国内お問い合わせ窓口

info@displaysupplychain.co.jp

FOR IMMEDIATE RELEASE: 07/26/2021

Flat Panel Displays to Enjoy Record Revenues in 2021

Bob O'Brien, Co-Founder, Principal AnalystAnn Arbor, MI USA -

Strong demand for Flat Panel Displays (FPD) across a range of applications, combined with a dramatic increase in panel prices, will lead to a 39% Y/Y increase in flat panel display revenues in 2021, based on DSCC’s newly released Quarterly FPD Forecast Report (一部実データ付きサンプルをお送りします). While the surge in revenues will not be repeated beyond 2021, industry revenues will settle at a new, higher plateau, allowing better profitability for the entire display supply chain.

DSCC's Quarterly FPD Forecast Report covers the history and DSCC’s forecast for FPD demand, covering flat panel display shipments across eight different applications, with technology split between LCD and OLED. The report includes history and forecasts of units, area, average selling price (ASP), average diagonal, resolution (pixels per inch or PPI) and revenue for all applications with quarterly data from 2018 to 2025.

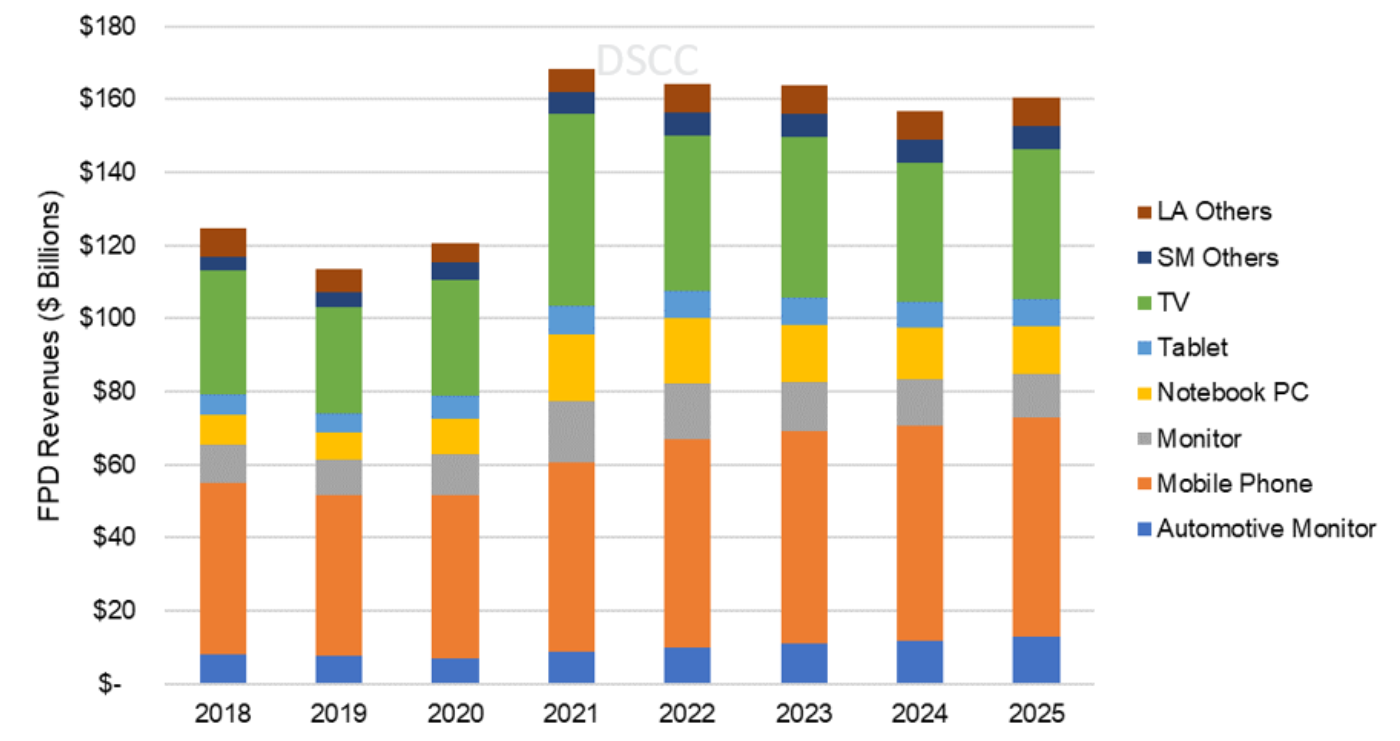

The first chart here shows our forecast for display revenues by application. After declining in 2019, total revenues increased by 6% Y/Y in 2020 to $121B and will jump by 39% in 2021 to $168B driven by continuing strong demand and the unprecedented increase in LCD large-area panel prices. While mobile phones (smartphones plus feature