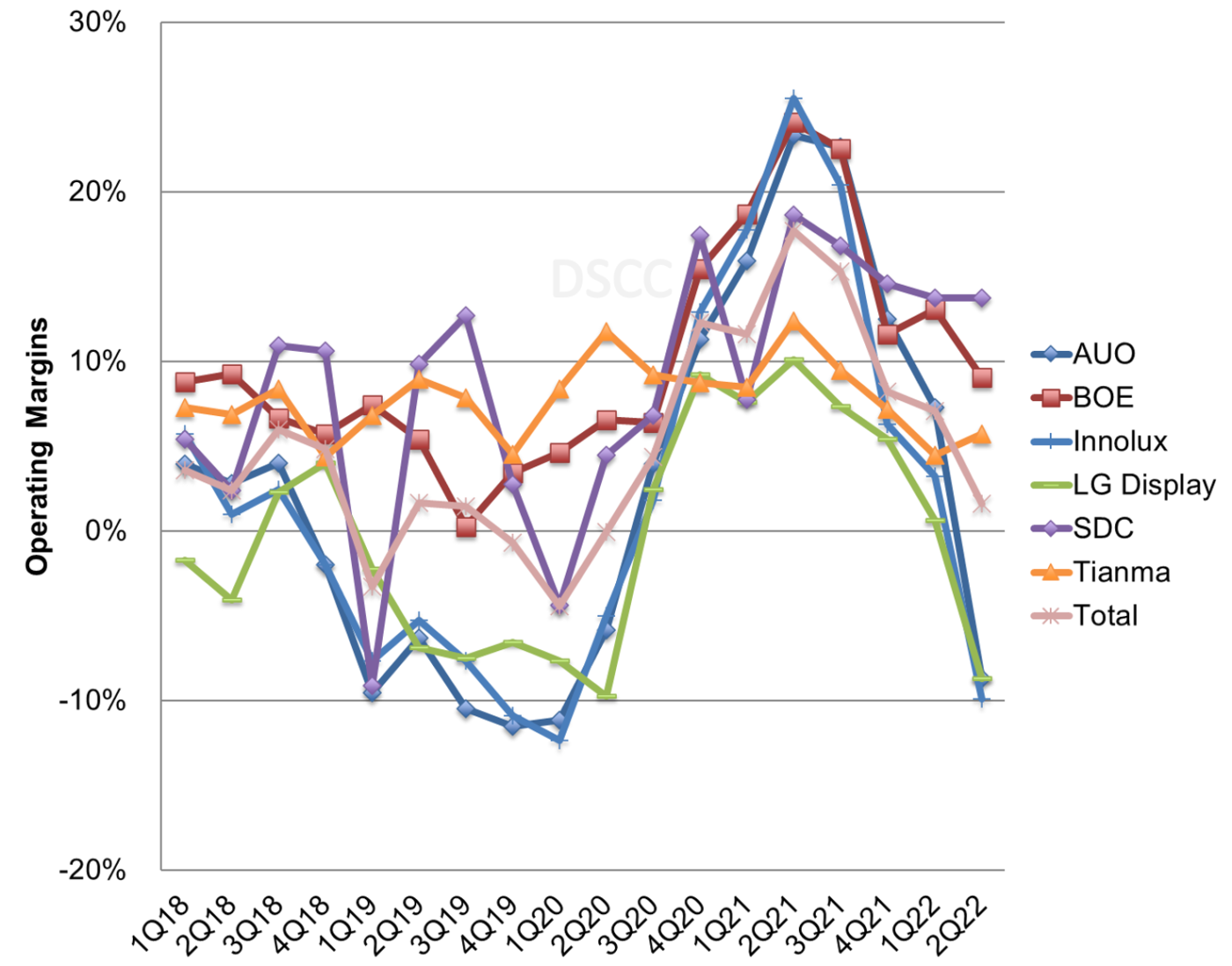

The second chart shows the operating margins of the larger companies in the industry. While the trend of the Crystal Cycle is clear to see, there is a wide divergence of outcomes.

- SDC sustained positive operating margins during the prior downturn and SDC is now immune to declines in LCD panel prices since it stopped all production of LCD in June 2022;

- AUO, Innolux and LGD have been more sensitive to the cycle with margins falling sharply from Q3 2020 through Q2 2022;

- BOE saw operating profit margin increase slightly in Q1 and decline in Q2; BOE continues to benefit from government subsidies which cushion the company against downturns;

- While it benefited somewhat from the upswing in the Crystal Cycle in 2020-2021, LGD’s unprofitable OLED business kept its margins below that of its peers. The company’s reduced dependence on LCD means that it suffers less from LCD TV panel price declines, but its OLED TV panel business has struggled to compete with low-priced LCD TV panels.

