QD-OLEDのコストデータを提供~Advanced TV Display Cost Report 最新刊

冒頭部和訳

DSCCが Semi-Annual Advanced TV Display Cost Report (一部実データ付きサンプルをお送りします) の最新号をリリース、OLEDとLCDのコストプロフィールを更新した。最新号には、全サイズのWOLED、55インチ以上のLCD (MiniLEDバックライト搭載LCDを含む) 、およびSDC製の55インチと65インチのQD-OLEDのコストプロフィール最新情報を収録している。

同レポートでは、画面サイズ、リフレッシュレート (60Hz/120Hz) 、バックライト (従来型/QDEF/MiniLED) 、生産ライン世代、製造ロケーション (韓国/中国) の各項目の組み合わせによる、オープンセルモデルを含む132の異なるLCD製品の詳細なコストプロフィールを提供している。また、サイズが27インチ~97インチ、解像度がFHD~8Kで、中国と韓国で第8.5世代と第10.5世代の生産ラインで製造された72の異なるOLED製品の情報も掲載している。

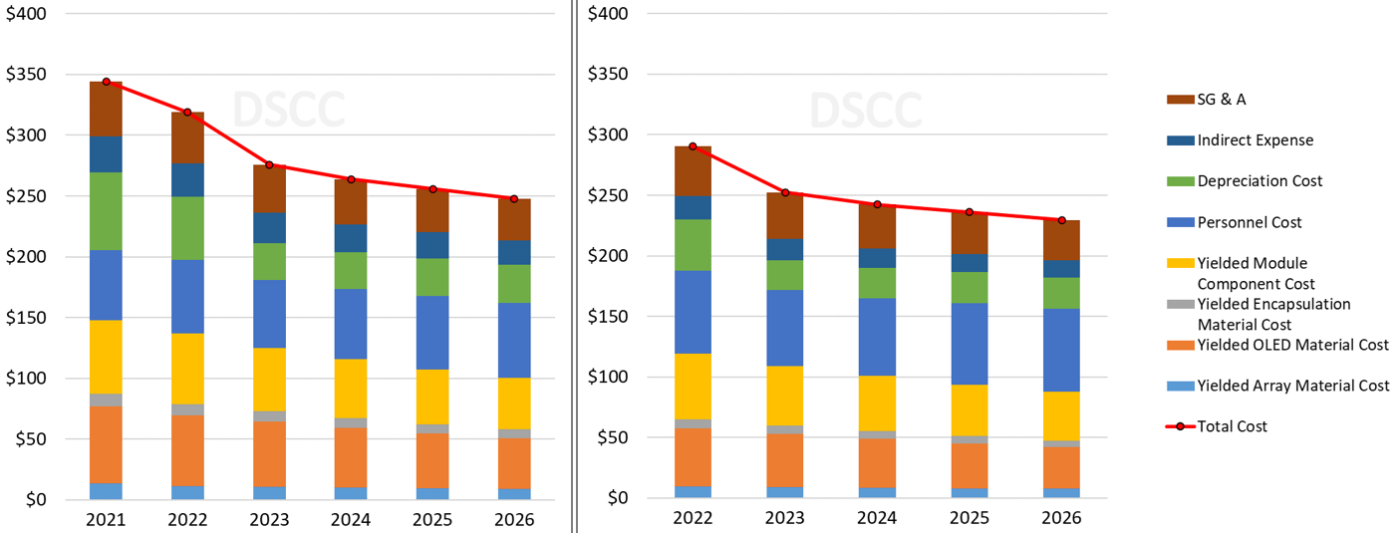

LGDは中国・広州の第8.5世代White OLED (WOLED) ラインで生産改善を継続している。レポートによると、2020年の中国製FPDの総コストは韓国製の同等FPDよりも高かったが、2021年には中国生産の優位性によって総コストが下がり、2022年には韓国の歩留まりの優位性がなくなっている。中国では、減価償却費、人件費、間接費、販売費および一般管理費が低いことから、総コストが低くなっている。2022年の中国の55インチUHDの総コストは韓国生産より11%低く、65インチでも同様の優位性があると推定される。

DSCC Advanced TV Display Cost Report Includes QD-OLED Cost

DSCC has released its latest update of our Semi-Annual Advanced TV Display Cost Report (一部実データ付きサンプルをお送りします), with updates to OLED and LCD cost profiles. This edition includes updates to all sizes of WOLED panels and 55”+ LCD sizes including LCD with MiniLED backlights, and cost profiles for 55” and 65” QD-OLED panels from SDC.