phones) have been the application with the highest revenue in recent years, the dramatic increase in LCD TV panel prices along with increasing screen sizes, will allow TV revenues to jump into first place in 2021 at $52.6B as both OLED TV and LCD TV show big revenue increases. Revenues for monitors, notebooks and tablets are expected to grow by 48%, 84% and 35%, respectively, to a total of $43B.

Flat Panel Display Revenues by Application, 2018-2025

After 2021, we expect revenues to plateau at close to $160B, much higher than the pre-pandemic 2019 revenues of $113B. Continuing growth in automotive and mobile phone displays will offset a modest pullback in TV and IT panel revenues to keep the total close to constant.

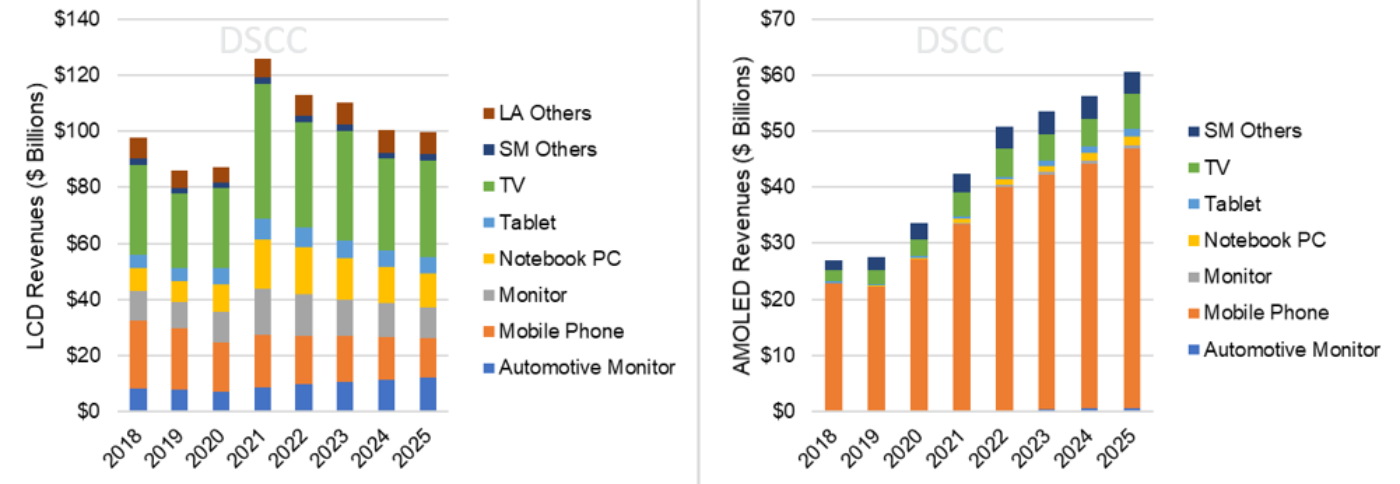

The next two charts here show our forecast of revenue by display technology for LCD and OLED. OLEDs will continue to gather an increasing percentage of display revenues, but the big increase in revenues in 2021 will go to LCD. We expect LCD panel revenues to increase 45% in 2021 to $126B, and then to regress in the following years to $100B in 2023. OLED revenues will see a more modest 26% Y/Y increase in 2021 to $43B, but the increasing penetration of OLED in smartphones, TVs and other applications will allow OLED revenues to continue to grow to $61B in 2025. While TV has been the largest application for LCD revenue, OLED revenue has been and will continue to be dominated by smartphones.

