国内お問い合わせ窓口

info@displaysupplychain.co.jp

FOR IMMEDIATE RELEASE: 06/07/2021

LCD Supply Demand Shifting to Oversupply

Bob O'Brien, Co-Founder, Principal AnalystAnn Arbor, MI USA -

The shortage of large LCDs, which has lasted for almost a year and has resulted in the biggest panel price increases in the history of the industry, has begun to turn into an oversupply. The demand drivers that led to the shortage, particularly strong TV demand in the USA, are fading away with the spread of vaccination in the United States, and industry supply is filling the pipeline with enough inventory to eliminate any fear of shortage.

While the pandemic has affected every country in the world, and while demand for LCD panels for IT applications is likely to continue to be strong, the biggest factor for LCD supply/demand is the TV market, which accounts for more than 70% of LCD area demand. Among all geographic regions, North America stands out as the driver of the LCD shortage: as we reported last week from DSCC’s Quarterly Advanced TV Shipment and Forecast Report (一部実データ付きサンプルをお送りします), Advanced TV revenues in Q1 2021 increased 83% Y/Y as sales of big TVs surged. High prices for premium TVs in the US fed healthy profit margins at all the major TV brands in Q1 despite big increases in LCD TV panel prices.

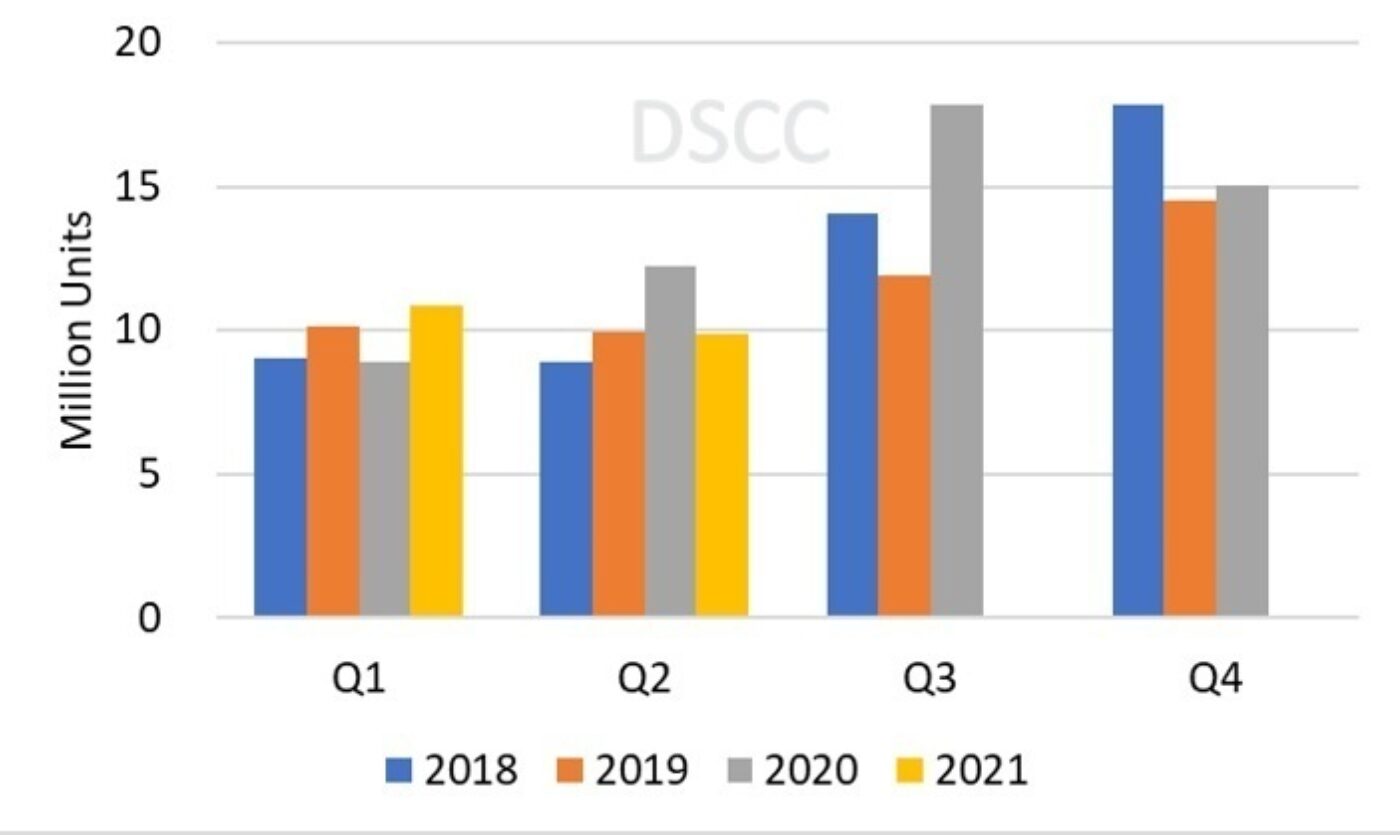

As shown in the chart here, US TV demand surged starting in the second quarter of 2020, with a 23% Y/Y increase in Q2 2020 and a 50% Y/Y increase in Q3 2020. In tracking US TV imports, we have reported that TV imports from China surged in Q2 2020 despite higher tariffs, since TV makers were forced to rush to fill orders. NA TV shipments in Q1 2021 continued at a torrid pace, increasing 23% over the prior year.

However, as the US has successfully rolled out vaccinations for COVID-19, and as pandemic restrictions have been removed, the demand for TVs is slowing. As of the end of May, more than half of US adults are fully vaccinated, and three-quarters of the higher risk population of 65+ adults are fully vaccinated. While demand for in-home entertainment soared during the pandemic, US consumers are starting to spend more on travel and other areas that were restricted during lockdown, and therefore will spend less on TVs. We estimate that US TV shipments in the second quarter of 2021 are likely to be about the same as 2019 and down 24% Y/Y from 2020.

TV Shipments in North America by Quarter, 2018-2021