Display Maker Quarterly Operating Margins

One bright spot for panel maker earnings comes from the currency markets. While panel prices have fallen in US dollar terms, when translated into each company’s local currencies the decline is much less severe. On a sequential basis the Korean won fell by 6%, and both the Taiwan new dollar and the Chinese yuan fell by 3%. Also, while it does not affect the revenue picture the Japanese yen fell by 6% Q/Q, and since display glass is priced in yen, this translates to a cost decline of 6% for that important input.

In terms of guidance, in July these companies expressed caution for Q3, but in hindsight many of the forecasts seem far too optimistic:

- LGD expected area shipments to increase by a mid-single digit % Q/Q, and area ASPs to increase by about 20% based on a seasonal increase in mobile shipments. The combination of higher shipments and higher price implied a revenue increase of as much as 25% Q/Q, and since ASP is expressed in US$ terms, when translated into Korean won this would imply a revenue increase of more than 30%.

- AUO expected area shipments down by mid-teens % and ASPs roughly flat Q/Q on an improved product mix, implying a revenue reduction of ~15% Q/Q in US$ terms or about 12% Q/Q in TWD terms.

- In July, Innolux expected large panel shipments to be flat Q/Q, small/medium panel shipments down high teens % and blended ASP down by high-single digit %, implying revenue down by about 10%. However, in August the company revised its outlook for large panel shipments, saying then that it expected shipments to decline by 12% Q/Q, which would imply revenues down about 20% sequentially.

For the Taiwan players, because they report monthly revenues and shipments, we now know that AUO’s revenues decreased by 21% Q/Q, almost 10% worse than their guidance, and AUO’s ASP fell by about 3% Q/Q, also worse than its guidance of flat prices. Innolux’s revenues declined by 17%, roughly in line with its revised guidance. In hindsight, both companies were too optimistic about both prices and shipments.

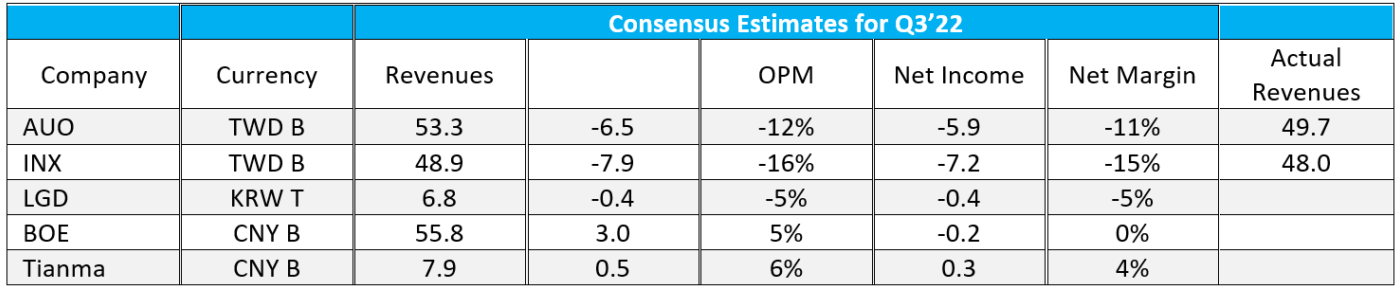

The table below shows analyst expectations for Q3 2022 for the panel makers with analyst coverage, according to marketscreener.com. The analyst expectations for margins anticipate that margins worsened in Q3, but the reality is likely to be worse. The Taiwan panel maker revenues are 7% and 2% lower than expectations for AUO and Innolux, respectively, so operating profit margins are likely to be correspondingly worse.

LGD’s guidance implies an increase in revenues (in KRW) of more than 30% but consensus estimates predict a more modest 21% revenue increase Q/Q, so if LGD performed to their guidance they will be better than consensus, but the reality is more likely to be worse than consensus.

According to DSCC’s Quarterly OLED Shipment Report, LGD revenues in US$ for OLED shipments increased by 22% Q/Q in Q3, with a huge increase in revenues for smartphones overcoming a slight decrease in revenues for OLED TV panels. When translated into Korean won, the OLED revenue increase should be 30% Q/Q. However, OLED represented less than half of LGD revenue in the 2nd quarter, and because of declining prices and weak demand in LCD, LGD was unlikely to generate a similar increase in LCD revenue.

Perhaps just as important as the results will be the guidance given about Q4 2022 and any comments about 2023. With panel prices appearing to stabilize at all-time lows, and no obvious demand drivers, we believe that panel makers will again be cautious about prospects for the end of the year.