Flat Panel Display Revenues by Display Technology, LCD (L) and OLED (R), 2018-2025

While the revenue picture for the display industry shows a clear discontinuity from the pandemic, which has driven LCD panel prices up sharply, the forecast for units and area shows a less dramatic change. Flat panel display units across all applications suffered a 2% decline in 2020, mainly because of an 8% decline in mobile phone panels, which make up more than half of the total. We expect unit shipments to rebound with 8% Y/Y growth to 3.54B units in 2021 as mobile phone panel shipments increase by 6% to nearly 2B units. We expect unit growth to continue in 2022-2024 at a more modest 2% to 3% growth rate to reach nearly 3.9B units in 2025.

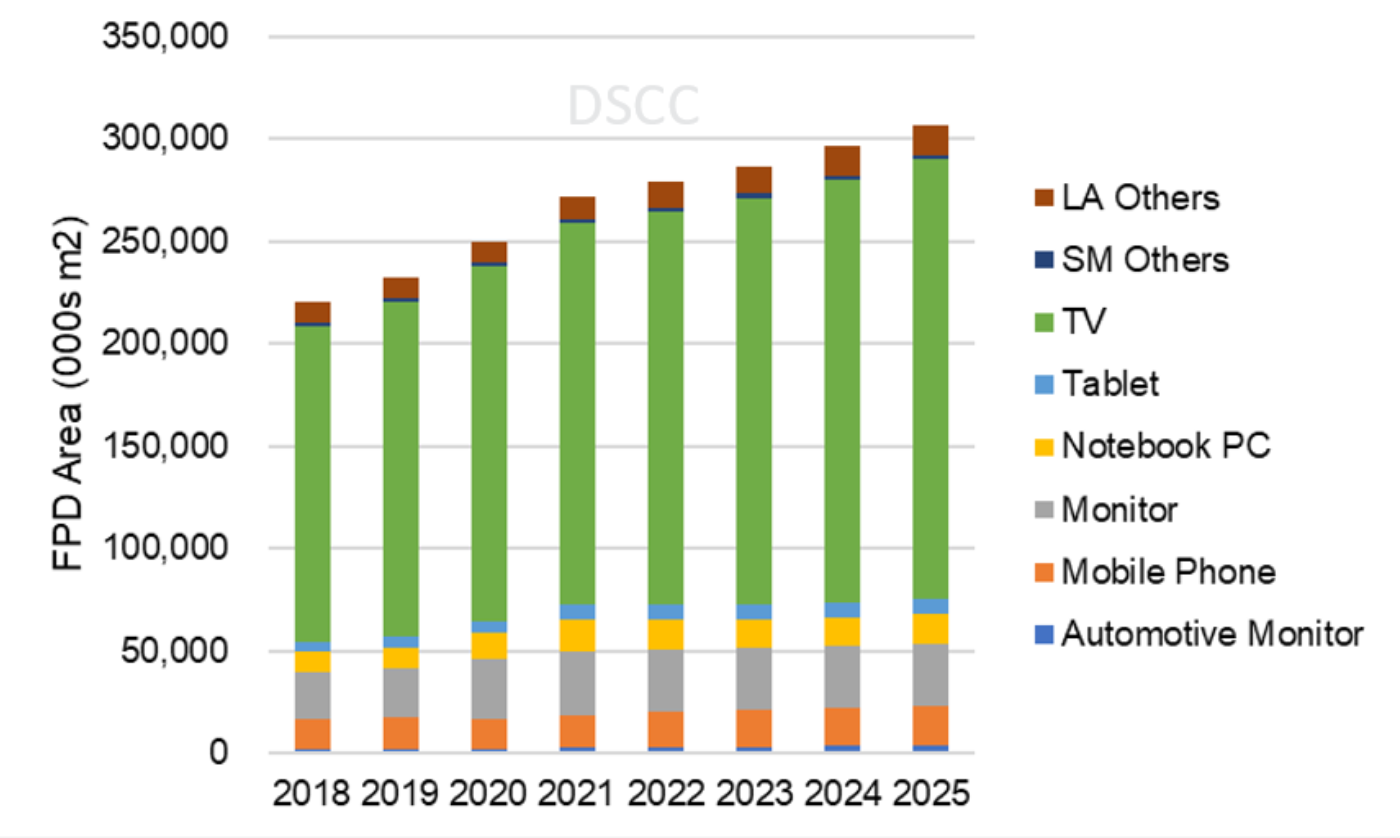

The following chart here shows our outlook on FPD area by application, which is dominated by TV and will continue to be so. We expect TV unit shipments to be close to flat, but area will continue to increase with increasing screen size. TV panel area grew by 6% in 2020 to 173M square meters, and we expect another 8% growth in 2021. We expect TV area growth to continue but at a slower pace as the growth of screen size slows but expect total TV panel area to reach 215M square meters by 2025.

Flat Panel Display Area by Application, 2018-2025

In each of the three IT applications (monitor, notebook and tablet) display area grew by 20% or more in 2020 fed by WFH/LFH. We expect continued strong growth in 2021, especially for NB and tablet, and we expect area in these applications to decline in 2022-2024 as the effect of the pandemic recedes. Nevertheless, some of the effects of the pandemic on remote working and learning are expected to be permanent and will lead to a permanent increase in IT panel demand. Therefore, IT panel area in 2025 will settle at levels about 30% higher than 2019 levels.