The cost report provides detailed cost profiles of 132 distinct LCD products, including combinations of screen size, refresh frequency (60Hz/120Hz), backlight (conventional /QDEF/MiniLED), gen size and manufacturing location (Korea / China) and including open cell models. The report covers 72 distinct OLED products, ranging in size from 27” to 97”, with resolutions from FHD to 8K, and manufactured on Gen 8.5 and Gen 10.5 in China and Korea.

LGD is continuing to improve production at its Gen 8.5 White OLED (WOLED) fab in Guangzhou, China. While our cost report shows that total panel costs from China production in 2020 were higher than the costs for comparable panels made in Korea, by 2021 the advantages for China production allowed lower total costs, and by 2022 Korea’s yield advantage has been eliminated. China has lower costs for depreciation, personnel, indirect and SG&A, leading to lower total costs. We estimate that 55” UHD total costs in 2022 in China will be 11% lower than Korea production, with a similar advantage for 65”.

WOLED TV Panel Cost for China in 2022

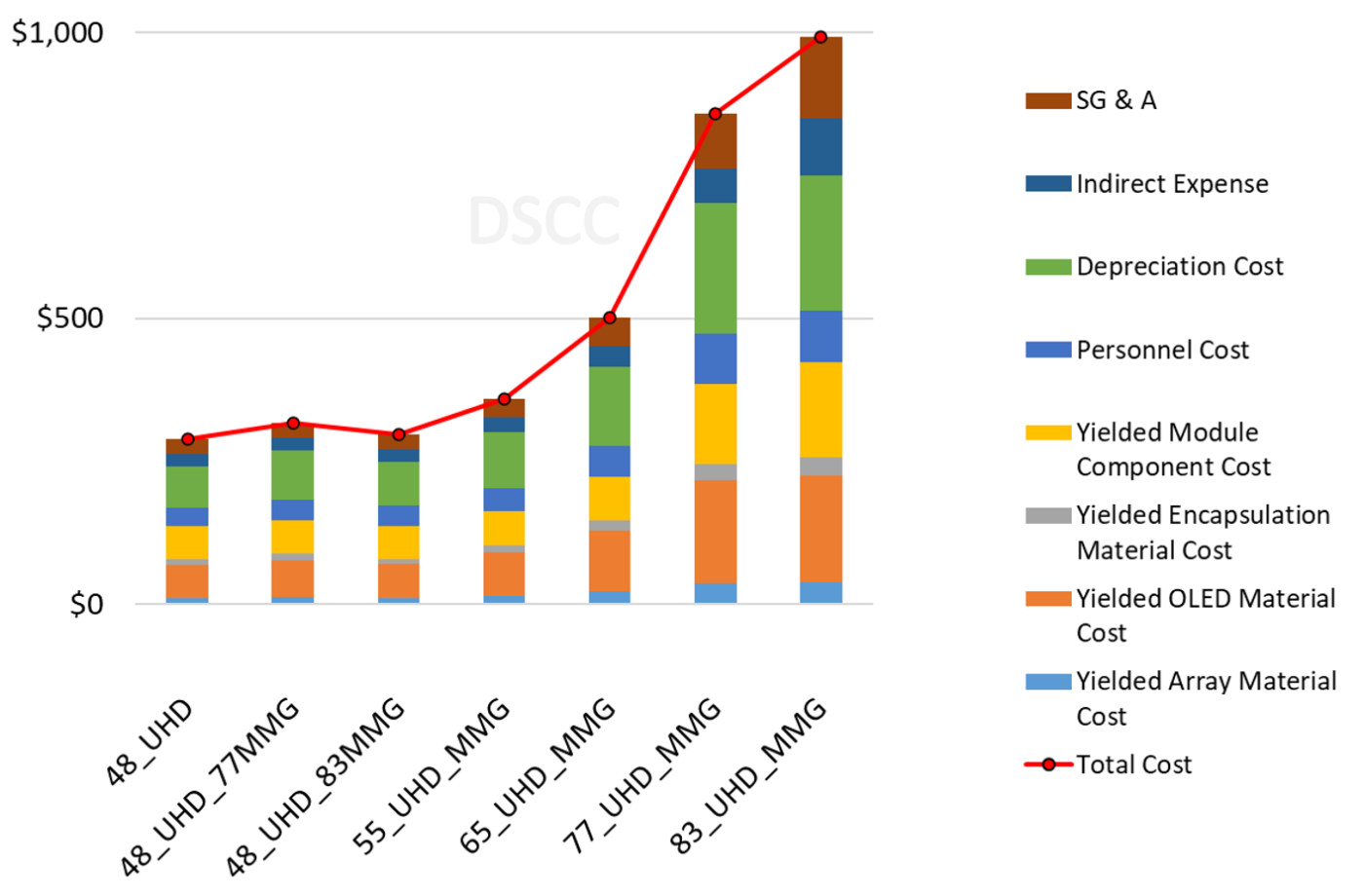

In the last two years, LGD has greatly increased the range of screen sizes for WOLED products, and our report covers additional monitor products to be introduced in 2022, including 27” FHD, 31” QHD and 42” UHD panels. For this quarter we include a new size that may be introduced in 2022 or 2023, a 45” WQHD panel with an ultra-wide (21.5:9) aspect ratio. This size panel and the ultra-wide aspect ratio allows an efficient 10-cut on a single Gen 8.5 substrate. The next chart here shows how this panel compares with the 48” UHD TV panel, which is an efficient 8-cut on Gen 8.5.