In a presentation at the SID/DSCC Business Conference during Display Week 2021, Stephen Baker of NPD showed that TV sales in the US in April declined by 24% Y/Y. A part of this was an unusually strong April in 2020 because of US government stimulus payments, but our sources have indicated that TV sales in the US have continued to decline by double digits % Y/Y through the month of May, and we have every reason to believe that this pattern will continue.

Overall, we see several examples related to the reversal of supply and demand for large LCDs in the last few weeks:

- Strong TV demand has been slowing especially in the US.

- Slowdown of various consumption in India etc. due to rapid spread of coronavirus infection (32-43 "TV inventory is said to be increasing)

- Samsung VD is said to have had a downward revision of its 2021 sales plan for TVs by more than 10%.

- Chinese LCD makers have begun to ask TV brands to buy more panels.

- The rate of increase in LCD TV panel prices began to ease in May.

With this combination of factors, DSCC has concluded that the reversal of supply and demand for large LCDs has begun.

With respect to the outlook for LCD panel prices in the second half of 2021, we see a possibility that the panel price for LCD TVs will fall in some sizes starting in July. Since the profit margins of LCD manufacturers are at a very high level, we expect that panel makers will maintain a high utilization rate without adjusting production even if there is an oversupply.

Therefore, the tightness of various components such as driver ICs and glass substrates will continue for the time being.

As we reported in the DSCC Weekly Review last week, LCD makers have responded to the higher prices by planning 14 new LCD investments, and DSCC’s outlook for LCD capacity in 2022-2025 has been increased by between 2% and 5%. In addition to those increases, we have recently learned that BOE has begun planning a third Gen 10.5 fab investment, to be called B20 or B21, with mass production planned for 2023.

This turn of the Crystal Cycle has brought unprecedented price increases for LCD panels and terrific profits for LCD makers. It is a natural function of the Crystal Cycle that increased prices result in both increased supply and suppressed demand, and we are seeing that happen. The industry has been through almost a full year of shortage, but it is now shifting to oversupply.

About Counterpoint

https://www.displaysupplychain.co.jp/about

[一般のお客様:本記事の出典調査レポートのお引き合い]

上記「国内お問い合わせ窓口」にて承ります。会社名・部署名・お名前、および対象レポート名またはブログタイトルをお書き添えの上、メール送信をお願い申し上げます。和文概要資料、商品サンプル、国内販売価格を返信させていただきます。

[報道関係者様:本記事の日本語解説&データ入手のご要望]

上記「国内お問い合わせ窓口」にて承ります。媒体名・お名前・ご要望内容、および必要回答日時をお書き添えの上、メール送信をお願い申し上げます。記者様の締切時刻までに、国内アナリストが最大限・迅速にサポートさせていただきます。