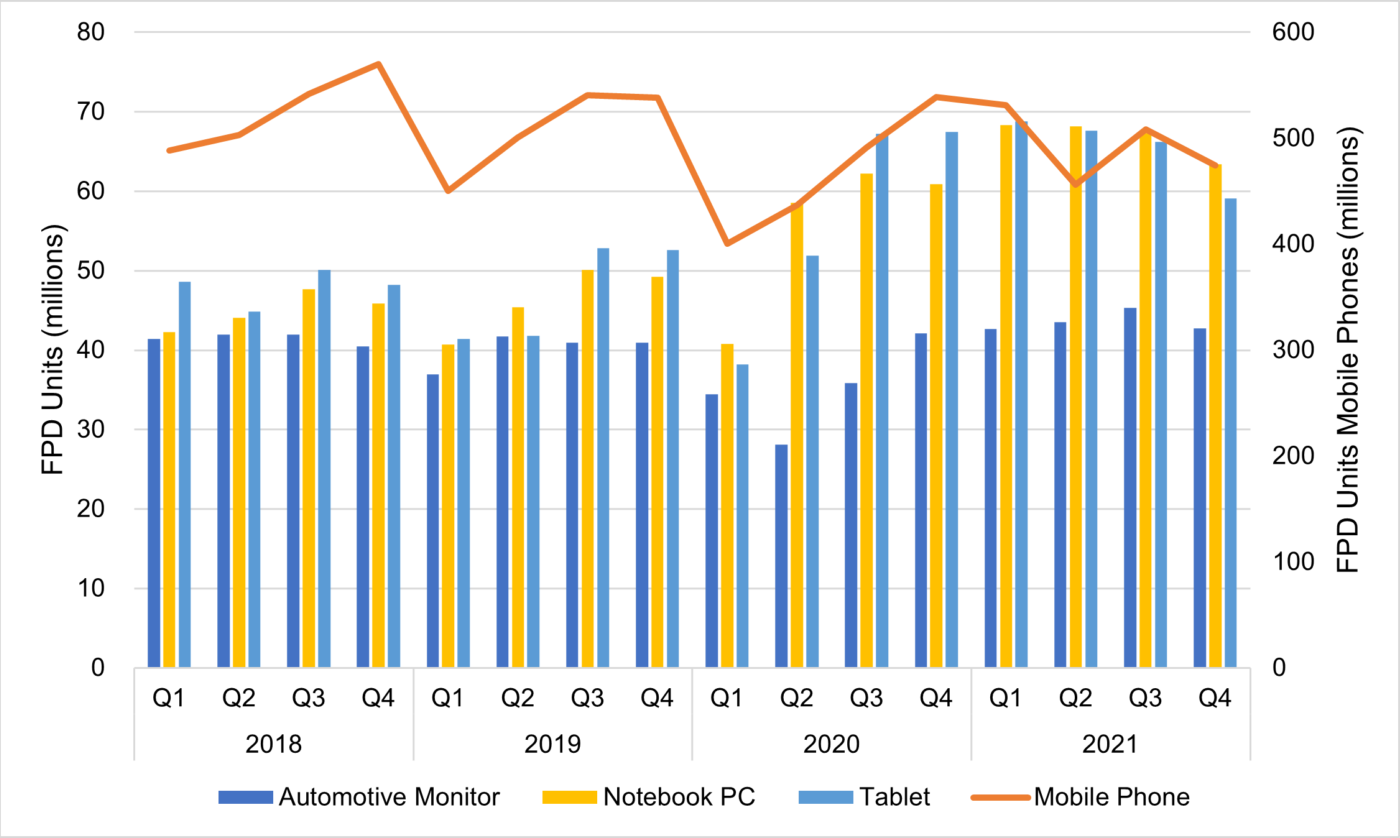

A closer look at some applications on a quarterly basis allows for an analysis of how the pandemic has affected applications differently, as shown in the next chart here. Shipments of mobile phone panels have a consistent seasonal pattern with a strong second half but were hit by supply constraints in the first half of 2020 before recovering in the second half.

Flat Panel Display Units for Selected Applications by Quarter, 2018-2021

Automotive panel shipments suffered a similar setback, not resulting from supply constraints of panels but because automotive production was constrained by semiconductor shortages. Automotive panel shipments in Q2 2021 have recovered to pre-pandemic levels, and we expect continued growth in the second half of 2021.

The shipments for notebooks and tablets show the clearest impact of the pandemic as demand for these products has surged. Although panel shipments were constrained in Q1 2020, by the second