国内お問い合わせ窓口

info@displaysupplychain.co.jp

FOR IMMEDIATE RELEASE: 11/01/2021

LCD TV Panel Prices Continued to Plunge in October

Bob O'Brien, Co-Founder, Principal AnalystAnn Arbor, MI USA -

The best thing that can be said about LCD TV panel prices in October is that the pattern is not worse than September, which remains the month with the largest single-month decline in panel prices in the history of the industry. The average decline in October among the seven TV sizes we track was “only” 15.5%, almost but not quite matching the 15.8% decline in September. LCD TV panel prices have now lost more than half the gains that they achieved in the long up-cycle from May 2020 to June 2021.

In our summer updates, we referred to a series of events that suggested slowing demand and increasing supply, and nothing in autumn has disrupted this outlook. The increasing panel prices led to an unprecedented increase in TV prices in the US, which will hinder demand. After nearly a year where component shortages and logistics problems had brands and retailers scurrying to find enough supply, the brands and retailers have caught up. For developed regions, the opening of economies allows consumer spending to shift back to services, and emerging economies are still struggling with COVID and suffering an economic slowdown.

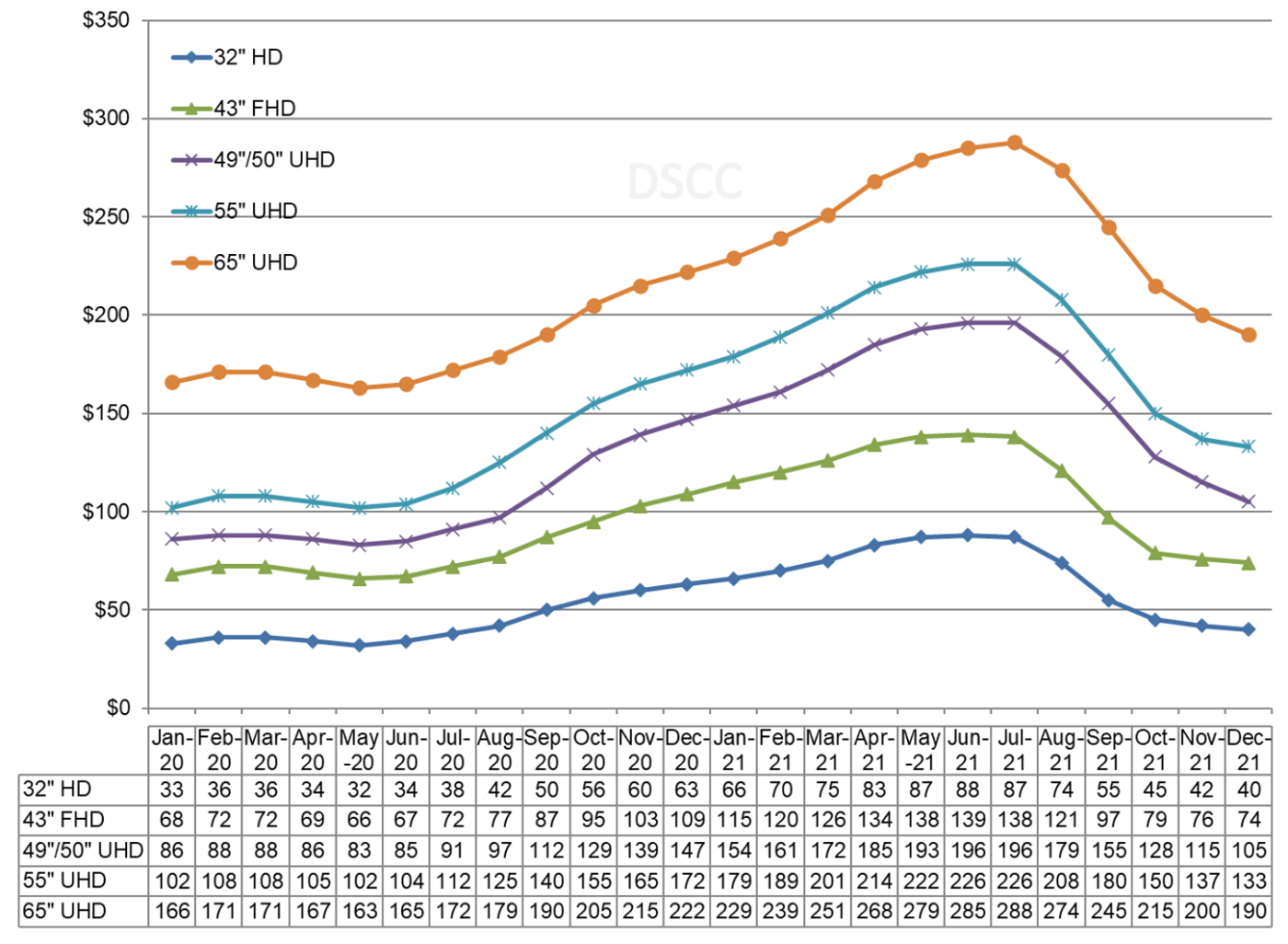

The first chart here highlights our latest TV panel price update, showing the both the biggest price increases in the history of the flat panel display industry, from May 2020 to June/July 2021 and then the fastest price decreases in the industry in September and October 2021. With substantial price decreases in October, the smaller size panels (up to 55”) are now at lower prices Y/Y, although the largest size panels (65” and 75”) remain priced higher than a year ago.

LCD TV Panel Prices January 2020 - December 2021

In October, prices for all TV panel sizes fell, with larger percentage declines occurring for smaller sizes.

Although we expect panel price declines to come more slowly in Q4, much of the damage has been done. Even if prices managed to stop falling and stay at October levels, the average price in Q4 would be 26% lower than the average price in Q3. With the additional price declines that we expect in November and December, we expect prices to decline by 32%, with the Q/Q price declines ranging from 18% to 41%.