The 45” WQHD panel will be targeted at the high-end gaming monitor market, where its deep contrast and fast response time are key features compared to LCD-based displays. Addition of this 45” panel and additional monitor sizes like 27”, 31”, 42” can allow LGD to generate more revenue from its Gen 8.5 capacity.

WOLED Panel Cost on Gen 8.5 in Korea for 48” UHD (L) and 45” WQHD (R)

For the first time, we include QD-OLED panel cost in this report. We expect that in its year of introduction QD-OLED panel costs are dramatically higher than any other flat panels of the same screen size due to low yields. Our yield estimates for 2022 are under 60% for 55” and 65” TV panels. We have recently seen reports (see separate story in this issue) that some QD-OLED production (screen size undetermined) had reached 75% yield, so SDC may be improving QD-OLED panel yield faster than expected. If these reports are confirmed and attributable to TV size panels then our yield estimate will be revised in the next update.

The costs for QD-OLED panels will come down sharply as yield improves. We estimate that QD-OLED panel costs will decrease by ~30% Y/Y in 2023, primarily based on the impact of higher yields. Higher yields allow for fixed costs, which include depreciation and most personnel and indirect costs to be amortized over higher volumes.

Subscribers to the report can see the detailed cost models for 55” and 65” QD-OLED panels, including quarterly cost estimates from 2022 through 2026 with breakdown by cost components and the corresponding estimates of yield and fab utilization.