quarter of 2020, the demand surge was already clear, and by the first quarter of 2021, notebook shipments had grown 68% compared to the same quarter of 2019.

As noted above, the DSCC Quarterly FPD Forecast Report provides a comprehensive listing of historical panel shipments in LCD and OLED for eight different applications by quarter, plus a forecast of units, area and revenues for each application. The report provides pivot tables for units, revenues, ASPs, area, PPI and average diagonal for easy analysis. Readers interested in subscribing to the DSCC Quarterly FPD Forecast Report should contact info@displaysupplychain.co.jp.

About Counterpoint

https://www.displaysupplychain.co.jp/about

[一般のお客様:本記事の出典調査レポートのお引き合い]

上記「国内お問い合わせ窓口」にて承ります。会社名・部署名・お名前、および対象レポート名またはブログタイトルをお書き添えの上、メール送信をお願い申し上げます。和文概要資料、商品サンプル、国内販売価格を返信させていただきます。

[報道関係者様:本記事の日本語解説&データ入手のご要望]

上記「国内お問い合わせ窓口」にて承ります。媒体名・お名前・ご要望内容、および必要回答日時をお書き添えの上、メール送信をお願い申し上げます。記者様の締切時刻までに、国内アナリストが最大限・迅速にサポートさせていただきます。