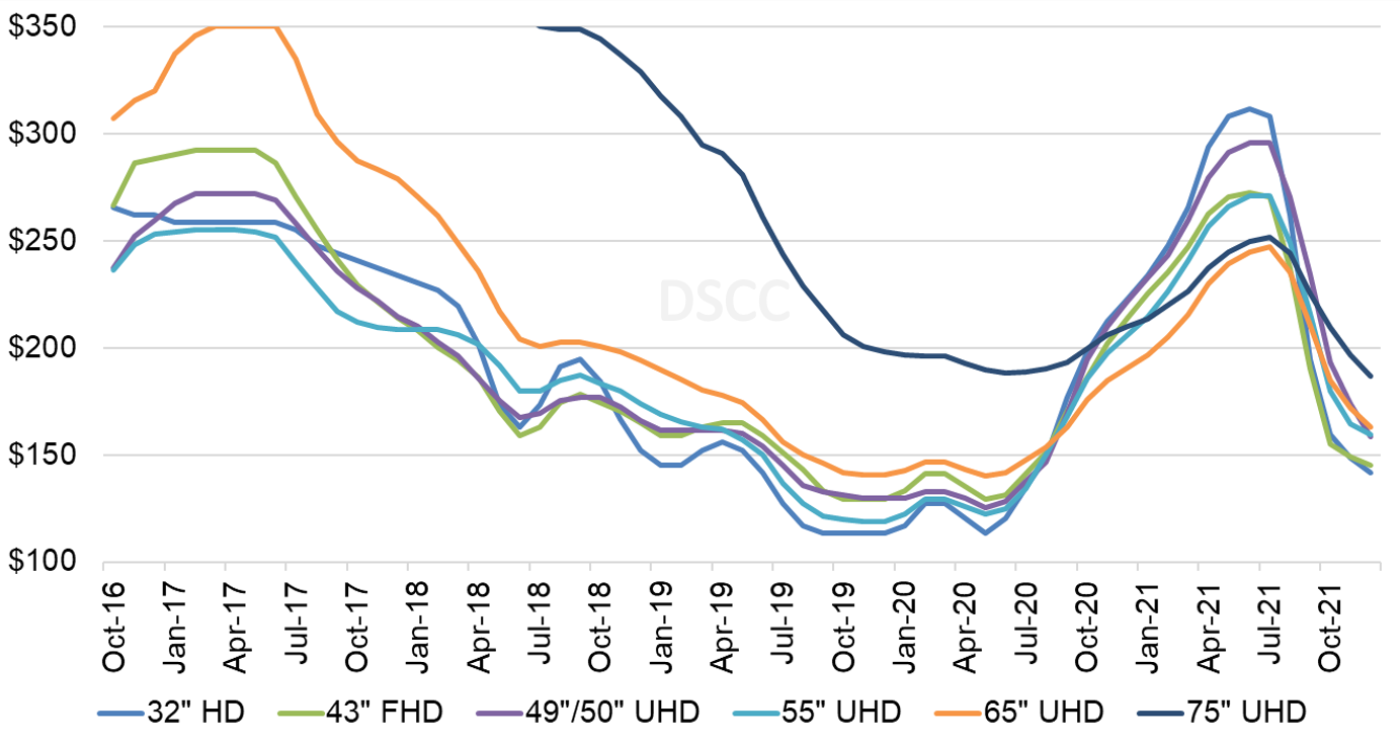

As we look at pricing on an area basis, we have noted that smaller screen TVs are the most commoditized: prices for 32” panels fall the fastest during a period of oversupply and rise the fastest during a period of shortage. We see that pattern repeating again with oversupply. At the peak of the recent upswing, the smallest TV panels sold with an area premium, but the shift to oversupply has caused that pattern to flip, as shown in the next chart.

Monthly Area Prices per Square Meter for TV Panels, October 2016 - December 2021

At the peak of panel prices in June 2021, 32” panels sold at a premium of $67 per square meter or 27% over 65” panels, and $62 or 25% over 75” panels. That premium was gone by September and in October 32” panels sold at a discount of $26 or 14% compared to 65” panels and at a discount of $51 or 24% compared to 75” panels. The chart shows that 75” panels, while they are subject to the supply/demand dynamics of the industry, are by far the least volatile screen size. Panel makers with Gen 10.5 capacity (BOE, CSOT and Sharp SIO) will be at a relative advantage in the oversupply environment that will carry into 2022.

