国内お問い合わせ窓口

info@displaysupplychain.co.jp

FOR IMMEDIATE RELEASE: 11/02/2020

Improved Market Conditions Boost 2020-2023 Display Equipment Spending by 9%

Ross Young, Founder and CEOAustin, TX USA -

Strong LCD panel demand from the work-from-home and education markets, steady LCD TV demand along with declining LCD panel capacity in Korea as the result of excessive losses from government subsidized Chinese competition has led to tight supply, higher LCD prices, consolidation in China, a return to profitability for most LCD suppliers and now rising future LCD capex.

In DSCC’s latest Quarterly Display Capex and Equipment Market Share Report, LCD equipment spending was upgraded by 37% on a move-in basis for 2021 as the result of three recently announced smaller expansions along with additional spending being pulled in from 2022. From 2020-2022, LCD equipment spending has been upgraded by 3% to $13.4B.

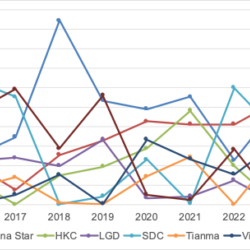

At the same time, OLED capacity spending is also on the rise due to its bright outlook and is more beneficial to equipment suppliers due to its higher capital intensity relative to LCDs. With LG Display boosting mobile OLED capacity in response to tight supply resulting from increased allocation on the Apple iPhone 12, China Star boosting its commitment to OLED TVs/IT/automotive panels through its announced $6.8B RGB IJP fab projects and Visionox and EDO pulling in new mobile fabs as they look to take more share , 2020-2023 OLED equipment spending was increased by 11% to $45B.

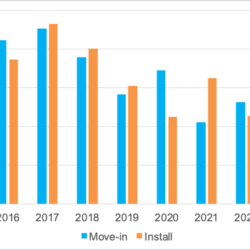

In total for both LCDs and OLEDs, display equipment spending for 2020-2023 was upgraded by 9% vs. our last issue to $51B. By year:

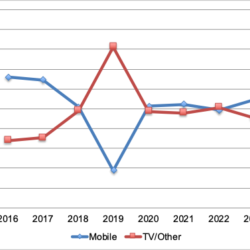

- 2021 was upgraded by 20% on a move-in basis to $10.6B and 24% on an install basis to $16.2B with the large difference between move-in and install the result of the additional time required to install tools due to COVID-19 travel and work restrictions. On a move-in basis, OLEDs are expected to hold a 52%/48% advantage over LCDs with mobile holding a 52%/48% advantage over TVs.

- 2022 move-in spending was revised up by 11% to $13.2B which is up 24% Y/Y. OLED spending is expected to rise 101% with LCD spending down 61% with the OLED share rising to 85%. TVs to hold a 51%-49% advantage.

- 2023 move-in spending was upgraded 9% on increased RGB IJP OLED fab spending by China Star. Overall, we show a 10% decline in OLED spending and no LCD spending. Mobile should account for a 55% share of spending.

⇒ 続き (図表入り全文) はこちらから

About Counterpoint

https://www.displaysupplychain.co.jp/about

[一般のお客様:本記事の出典調査レポートのお引き合い]

上記「国内お問い合わせ窓口」にて承ります。会社名・部署名・お名前、および対象レポート名またはブログタイトルをお書き添えの上、メール送信をお願い申し上げます。和文概要資料、商品サンプル、国内販売価格を返信させていただきます。

[報道関係者様:本記事の日本語解説&データ入手のご要望]

上記「国内お問い合わせ窓口」にて承ります。媒体名・お名前・ご要望内容、および必要回答日時をお書き添えの上、メール送信をお願い申し上げます。記者様の締切時刻までに、国内アナリストが最大限・迅速にサポートさせていただきます。