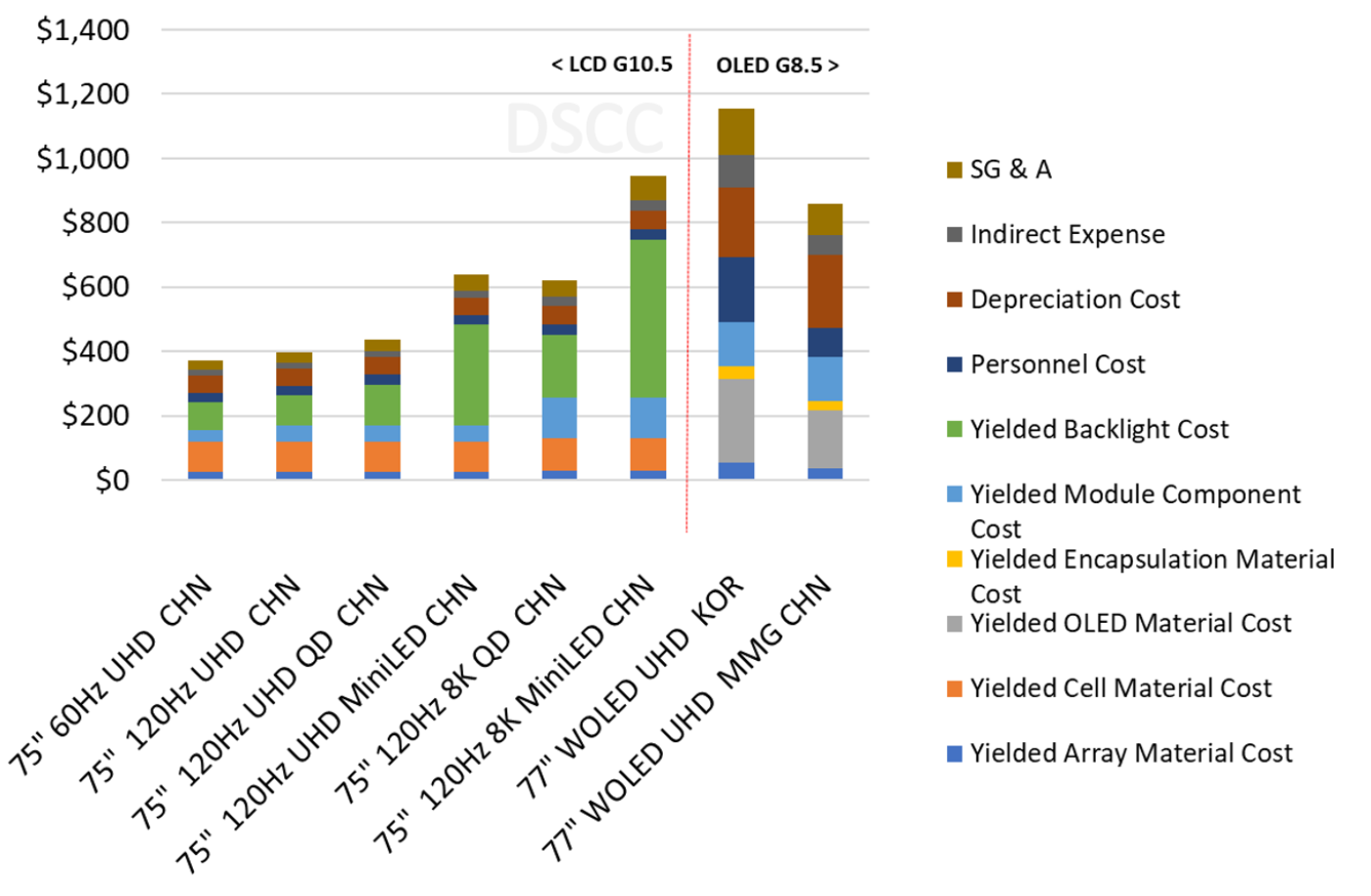

The latest report updates the cost models for LCD panels with MiniLED backlights. The report allows for comparison across the wide range of performance (and cost) within LCD, from conventional LCD with 60Hz refresh to 120Hz to QDEF panels and finally MiniLED + QDEF. Combined with the OLED cost models, the report allows a complete comparison of the cost of all large-screen TV types.

The next chart here shows the cost profiles for 75”/77” panels across the range of technologies on the market in 2022. LCD products are made on Gen 10.5 lines in China while WOLED products are made with MMG on Gen 8.5 lines in China. Conventional LCD with UHD resolution and 60Hz refresh rates have the lowest cost, more than 50% lower than WOLED UHD made in China. LCD step-up products with 120Hz and QDEF add only a modest cost, roughly 5% and 10% respectively. MiniLED UHD and 8K QD LCD are both substantial cost adders, increasing total costs by roughly 50% each individually, and when combined the 75” 8K MiniLED LCD TV panels have a total cost higher than 77” WOLED UHD panels, at least those made in China with MMG.

75”/77” Panel Total Cost in 2022 for LCD and OLED Panels

As noted above, subscribers to the Advanced TV Cost Report receive cost profiles of all major product configurations competing in the premium TV space in both LCD and OLED. The report includes Excel files with the detailed cost models in tables and in graphical form, and a PowerPoint which outlines the main findings of this quarter’s update. The PowerPoint includes comparisons of competing technologies (such as WOLED vs. Inkjet Printing, or LCD vs. QDEF) and differing manufacturing platforms (Korea vs. China, Gen 8.5 vs. Gen 10.5). Readers interested in subscribing to the Advanced TV Cost Report should contact gerry@displaysupplychain.com.

本記事の出典調査レポート

Semi-Annual Advanced TV Display Cost Report

一部実データ付きサンプルをご返送

ご案内手順

1) まずは「お問い合わせフォーム」経由のご連絡にて、ご紹介資料、国内販売価格、一部実データ付きサンプルをご返信します。2) その後、DSCCアジア代表・田村喜男アナリストによる「本レポートの強み~DSCC独自の分析手法とは」のご説明 (お電話またはWEB面談) の上、お客様のミッションやお悩みをお聞かせください。本レポートを主候補に、課題解決に向けた最適サービスをご提案させていただきます。 3) ご購入後も、掲載内容に関するご質問を国内お客様サポート窓口が承り、質疑応答ミーティングを通じた国内外アナリスト/コンサルタントとの積極的な交流をお手伝いします。