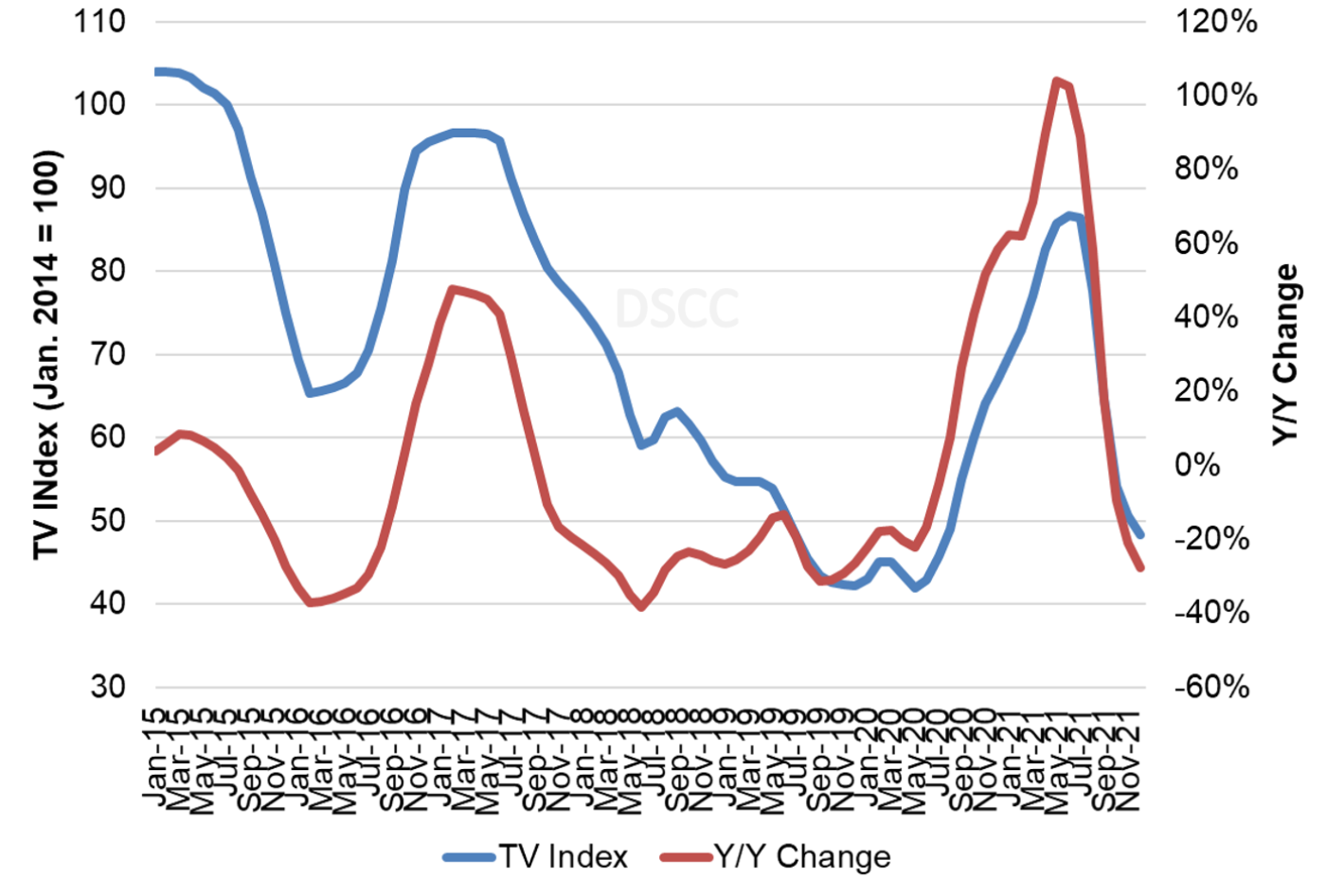

The last chart here shows our TV price index, set to 100 for prices in January 2014, and the Y/Y change of LCD TV panel prices. Our index increased from its all-time low of 42 in May 2020 to 87 in June 2021, but prices have already fallen to 54 in October. We now expect the index to decline to 48 at year-end, 28% lower than in December 2020, but still 15% higher than in May 2020. The Y/Y increase in October fell to negative for the first time since July 2020 at -10%.

TV Panel Price Index and Y/Y Change, January 2015 - December 2021

As we have forecasted in DSCC’s Quarterly All Display Fab Utilization Report (一部実データ付きサンプルをお送りします), we expect panel maker utilizations to slow down in Q4 to help alleviate the pressure on prices. In its earnings call this week, Corning indicated that such a slowdown is starting to happen. The seasonal slowdown in TV demand after Q4, leaves the industry with few demand drivers heading into the new year, and we expect utilizations to slow further in Q1 as prices continue to fall.

With the COVID-19 demand surge assisted by shortages in glass and DDICs, we saw a historic year of increases in panel prices, and panel makers post their most profitable quarter ever in the second quarter of 2021. The first results of Q3 earnings from LGD and AUO (see separate story) indicate that while profits declined in Q3, these panel makers escaped the worst effects of the pricing spiral by adjusting their product mix to favor IT panels. Even price declines in Q4 will sustain some profitability for LCD panel makers, who continue to be in line for record full-year profits.

About Counterpoint

https://www.displaysupplychain.co.jp/about

[一般のお客様:本記事の出典調査レポートのお引き合い]

上記「国内お問い合わせ窓口」にて承ります。会社名・部署名・お名前、および対象レポート名またはブログタイトルをお書き添えの上、メール送信をお願い申し上げます。和文概要資料、商品サンプル、国内販売価格を返信させていただきます。

[報道関係者様:本記事の日本語解説&データ入手のご要望]

上記「国内お問い合わせ窓口」にて承ります。媒体名・お名前・ご要望内容、および必要回答日時をお書き添えの上、メール送信をお願い申し上げます。記者様の締切時刻までに、国内アナリストが最大限・迅速にサポートさせていただきます。